Good morning,

Humanitarian and veterans’ groups trying to evacuate people who worked for Canada’s military and diplomatic mission in Afghanistan face major hurdles because Ottawa is strictly enforcing anti-terrorism laws.

Non-governmental organizations say because the federal government is considering Afghanistan’s ruling Taliban a terrorist group, laws prohibiting financing of terrorism prevent them from making basic purchases in Afghanistan to get people out of the country.

The Justice Department and federal security agencies are strictly enforcing the law, putting added pressure on humanitarian and veterans groups to comply as they try to get Afghans in danger of being captured by the Taliban to Pakistan and then to safety in Canada.

A Taliban fighter stands guard as people receive food rations distributed by a South Koren humanitarian aid group, in Kabul, Afghanistan, Tuesday, May 10, 2022.Ebrahim Noroozi/The Associated Press

This is the daily Morning Update newsletter. If you’re reading this on the web, or it was forwarded to you from someone else, you can sign up for Morning Update and more than 20 other Globe newsletters on our newsletter signup page.

Energy sector presses Ottawa to clarify how climate targets will be reached

Industry groups and Alberta want Ottawa to move quickly to clarify and implement policies intended to get Canada on track to meet its 2030 climate goals if the oil and gas sector is to have any chance to deliver steep emissions cuts under tight timelines.

Confidential government documents obtained by The Globe and Mail show that federal bureaucrats identified only about half of the emissions cuts required from the pollution-heavy oil and gas sector just weeks before Prime Minister Justin Trudeau unveiled his March climate plan.

Government officials have said the internal analysis presents an incomplete picture because it doesn’t reflect all of the new policies Ottawa will implement to push for steeper emissions cuts.

However, with less than eight years to go before the 2030 deadline, many of those policies aren’t yet in place or fully developed.

Who’s in charge of fixing B.C.’s flood defences? In communities near ‘orphan dikes,’ no one’s really sure

The South Vancouver sea dike runs along a stretch of the north arm of the Fraser River to protect – notionally, at least – Vancouver’s Southlands neighbourhood, an improbable pocket of countryside in the middle of a metropolis of 2.5 million people.

A little more than 300 buildings, most of them residential, worth a combined value of about $1.7-billion have been built behind the dike. The aging, three-kilometre-long embankment gives the community a sense of protection from rising waters, but according to a 2020 survey of the structure conducted by independent engineers, it’s deteriorating badly and has a strong likelihood of failure. Repairs aren’t likely to happen soon, however, because no one wants to take responsibility for fixing it.

A so-called “orphan dike,” the South Vancouver structure is one of more than 100 in the province that have no owner or diking authority responsible for their maintenance.

- Calgary, other communities prepare for potential flooding along rain-swollen rivers

- Kelowna latest to declare local state of emergency due to possible flooding

Got a news tip that you’d like us to look into? E-mail us at tips@globeandmail.com Need to share documents securely? Reach out via SecureDrop

Also on our radar

Freeland accused of being evasive on use of Emergencies Act: Finance Minister Chrystia Freeland was repeatedly accused of providing evasive responses yesterday as she appeared before a special joint committee of MPs and senators reviewing the government’s first-ever use of the powers contained in the federal Emergencies Act.

Canada set to ramp up critical minerals protection against China: Canada is set to take a far more protectionist trade stance against China, as it teams up with the United States and other Western countries in a concerted effort to secure supplies of critical minerals that are key to a lower-carbon future.

Canadian crypto sector starting to see hiring slowdown: The global downturn in cryptocurrency is starting to squeeze domestic hiring in the sector – companies are either pressing pause on hiring or shelving growth plans altogether, according to industry executives and recruiters.

Wall Street braces for possible Fed rate hike: Investors are betting the U.S. Federal Reserve will announce its first 75 basis point interest rate hike since 1994 today – a sharp shift in market expectations in recent days as inflation proves more stubborn than expected. This shift in investor sentiment has roiled financial markets. Bonds, equities and alternative assets such as cryptocurrencies have sold off dramatically in recent days.

Federal government’s fund to support Indigenous women and girls largely unused: Nearly two years after the federal Liberals announced a $724.1-million fund to support Indigenous women and girls facing gender-based violence, the money sits largely untouched, according to government figures as of May 31.

