JP Gladu wants me to see the land. He turns around the camera on his computer—we’re on a Zoom call—and points it across Bingwi Neyaashi Anishinaabek (Sand Point First Nation) and toward Lake Nipigon. There’s been a dump of snow in this part of northwestern Ontario overnight, and the snow seems to hush the rolling landscape. But there’s nothing quiet about what Gladu wants to tell me, what he wants you to know: that Indigenous people have had enough—enough discrimination, enough exclusion, enough destitution, enough paternalism—and are therefore buying back Canada. “We’re tired of managing poverty—I can tell you that managing poverty is not a fun job. We want to manage wealth.”

And wealth, really, comes back to the land—the swath outside Gladu’s window, the territories to which Indigenous peoples are inextricably linked. Just to exercise traditional activities like hunting and fishing requires a certain level of economic means, Gladu explains. “It’s not like in the past, when our people hunted with dog teams. Today, people need money for a snowmobile and gas.” At the core of what Gladu is saying is a demand for economic reconciliation, which he defines as economic parity between Indigenous peoples and the rest of Canada. The founder and principal of Mokwateh, a consultancy that works to bridge the gap between Indigenous businesses and corporate Canada (mokwateh means “bear heart” in Ojibway), he says economic reconciliation needs to be part of our collective move toward overall reconciliation. It’s about bringing Indigenous communities and businesses into the economy.

The reality is that the policies that have shaped this country’s relationship to Indigenous peoples are as white as the snow outside Gladu’s window. The supremacist underpinnings of the disparities we see today are the legacy of the Indian Act, which has formally restricted Indigenous economic development since its enactment in 1876. So to move forward as a country for all citizens, we need a collective reckoning with our post-European-contact past. Ours is a history of exclusion: When the Crown forced Indigenous peoples from their lands and onto reserves, it effectively deported them to poverty. Unless Canadians grasp this and confront the brutal legacies of colonialism, there can be no reconciliation.

The Globe and Mail

Jake Dockstator (Oneida Nation of the Thames, southwestern Ontario), whose mission is to foster economic prosperity in Indigenous regions, remembers when he was studying arts at the University of Waterloo; in his class of 40, only two had heard of residential schools. When revelations of the 215 unmarked graves at the former Kamloops Indian Residential School were made in May 2021, non-Indigenous people finally started realizing the scope of the horrors inflicted on Indigenous peoples by their own country. “The Indian Act is a racist piece of legislation, simply because it governs a group of people based on their race,” says Dockstator, a law graduate, filmmaker and executive director of the Sioux Lookout Friendship Accord Economic Development Corp. (SLFA-EDC). “Under it, there’s no ability for Indigenous people to be masters of their own destiny.” The act prevents First Nations people living on reserves from using their land as security, since the land belongs to the Crown. “Non-Indigenous Canadians can use their house as collateral for loans; First Nations people on reserve can’t do that.”

The Indian Act is like a black hole sucking up and obliterating Indigenous well-being. Imagine not being able to leave your reserve without first getting written permission from the Indian Agent, or not being allowed to hire a lawyer, a rule that was finally struck when the act was revised in 1951. And if Indigenous people got a university education, they were stripped of their Indian Status; the State considered them “enfranchised.” “How do you generate wealth under those circumstances?” asks Tabatha Bull (Nipissing First Nation, southcentral Ontario). “Economic reconciliation is about truth—understanding where we are now, and how and why Indigenous people were left out of the economy.”

Tabatha Bull, president of the Canadian Council of Aboriginal Business, in April 2021.Galit Rodan/The Globe and Mail

Stolen land won’t be returned to Indigenous peoples any time soon. That means the reconciliation journey must include a path toward economic self-determination, says Bull, president and CEO of the Canadian Council for Aboriginal Business (CCAB). “We talk about human rights—safe drinking water, access to land, treaty rights, Indigenous access to education—but we seldom talk about economic prosperity,” or the all-too-common lack thereof. A few examples: 11.8% of Indigenous people live below the poverty line, nearly double the rate of the non-Indigenous population; the high school completion rate is 18.5 points lower, and 15.6 points lower for university; the unemployment rate is 8%, compared to 5.2% for non-Indigenous people.

For the past 20 years, the CCAB—which marks its 40th anniversary in 2024—has worked on turning that narrative on its head. It runs the Progressive Aboriginal Relations (PAR) program, whereby corporations sign up for help on how to boost Indigenous relations, with gold, silver and bronze certificates awarded as a company makes PAR progress. (Gold-level companies include Scotiabank, Bank of Montreal, HydroOne, BC Hydro, Syncrude and Ontario Power Generation.) And in 2018, the CCAB launched Supply Change, a multiyear strategy to boost procurement from Indigenous-owned businesses; Suncor’s then CEO, Mark Little, was the inaugural chair.

