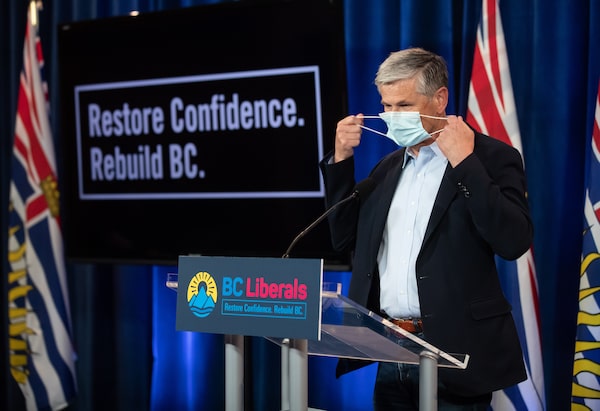

B.C. Liberal Leader Andrew Wilkinson removes his face mask before speaking during a campaign stop in Vancouver, on Sept. 26, 2020.DARRYL DYCK/The Canadian Press

The BC Liberals say they would eliminate the provincial sales tax for a year and slash it in half the following year if they are elected in next month’s election.

The move would remove a projected $11-billion from the province’s revenue over the two years, but Liberal Leader Andrew Wilkinson said it’s necessary to get the economy back up and running after the devastation of the pandemic.

Business groups, including the Business Council of British Columbia, had proposed a sales-tax cut this year, but not a complete erasure of the 7-per-cent levy. The B.C. branch of the Canadian Centre for Policy Alternatives said the BC Liberal plan threatened to create higher deficits than it would be comfortable with.

But the Liberal Leader said deficits are not as much an issue now, with every government in the Western world facing deficit spending to pay for health and education, to maintain necessary services, and to build projects.

“What we have to do is stimulate this economy, get people back to work, bring in investment and rebuild the confidence we have lost and get people working again,” said Mr. Wilkinson, who is campaigning for the Liberals to regain power from the NDP in the Oct. 24 vote.

He said the BC Liberals would not cut health and education services. “At a time like this, that’s exactly when they are needed.”

The provincial Liberals said, as outlined in a statement, that they would eliminate the tax for one year, and cut it to 3 per cent in Year 2 “until the economy recovers from the COVID-19 pandemic."

That would cost $6.9-billion in Year 1 and $3.9-billion in Year 2, but help the economy in such areas as consumer goods, housing, tourism and business investment, they said.

The BC NDP dismissed the proposal.

Speaking for the party, which led a minority government at dissolution of the last legislature, MLA George Heyman told a news conference in Vancouver that the idea wouldn’t apply to groceries, rent, car insurance or child care, which are already exempt from the provincial sales tax, or PST, as well as prescription medication, children’s clothing and school supplies.

He said the BC NDP have been more focused on health care, including the elimination of the medical services premium, and on education and seniors' care.

BC Green Leader Sonia Furstenau said the PST proposal shows a lack of imagination by the BC Liberals after 3½ years in opposition, following 16 years of governing the province.

“This old-school style of economics is not what B.C. needs to recover. We need to target our recovery efforts to the economic sectors that need it most,” she said in a statement.

Steeve Mongrain, an economics professor at Simon Fraser University with an academic interest in taxation, panned the proposal as untargeted.

“Why would we cut down the tax on cars and luxury boats?” he said, hypothetically. “There’s no reason to cut those taxes right now, and create more deficits right now when you don’t need it. There’s no reason to offer a broad relief to everybody. A good fraction of the population didn’t lose their job, didn’t lose any income so we should not give them a tax break right now."

Jock Finlayson, executive vice-president of the Business Council of B.C., said his organization recommended a 50-per-cent cut to the PST for two years to spur the recovery of the economy.

“That’s a bolder move than we had contemplated,” he said of the BC Liberals' proposal. “If the goal is to strengthen the economic recovery scenario, this, I think, would help to do that.”

He said the biggest effect of the plan would be on “consumer durables” such as furniture, non-luxury vehicles and consumer electronics, prompting people to bring forward purchases.

He acknowledged the “substantial hit to the government’s bottom line” the proposal would cause in the short run. "But we’re in an era, not just here but around the world, where previous concerns about balanced budgets and so on have really been cast aside because of the nature of the economic shock we’re facing and living through, and the severe risk we could end up in a period of economic stagnation.”

Marc Lee, a senior economist at the B.C. office of the Canadian Centre for Policy Alternatives, said the “big bang” plan could capture the imaginations of some voters.

He noted that sales or consumption taxes are regressive, with lower-income households paying a bigger share of their income to the tax than higher-income households, who don’t spend all of their income but rather save a lot of it.

However, he suggested the cost could drive the B.C. deficit toward $20-billion, and the question for the BC Liberals is their upper limits for increased deficits. “We generally have been supportive of high deficits because of the downturn in the economy and employment, but the capacity to do that isn’t unlimited.”

At dissolution, the NDP had 41 members, and the Liberals 41, with two Greens, two independents and one vacancy.

We have a weekly Western Canada newsletter written by our B.C. and Alberta bureau chiefs, providing a comprehensive package of the news you need to know about the region and its place in the issues facing Canada. Sign up today.

Ian Bailey

Ian Bailey