Ottawa seeks broad powers over telecoms: The federal government has tabled legislation that seeks to give Ottawa broad powers over telecommunications service providers, including barring equipment – such as that made by Chinese flagship Huawei – as well as the power to keep any measures they take secret.

Morning markets

Markets await the Fed: European markets rallied on Wednesday on news the European Central Bank would hold an emergency meeting on the recent bond market sell-off ahead of what is expected to be the most aggressive rise in U.S. interest rates since 1994. Just before 5:30 a.m. ET, Britain’s FTSE 100 was up 0.96 per cent. Germany’s DAX and France’s CAC 40 rose 0.93 per cent and 0.91 per cent, respectively. In Asia, Japan’s Nikkei closed down 1.14 per cent. Hong Kong’s Hang Seng added 1.14 per cent. New York futures were positive. The Canadian dollar was trading at 77.22 US cents.

What everyone’s talking about

Konrad Yakabuski: “Ottawa missed the boat (or flight) by not privatizing Canada’s airports before the pandemic. It may have to turn to the private sector to save them now. Otherwise, taxpayers will foot the bill.”

Gary Mason: “The UN estimates that the war could move nearly 50 million people in several countries across Africa, Asia and the Middle East into famine or famine-like conditions because of its horrific impact on supply and prices. And this is all a very calculated act by Russian President Vladimir Putin. Mr. Putin has weaponized food and is now blackmailing the world with it.”

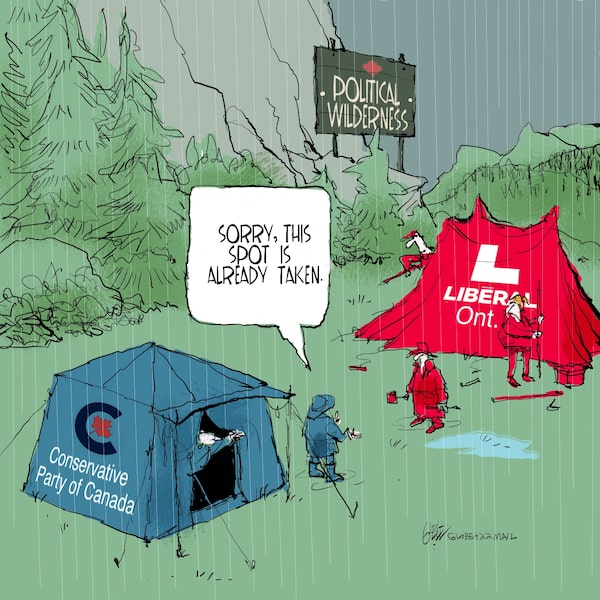

Today’s editorial cartoon

Brian GableBrian Gable/The Globe and Mail

Living better

Avoid the crowds and go skiing this summer

Depending on just how far powderhounds want to travel, glacier skiing is possible all summer in the U.S. and Europe, while snow dumps in Australia and Argentina have meant some southern hemisphere resorts opened earlier than usual.

Moment in time: June 15, 1987

GIPHY is an American website containing a database allowing the search, sharing and creation of animated GIFs devoid of sound. Paris, September 2020.Riccardo Milani/Hans Lucas Pictures via Reuters Connect

First GIF produced

It’s hard to find anything to do with the internet that has remained unchanged from one year to the next. Several decades? Forget about it. And yet, exactly 35 years ago, a team of developers at a since-defunct online service provider in Ohio came up with something so spectacular, perhaps the kitsch alone made it survive: GIF, or Graphics Interchange Format. Whether you’re using it for messages, memes or reactions – or arguing about how to pronounce the acronym itself – GIFs are the internet’s favourite image file extensions. The first GIF uploaded was a pixelated graphic of an airplane in flight with moving clouds. When CompuServe developers introduced it in 1987, however, animation wasn’t exactly part of the plan; lead inventor Stephen Wilhite was simply looking for a faster way to send images. But when the web opened to the public a few years later, GIFs started to take off. Save for a few years in the early 2000s, when they were considered too garish, GIFs never went out of vogue. They continued to evolve as the internet aged, and the advent of social media only made them more popular. Today, a GIF’s distinct loop remains the only video format that is able to run everywhere online, automatically. Temur Durrani

Read today's horoscopes. Enjoy today's puzzles.

If you’d like to receive this newsletter by e-mail every weekday morning, go here to sign up. If you have any feedback, send us a note.