Anyone who pays even scant attention has noticed that as a concept, economic reconciliation gets bandied about a lot these days, by everyone from banks to corporations to political parties, with different interpretations depending on whose agenda it becomes part of. Political parties might use the term to court votes; for corporations, adopting the concept could enhance environmental, social and governance (ESG) goals. Even for Indigenous people, the definition varies depending on, among other things, what a particular community needs to advance economic and social well-being, and where the community is situated. Dockstator emphasizes the need to consider geography in addition to history when we talk about persistent barriers to economic reconciliation. “People need to understand what it’s like to live in a small community that’s a two-hour drive from the nearest Tim Hortons,” he says, referring to the lack of opportunities in remote locations, which tend to be inhabited mostly by Indigenous people.

But Hayden King (Beausoleil First Nation, southern Ontario) says we’re going about economic reconciliation the wrong way. “The premise should start elsewhere,” says the executive director of the Yellowhead Institute, an Indigenous-led research and education centre based at Toronto Metropolitan University. “Conversations around economic reconciliation tend to skirt the idea of Indigenous sovereignty. What I’d like to see applied to these discussions is a restitution-based framework as opposed to one that is recognition- and reconciliation-based.” The current structure doesn’t get at the root causes of injustice: dispossession of land, denial of livelihoods and exploitation. “Instead, we’ve got Impact Benefit Agreements, we’ve got joint ventures, we’ve got procurement strategies, all of which are premised on these limited rights that Indigenous people possess based on Canada’s interpretation of its obligations.”

King describes it as a sleight-of-hand, whereby the government and industry appear benevolent: “They’ve taken your land but are now inviting you into this narrow paradigm of economic development. We need to shift away from that to restitution, sovereignty, land back—the redistribution of power back into the hands of Indigenous people.” Still, he says it’s not for him to decide how Indigenous communities should move forward; it’s up to them to choose their path.

Hayden King of Beausoleil First Nation, is the executive director of the Yellowhead Institute, an Indigenous-led research and education centre based at Toronto Metropolitan University.Michelle Siu/The Globe and Mail

At the end of the day, economic reconciliation doesn’t come in one size fits all, nor is there a unified opinion on how to get there. Indigenous communities each have their own history and culture, their own sets of values and aspirations, their particular disagreements, challenges and victories. “We are not a monolith,” says Gladu. “Why are we expected to have 100% consensus when our governments are in the sub-50%?” As an example, he points to the proposed development of the critical-minerals-rich Ring of Fire in northern Ontario, and environmentalist opposition and political caution because some communities in the region are against it. “Yes, it’s true—a couple of communities don’t want it. But there are communities that do that are also the most impacted. So why aren’t we supporting the communities that want that project, just because not all of them agree?” he says. “Tell me a situation where everybody agrees. That’s utopia.”

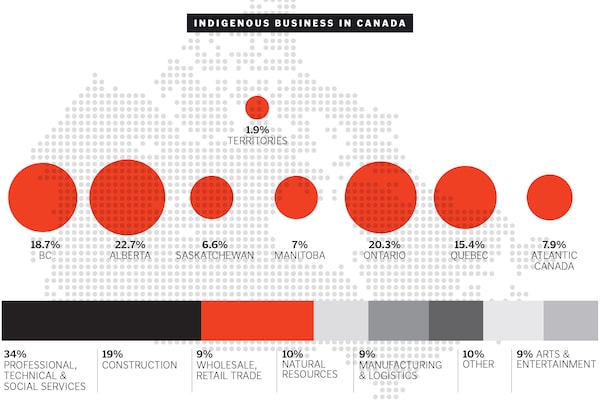

Regardless of how you—or your grandmother or the prime minister, for that matter—understand economic reconciliation, Indigenous peoples need all of us to commit to building a country based on equality, equity and fairness. The reality is that Canada needs it, too. Indigenous people account for the fastest-growing demographic in the country, with a booming youth segment compared to the rest of Canada, whose population—and work force—is aging. Add to this untapped resource the fact that Indigenous people start businesses at nine times the national average. “Investing in Indigenous businesses is not riskier than any other business,” says Bull. And when people get over their prejudices, she hopes the investment coin will drop.

For reconciliation—including economic reconciliation—to happen, words must be matched by action. The federal government earlier this year promised $65 million for “advancing economic reconciliation by unlocking the potential of First Nations lands.” But everyone knows how slowly government works. Take the Truth and Reconciliation Commission’s Calls to Action. Out of 94 action calls—number 92 deals with economic reconciliation and supporting Indigenous businesses—only 13 have been completed so far, eight years after the final report came out. And just imagine the years, even decades, it would take to bring about a constitutional amendment to abolish the Indian Act.

In the meantime, Indigenous people are finding ways to actively shape their economic future—by buying back Canada. Short of sovereignty and getting land back (at least for the time being), they’re setting up their own development corporations. They’re investing land claims in revenue-generating businesses to support social and cultural programs, health facilities, sport and recreation centres, and higher education and skills training. (See the profiles starting on page 30 for examples of what economic reconciliation and self-determination can look like.) They’re demanding a seat at the negotiation tables of corporate Canada. And they’re pushing for a national loan-guarantee program. But no one claims it’s easy going.

