Looking for investing ideas? Here’s your weekly digest of the Globe’s latest insights and analysis from the pros, stock tips, portfolio strategies plus what investors need to know for the week ahead.

Coronavirus has finally broken the resolve of markets. Here’s why you shouldn’t run from stocks

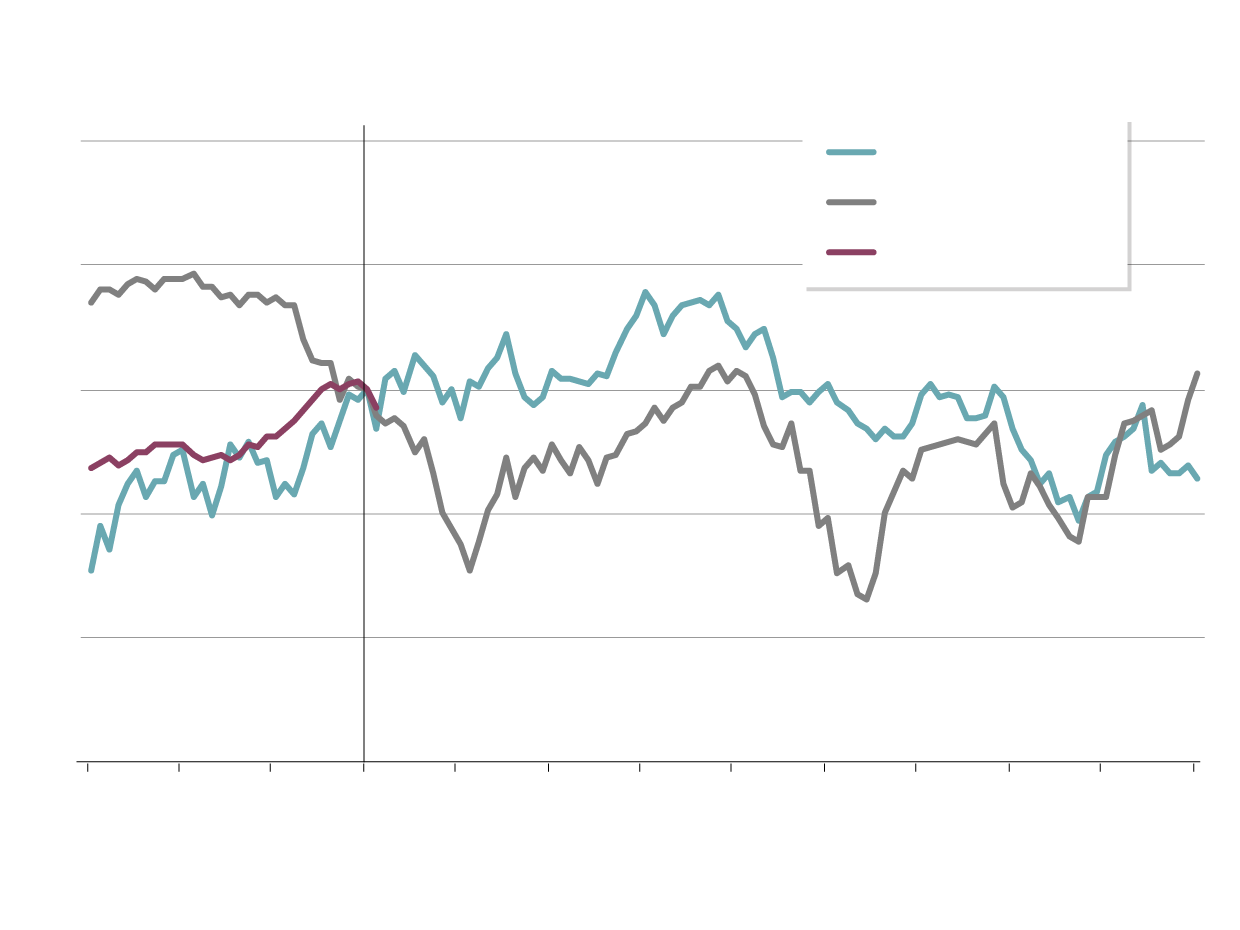

The stock market, rarely a bastion of calm in a crisis, was unusually resilient in January to the emerging threat of a global pandemic – until Friday, Tim Shufelt writes. A day after the World Health Organization (WHO) declared the novel coronavirus outbreak a global emergency, the continuing spread of infections around the world overwhelmed the market’s resolve, sending benchmark indexes deep into the red. The S&P 500 index had its worst trading day since October with a decline of 1.8 per cent, while the S&P/TSX Composite Index fell by nearly 1 per cent.

Periods of heightened volatility are common in the early days of an outbreak, judging by the way other epidemics, such as severe acute respiratory syndrome (SARS), rippled through financial markets. That track record of health emergencies also suggests stock-market losses are typically fleeting – sell-offs that can last as little as three weeks.

