After rising through the ranks to become CEO of Walmart Argentina and Chile, Horacio Barbeito was asked to head north to pump up Walmart’s limp operation in Canada in 2019.NATHAN CYPRYS/The Globe and Mail

Any company appreciates having a few true believers in its midst, but it thrives with true achievers. Horacio Barbeito (“Haio” to his friends and colleagues) seems to be both. Twenty-seven years ago—the same year Walmart launched in Canada with 122 rebranded Woolco stores—Barbeito joined the retailer in Argentina as a buyer-in-training. What he bought most was the company’s compete-hard philosophy, matching it with some natural people skills. He rose through the ranks, becoming CEO of Walmart Argentina in 2012 and adding Chile to his portfolio three years later. Then, in 2019, Barbeito was asked to head north to pump up Walmart’s limp operation in Canada. In two years he has witnessed, and contributed to, a retail landscape transformed by the forces of pandemic and technology. Walmart Canada’s e-commerce operation is now several years ahead of plan, and the company is adding high-tech fulfillment centres across the country. Next stop for Barbeito: the metaverse. He spoke to us via Zoom during Walmart’s presidents’ roundtable—its first in-person meetings in two years—at the company’s headquarters in Bentonville, Ark.

When you arrived in 2019, the Canadian retail landscape was considered a little sleepy. Did you find that?

With all due respect, I did. I thought Canada was behind in a broad, e-commerce proposition to the market. Even though there was some maturity around loyalty programs, I think they were programs that rewarded the loyal, rather than really creating digital connectivity with customers. And that’s what we’re trying to do. With the strong bedrock we have with our store footprint across Canada—half an hour away from 90% of the population—we could actually be a very important omnichannel player.

At the time, Walmart Canada wasn’t growing the way it was in the United States. Why not?

We hadn’t embraced e-commerce in a positively aggressive way. Maybe we were too caught up in running the stores. Sometimes you need a burning platform, and we didn’t have one.

A burning platform?

Yeah, you know, “We’re running a great business, so why change it?” That is why our strategy is around performing and transforming. It’s great that we have a very healthy business, but start making the investments in building the capabilities to transform, to be future-proof. Investing for growth, bringing in future-proof talent, remodelling stores, building new distribution centres and fulfillment centres, investing in technology. How do we accelerate our flywheel? I think going from hunkering down to playing offence really changed our body language into omnichannel.

You launched a $3.5-billion modernization plan. Was that your initiative, or was that laid down on Walmart Canada from on high?

It’s based on a local strategy to perform and transform. And we already have deployed $1.2 billion of those $3.5 billion in the past 24 months. This year is gonna be the highest investment year since we arrived in Canada. It is about remodelling more stores than we ever did, and it’s not just remodelling—it’s modernizing. It’s not just about building improvements, it’s about our pick-up area, it’s about technology, it’s about empowering the associates with better tools, and at the same time, obviously, modernizing the proposition. We have three distribution centres in flight right now. One micro-fulfillment centre in our Scarborough store that we’re ready to open, and we will be announcing shortly two fulfillment centres to accelerate our e-commerce and marketplace capabilities. So I think it’s a good time to be Walmart Canada.

How has the pandemic complicated this process of modernization?

I saw it as an opportunity, Trevor. Despite the tragic moments that we all have lived in the past two years, and what’s going on in Eastern Europe now. You know, we have all kinds of situations that require us, as corporate citizens, to take a hard look at how we operate. So, racial equity and inclusion being more than something we were all working on to something that we needed to address head-on. We were able to bring our associates to the table to express their concerns and seek to be a better place to work. So, I see this crisis as unprecedented, and very difficult and complex but, at the same time, something that made us better, made us more agile.

So you’re improving the physical stores, and you’re ramping up on the e-commerce side. Which of those two things is more expensive?

