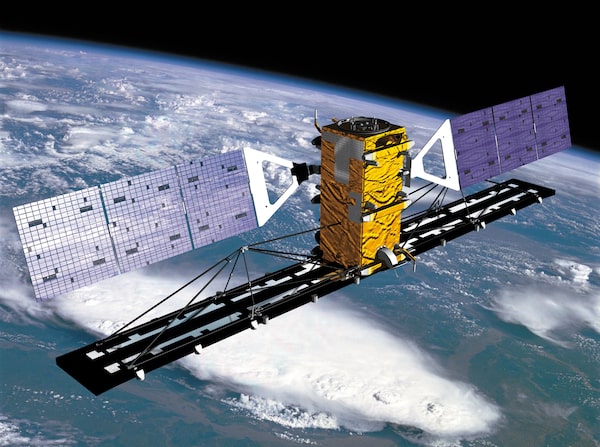

MDA, which owns and operates the Radarsat-2 satellite, has cut the size and pricing of its initial public offering.Courtesy of MDA

Canada’s booming market for initial public offerings is facing a substantial cooling, with space equipment company MDA Ltd. the latest casualty of the correction.

In March, MDA, maker of the iconic Canadarm, laid out plans to raise $500-million and price its shares between $16 and $20 apiece. The company has since slashed the deal size to $400-million and priced at $14 a share.

The pricing change follows similar revisions by recent IPO candidates Boat Rocker Media Inc. and ABC Technologies Holdings Inc. While all three offerings were ultimately sold, they each faced more tepid investor demand, a far cry from the heights of December and January when IPOs could sell in a flash.

Behind the cooling is a sharp correction in growth stocks, particularly in the United States, according to bankers, whom The Globe is not identifying because they were not authorized to speak publicly. Even though the S&P 500 and the S&P/TSX Composite Index are trading around record highs, there has been a sector rotation out of some fast-growing – and often unprofitable – companies into industries such as financials, causing many high-flying names to sell off.

Tesla Inc., for one, is down 7 per cent year to date, and its shares have dropped 23 per cent from their January peak. Shopify Inc. , which trades in both Canada and the U.S., is down 22 per cent from its record high in February.

The sector rotation has hit a number of Canadian companies that recently went public. Dye & Durham Ltd. , which provides software for legal and business professionals, is down 20 per cent since the start of the year, and shares of fuel-cell producer Loop Energy Inc. have dropped 19 per cent since they started trading in February.

Despite the cooling, bankers say the IPO pipeline remains robust, and they are still asked often to pitch their underwriting services to private companies that want to go public. The private businesses remain encouraged by recent deals that still saw strong demand.

In February, Telus International (Cda) Inc. easily raised US$925-million, and its shares are still trading above their IPO price. More recently, Dialogue Health Technologies Inc. completed its $100-million offering and its stock has jumped 40 per cent since it started trading.

But institutional investors have started differentiating between quality companies with solid business models and startups with little revenue or a long path to positive cash flow.

“The market in Canada is generally hungry for innovative companies because technology has been a smaller sector in our market so there is pent-up demand for these opportunities,” Lesley Marks, chief investment officer for equities at Mackenzie Investments, wrote in an e-mail. “But not all innovative companies are the same and we have seen a broad range of quality.”

Earlier this year, startup IPOs sold because many investors had adopted a venture-capital mentality that focused on growth potential, not profit.

In December, MindBeacon Holdings Inc. , which provides mental-health therapy over the internet and lost $6.5-million over the first three quarters of 2020, upsized its IPO to $65-million. Its shares soared when they started trading, jumping 64 per cent in two months. Since then, they have given up all their gains and are currently trading around their $8 IPO price again.

Lately, the focus is on quality businesses that will attract stable, long-term capital. Much of the fervour for growth stocks came from retail investors, and these buyers have shown they are quick to sell when the market turns.

Brampton, Ont.-based MDA, once known as MacDonald, Dettwiler and Associates, was previously owned by Colorado-based Maxar Technologies Inc. but was purchased last year by Northern Private Capital, which is controlled by John Risley and Andrew Lapham, and whose investors include Jim Balsillie, Senvest Capital and the Fonds de solidarité FTQ.

MDA laid out ambitious plans in its IPO prospectus to nearly quadruple revenue over five years, with hopes to be a key player in the 2020s vintage of the space race. Proceeds from the company’s IPO will be used to pay down debt and to bid on new projects.

Despite the weaker pricing, the investor group that bought MDA in April, 2020, during the depths of last spring’s market correction are expected to almost triple the value of their investment.

MDA expects to post adjusted earnings before interest, taxes, depreciation and amortization of between $160-million and $180-million next year, up from $127-million in 2020. It lost $36.2-million in 2020 as it shifted from Maxar’s ownership, after earning $73-million in 2019.

MDA is opting for a TSX-only listing to stress its domestic roots when pitching for contracts from the federal government, a major customer.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.