S&P/tsx vs. Outbreaks

Approximate start of outbreak=100

110

SARS (2002-03)

Ebola (2014)

Current virus

105

100

95

90

85

-30

-20

-10

0

10

20

30

40

50

60

70

80

90

DAYS FROM OUTBREAK

JOHN SOPINSKI/THE GLOBE AND MAIL

SOURCE: robert kavcic, bank of montreal

S&P/tsx vs. Outbreaks

Approximate start of outbreak=100

110

SARS (2002-03)

Ebola (2014)

Current virus

105

100

95

90

85

-30

-20

-10

0

10

20

30

40

50

60

70

80

90

DAYS FROM OUTBREAK

JOHN SOPINSKI/THE GLOBE AND MAIL

SOURCE: robert kavcic, bank of montreal

S&P/tsx vs. Outbreaks

Approximate start of outbreak=100

110

SARS (2002-03)

Ebola (2014)

Current virus

105

100

95

90

85

-30

-20

-10

0

10

20

30

40

50

60

70

80

90

DAYS FROM OUTBREAK

JOHN SOPINSKI/THE GLOBE AND MAIL, SOURCE: robert kavcic, bank of montreal

Rob Carrick grades Canada’s online brokerages for 2020

The best online broker in Canada is also one of the priciest on commissions and fees, Rob Carrick writes. Pay more with Qtrade Investor, get more. No other broker is good in so many different areas and no other broker makes such consistent year-by-year improvements.

Online brokers are prevented by regulators from offering advice, but the best firms have figured out a way to provide tools that let investors help themselves. If investing to you is a years-long journey of wealth-building for goals like retirement and your children’s postsecondary education, then you’ll get more value from Qtrade’s tools and informative website than you will by paying a few bucks less per trade. Here are Rob Carrick’s complete rankings for Canada’s online brokerages.

More from Rob Carrick: This is how my adviser gauges returns - should I be worried?

Hidden gems: These 10 companies are using clever tactics to dominate their fields – and creating opportunities for investors

After a 10-year bull market that’s looking long overdue for a correction, dogged value investors are searching for bargains that might provide safety in a storm, John Daly writes. And hidden gems ready to be found, priced well below the traditional value investor’s price-to-earnings ratio threshold of 20. Finding them takes work, however.

To discover how the leaders of these companies have improved on traditional strategies, we searched beyond the financial statements. We called 10 of them to find out what their organizations actually do - and all were eager to tell their stories. They include diverse technology firm Calian Group, a lender called Goeasy and, yes, the Royal Canadian Mint.

Gordon Pape’s mailbag: Finding safer investments, surging REITs, firing advisers and other investing dilemmas

A reader asks Gordon Pape to suggest something safer for the 40 per cent of her US$40,000 investment account that she holds in cash. His reply: First, let me point out that there is nothing safer than cash, so I assume your question is really about getting a slightly better return at minimal risk. The first question to ask your broker is whether the firm offers U.S. dollar high interest accounts and, if so, what rate they are paying.

Compare that with the results of a low-risk U.S.-based ETF, such as the iShares Short Treasury Bond ETF. This fund gained 2.33 per cent in 2019, but that was an outlier year. The average annual gain of 1.03 per cent over the past five years is more in line with what you might expect. There a management fee of 0.15 per cent. Here he answers other readers’ questions.

Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up here.

SNC-Lavalin’s share price isn’t done rising yet

If you regret not buying SNC-Lavalin Group shares at their lows last year, before a division of the Montreal-based engineering firm struck a plea deal to resolve a criminal case against it, sending the price soaring, here’s an upbeat idea: Big gains are still ahead, David Berman writes.

One boost to the share price could come from shedding businesses that are no longer deemed particularly important or take the company to areas of the world that are too unstable, such as the Middle East. SNC shares could also get a lift from signs of improving cash flow. Third, consider that SNC shares are still cheap compared with many peers.

What investors need to know for the week ahead

Several corporations release their latest earnings in the week ahead, including BCE, Alphabet, Suncor, CAE, Walt Disney, Brookfield Property Partners, General Motors, Fox, Merck & Co., MetLife, Qualcomm, Brookfield Renewable Partners, Kellogg, Philip Morris, Saputo, Domtar, Cameco and Brookfield Business Partners.

Economic data on tap include: Canadian and U.S. auto sales for January (Monday); U.S. factory orders for December (Tuesday); Canada’s merchandise trade balance and U.S. goods and services trade balance for December (Wednesday); Canadian and U.S. jobs figures for January, plus U.S. wholesale trade and consumer credit for December (Friday).

Looking for more money ideas and opinions?

- John Heinzl: Your dividend ETF questions answered

- A defensive dividend stock with a 25% total return forecast

- Starbucks, Microsoft and more investing stars and dogs for the week

- Your retirement fund in a savings account? Perhaps that’s not as crazy as you think

- Former Dragons’ Den star is buying this stock that’s up 18% in 2020

- Fixed rate mortgages could go on sale as fears of spreading coronavirus push bond yields down

- TD’s move to charge compound interest on credit cards shows seamy underside of loyalty rewards

- Life insurance can be a core strategy for retirement savings

- Four utilities back on the radar as markets get defensive