Well, obviously the cost to serve an e-commerce customer is more expensive. Imagine—you used to park in a parking lot, grab a cart, pick up your items, pay, go home and put them away. We do a lot of that for our customers now. So, obviously there is a higher cost. But at the same time, there is this notion of customer lifetime value. If we address with our proposition that customer who shops multichannel—sometimes goes to the store for a stock-up trip, sometimes orders online and picks it up at one of the stores, sometimes has an immediate need and buys through one of our last-mile partners or our own delivery service—yes, it’s a business that has a higher cost to serve. But at the same time, it creates a loyalty and a relationship with the customer that will last for a long time. And that’s where the lifetime value of the customer plays an important role.

What percentage of your sales are online versus in-store?

I can tell you that the first year of the pandemic, 2020, we got to the penetration that we had planned for 2024—year four of our five-year plan. If I were a forecaster—this is personal opinion—Canada online will be 25% of commerce in the next five years.

Does an online purchase bring in more revenue than an in-person purchase?

There’s very robust data. The online shopping basket is significantly higher than the in-person shopping basket. Geographies differ a bit, but it could be up to three times. Higher cost to serve, but higher volume. That is why this notion of the lifetime value of the customer is so important.

Let’s talk about other challenges—supply chain, for one. Your Q4 earnings report says Walmart stores saw a 26% increase in inventory over the previous year. How did you do that?

We wanted to make sure we didn’t miss any seasons. You know, we operate under “everyday low prices,” but we also play offence in the seasonal categories. So, we ordered earlier and bigger—bikes, outdoor living, barbecues, garden sets—all that, we’re pretty heavy on right now, even though we are not selling. Because we wanted to make sure, based on the new lead times we’re experiencing, that we have the assortment the customer wants.

Another challenge is inflation. But am I right to think inflation is not as much of a problem for Walmart as it is for other retailers because you’re a discount outlet?

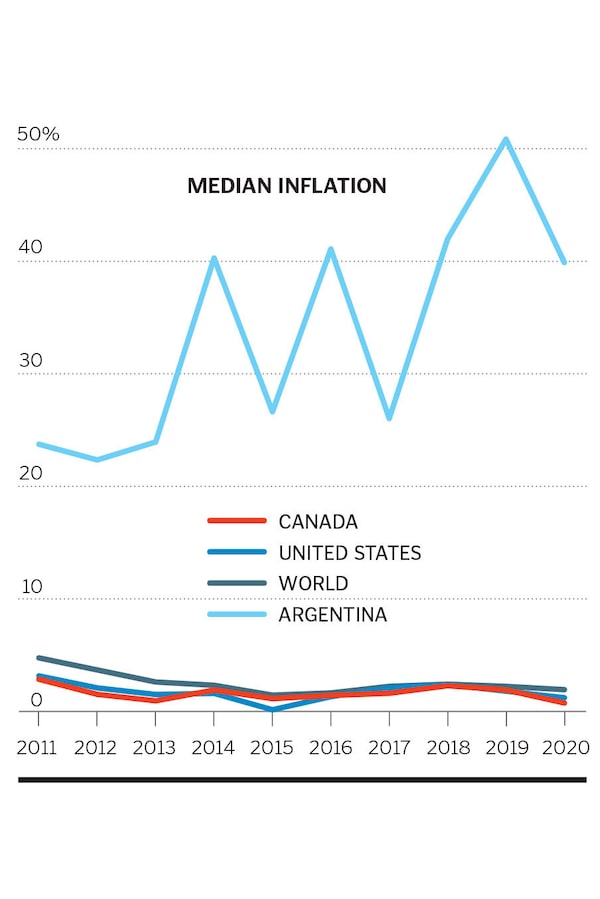

Obviously, Walmart stands for low prices. So, in that sense we fight inflation. It’s part of our DNA. We’re not naive to ignore that raw materials have been going up at some concerning levels, right? So, oil, soy beans, corn, wheat—everything at almost historic levels, and we see that with suppliers. And we work together making sure we do not penalize customers, we do not penalize consumption, that we talk about volume, continuity of supply. And we also want to make sure the customers have lots of options. I come from a country that has not been able to control inflation for the past 100 years, and I know first-hand that inflation is a tax on the lower socio-economic levels. It is that core customer of ours that we need to help to be in control in this inflationary environment.

