Illustration by Sam Island

Welcome to the first dispatch from Retire Rich Roadmap – I’m so glad you’re here. My name is Paul Brent and I frequently write about investing and retirement for The Globe and Mail. Let’s dive right in.

For many working-age Canadians, retirement is a far-off, hazy objective. For the detail-minded, it might finally start coming into focus in their mid-30s. But for those with more of a “live for today” attitude toward money and planning, thoughts of retirement pop up only when friends start bailing from the work force or they start sympathizing with the characters in retirement ads.

“How do you see your retirement?” is one of the standard questions financial advisers ask their clients in their first meeting. It is just as likely to produce a blank stare as a coherent answer.

Advisers ask the question not because they want their clients dreaming about seniors-only cruise ships or wintering in a tropical climate but because most financial planning is really retirement planning.

If you are established in your career and have some assets, an appreciating net worth, and a predictable pension or registered and non-registered equivalents, you can reasonably ask: When should I retire?

It’s such a great question that a well-known financial company built an entire advertising campaign around an aspirational number that’s well below the official retirement age.

Illustration by Sam Island

When can you check out?

Quitting the rat race or – to put it more positively – leaving a career you love for a comfortable and financially secure life has a certain brutal math to it that anyone who has run a simple retirement calculator can see. Here’s one from the Government of Canada website.

The main inputs are your current age, your annual pretax income, your retirement savings/pension as well as additional sources of income in retirement beyond the bare-bones federal Old Age Security and Canada Pension Plan.

That can give you a rough idea of your monthly post-retirement income in a decade or two in the future and whether you can call it quits “early” or at a more traditional age for leaving the work force.

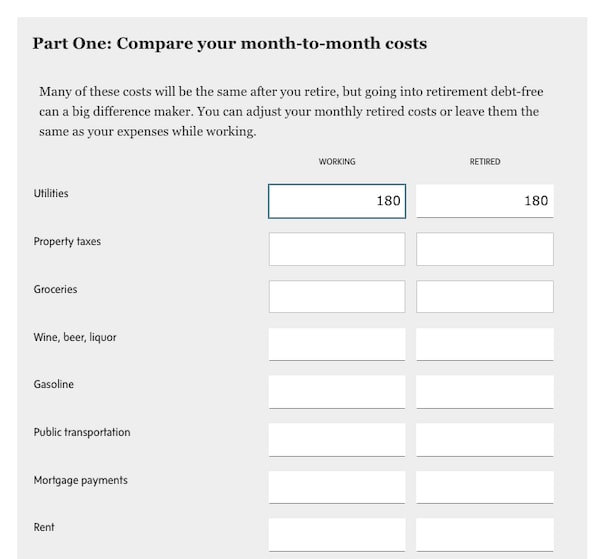

The Globe’s retirement readiness calculator is aimed to line up the income requirements you had during your career against forecast living costs in retirement, known as the retirement ratio. Frugal types may be comfortable on 50 per cent of their working income in their golden years, while the financial industry typically sets it at 70 per cent. Some of us may even plan on spending as much in retirement as we did while fully employed.

Illustration by Sam Island

The math plus adjustments

Determining when you can retire is driven by the basic math of your age and the assets you have now and will accumulate by the time you hit your chosen retirement milestone, such as age 55, 60 or 65.

It can be a sobering exercise or generate a pleasant surprise that an earlier career-end date is possible.

There is also some wiggle room for those inclined to move the date closer by simple adjustments such as saving more and spending less, eliminating high-cost debt, cutting “unnecessary” expenses (such as trimming the family auto fleet) or shifting to a less expensive home or city.

There are also non-financial questions you should be asking yourself and your partner beyond simply when to retire. Do you want to live large with extensive travel and vacation properties? Do you want to stay in your current home or downsize? Will there be a significant inheritance coming your way from elderly family members?

Illustration by Sam Island

A reality check

For most of us, the cold hard facts are getting colder and harder: Guaranteed income in the form of defined benefit pension plans is a rarity today, higher taxes from all levels of government make saving and investing harder, house values buoyed by ultra-low interest rates can no longer be counted on to rise year after year and markets remain unpredictable.

Rising inflation for basics such as food, energy and housing has also eaten into spending power. That means that your retirement portfolio has to at least keep pace with inflation – not always guaranteed when markets can plunge as rates and inflation spike as they did last year.

One of the foundations of retirement planning is ensuring that you will not run out of money before you die.

Reasons you may not have the glitzy retirement you expected include not saving enough, retiring earlier than you really should have, over-reliance on risky assets or overspending on your lifestyle. Some people also end up financially assisting family members, eroding a nest egg that was intended to last for decades.

Illustration by Sam Island

Fit to be retired

Beyond calculating your monthly cash flow needs and piling up the required assets to cover it, here’s a checklist for those who believe they are ready for that final paycheque.

- Are you/can you be debt-free? If you are still carrying a hefty mortgage on your principal residence or vacation property (or sizable investment loans, a sizable line of credit or loans on expensive new vehicles), your retirement is not as bulletproof as you think.

- Are you financially streamlined? Do you deal with multiple banks, have a number of registered retirement savings plans and tax-free savings accounts, accounts scattered at different institutions and a multitude of credit cards? Reduce the clutter, confusion and likely extra expenses that come with having your assets spread across a number of financial institutions and consolidate your finances. This will simplify drawing your retirement income to better monitor cash flow, investments and taxes.

- Are you dependant free? Do you still have financially dependent children who need stipends for education or housing or aging parents that require support? Are those costs factored into your retirement finances?

- Is your portfolio optimized for stable and predictable income generation? Likely your retirement portfolio is a mix that may include a pension, RRSPs, taxable investment accounts and other sources such as rental properties. Is the construction of your portfolio optimized for stable income generation and tax efficiency?

- Non-financial considerations: Are you mentally ready for leaving the work force? Retirement is a major life change. Your social network shrinks and your day-to-day living no longer revolves around work. Have you got a fun and rewarding retirement figured out or are you entering blindly? This applies particularly to those who choose to retire early. Emerging research has found that retirement can be a shock to the system with the loss of structure and routine. Beyond the loss of the network of work friends and weekday social interaction, there can be a decline in perceived status that came with a prominent position. Many new retirees also suddenly find themselves with too much free time and not enough rewarding activities and interests.

The Globe’s retirement readiness calculator is aimed to line up the income requirements you had during your career against forecast living costs in retirement, known as the retirement ratio.The Globe and Mail

Try this at home

- Run the retirement calculator for your ideal retirement age. Then try a few variations such as five years prior to that desired age as well as five and 10 years after.

- Is debt holding you back? Chances are your mortgage is your largest debt and is a drag on your finances. Can you pay it off sooner and what are your pre-payment options?

- Are you leaking cash? Scrutinize your monthly credit card statements. Are you making regular payments on little-used services, memberships or large impulse purchases? What can you cut?

- Like the financial adviser asks, what is your ideal retirement? Is it a time filled with rewarding adventures, friends and family, hobbies and activities or simply an ill-defined after-work life?

UP NEXT: Retirement cash flow vs your lifestyle costs today.

If you like this newsletter course, you might also like Stress Test, The Globe’s award-winning personal finance podcast for Gen Z and millennials. Listen for free wherever you get your podcasts.