What extra demands are you placing on your suppliers to help in this fight against inflation?

What we’re preaching, Trevor, is this is not the time to maximize profits. This is a great opportunity to create loyalty in their brands. They’re gonna miss an opportunity to actually gain share if they go up too much in their costs. So we need to work together. We have a supplier growth summit every year. And we transparently show what we are doing, what our strategy is, what our plans are for this year, and we encourage joint business plans. We have hundreds of meetings, and we have very talented people working on cost analytics. Dialogue and data is what needs to prevail.

Walmart is known for demanding concessions from its suppliers. You demand lower costs from them, and in the middle of the pandemic, you charged your suppliers higher fees to help cover the costs of your e-commerce improvements. What was your rationale for that decision?

You know, there are some myths around large retailers like ourselves. But—

You’re saying they’re myths?

Yeah. This is my opinion, right? But we work with suppliers. We work on our relationship based on win-win, that we need to grow together. We need to serve a common customer. Having said that, we did not increase fees. What we did is a program of investment for growth. Because e-commerce is now a much larger part of the market, with a different cost to serve. We need to invest in capabilities, in infrastructures. So we are not having the suppliers fund our infrastructure investment. They are investing in growing with Walmart. If you want to have access to that 300% increase in two years in e-commerce, let’s grow together. This was the spirit.

Suppliers were not happy with those extra fees. The timing of them was called “diabolical.”

That was somebody from an association. It was not a supplier of ours. That particular expression, we thought it was completely out of place, and we were not going to answer to a comment that was aggressive, disrespectful and irrational.

I think because of this controversy, the government is working on a code of conduct for retailers and suppliers. Some Canadian retailers are willing to go along. Why do you oppose it?

I think a code of conduct may limit competition. We strongly believe the best way to have a very competitive retail sector is to foster open competition. We have over 100,000 items in our stores. We have 125,000 more in our fulfillment centres, and we have millions in our marketplace. So, I think a code of conduct may be wanted by people who actually do not want to compete. But that’s them.

Are you still losing money on grocery deliveries?

Depending how you see it, Trevor. It’s hard to make a profit on such an intense service business. But I think we need to see it holistically. I may lose money with a customer ordering online groceries. But he also goes to the store, and he also orders in the marketplace site, and he’s a customer of my pharmacy. If I analyze channel by channel, and just make the decision to accelerate or not accelerate, I may be missing the opportunity to serve that customer in an omni way.

How important are groceries to your overall growth?

Oh, it’s super important. We have a very broad assortment of general merchandise. But in food, you generate stock-up trips. You generate frequency with fresh. You generate loyalty with everyday low prices. And the general merchandise is assortment, novelty, impulse. The one-stop-shop concept of Walmart—we were doubtful if it was future-proof. Now, incorporating the store in that digital connectivity with the customer, I think the one-stop shop is a winning format.

Cast your mind forward 10 years. Will Walmart customers be strolling through a meta store with a digital cart?

It’s not going to be a single view. Yes, we will have stores in the metaverse, where you will have a different experience that maybe would contain some entertainment within your retail experience. You will have—and we already have trials in the U.S.—personal dedicated shoppers that you trust with a code. They enter, and they leave the items in your refrigerator. We will have autonomous vehicles delivering goods to customers. We will have drones delivering items in minutes to your backyard. And we will have stores that become hubs to shop, pick up, return and complement a one-stop shop. I do not believe everything is gonna go online, and I do not believe the store will be the centre of the universe. It’s gonna be omni.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.