Perhaps the biggest challenge is the lack of access to financial capital. In Canada, Indigenous communities and companies have few avenues to access capital markets because of persistent colonial structures around ownership and collateral—as Bull puts it, “land issues that keep Indigenous people poor.” And while the government has provided limited funding at times, “they would only fund our projects a year at a time,” says Gladu. “But who writes a business plan on one-year funding?”

There’s also a shortage of Indigenous business leaders, social networks and board connections, and a negative bias in banks. An increasing crop of Indigenous financial institutions—including First Nations Bank, the First Nations Finance Authority and others—helps, as do three provincial loan guarantee programs in Alberta, Saskatchewan and Ontario—although the latter have a reputation for being chronically underfunded. Hence the call for a national loan guarantee program.

Chief Sharleen Gale, chief of Fort Nelson First Nation and chair of the First Nations Major Projects Coalition.Alison Boulier/The Globe and Mail

This past June, Chief Sharleen Gale from Fort Nelson First Nation in northeastern British Columbia led a delegation of peers and business and banking executives to Ottawa to meet with federal officials. What Gale wanted to make clear was that without financing that enables Indigenous communities to become owners, partly or wholly, in energy and infrastructure projects, those projects risk delays or may not get built at all. Without meaningful partnerships—the power to say yes and no—economic reconciliation is just a term. Gale is adamant that Indigenous peoples have a say in what’s happening on their traditional territories. In 2015, her Nation and 10 others launched the First Nations Major Projects Coalition (FNMPC)—of which Gale is the chair—to support members with advice as they seek ownership in resource and other major projects on their lands. The coalition currently has 145 members across Canada and is involved in 12 projects so far. One of those is Tu Deh-Kah Geothermal on Gale’s First Nation—a project that would not have been possible without the assistance of the FNMPC. In addition to providing clean energy for her Nation and the local community, the development will bring in plenty of benefits for her people. It also supports Canada’s goal of reaching net zero by 2050. But it all started with a seat at the table.

Board representation goes beyond securing economic benefits. It’s also a way to ensure that Indigenous values and avenues for cultural practices are respected. Gale says it could be about protecting a salt lick, a caribou migration route or a berry patch from industrial activity, and safeguarding cultural sites and places where medicines grow. Gladu, a corporate-board veteran, mirrors that sentiment. He calls for making ESG targets, not only profits, a prime objective, and seeks commitment from industry to collaborate with Indigenous peoples, not only securing their consent. “That’s why I’d like to see an Indigenous person on every board in this country,” he says, adding that there are maybe 10 such directors on major corporate boards today, including himself (he was one of the first when he joined Suncor in 2017). That would also put Indigenous people in the driver’s seat when it comes to environmental assessments and applying traditional knowledge essential to minimizing the impact on land and the species living on it. “In the 1930s, my community was flooded by Ontario Hydro,” says Gladu, referring to Lake Nipigon and the hydro development that drowned burial grounds and cultural sites. He also mentions Rio Tinto blowing up a 46,000-year-old Aboriginal site in Australia in 2020. “With Indigenous people on corporate boards, we can make sure something like that never happens again.”

It really comes down to “nothing about us, without us.” One of the best power tools to ensure this is the United Nations Declaration on the Rights of Indigenous Peoples, or UNDRIP. Enshrined by the international body in 2007 and adopted by B.C. in 2019 and by the federal government in 2021, it gives Indigenous people the means to enter partnerships. While not legally binding, it spells out a set of rules for business engagement anchored in so-called Free, Prior and Informed Consent, or FPIC—consultation with and consent from Indigenous peoples from the early planning stage on proposed projects that may impact their traditional lands and livelihoods. While going against FPIC might not be illegal, it is morally unacceptable and really bad PR.

“Consumers are increasingly demanding to know where things are coming from and whether there was consent to projects,” says Mark Podlasly (Nlaka’pamux Nation, Cook’s Ferry Band, B.C. Interior). What’s more, says Podlasly, the FNMPC’s chief sustainability officer: “Indigenous people hold increasing sway over vast amounts of land, and any development on traditional territories requires FPIC.” The green transition can’t happen without FPIC because most, if not all, of Canada’s critical minerals are on, or under, constitutionally recognized Indigenous ancestral and treaty lands. (The B.C. Supreme Court ruled in September that no mineral claims can be made on Indigenous land before the First Nations there have been consulted.) “And if companies think they will take their case to court, well, that can take years, maybe 25 years,” Podlasly says. “Do you really have 25 years to wait before starting a project?” To him, it’s a no-brainer: Involve consenting Indigenous people as co-investors.

Economic reconciliation is not about handouts; it’s about enabling Indigenous people to reach the same standard of living that the rest of Canada takes for granted. And yes, they will make decisions that not everybody likes; we all do. And they will not all agree on everything; nobody does. To some, even the concept of “reconciliation” is flawed, because it doesn’t challenge the status quo or address the fact that Indigenous people are not the ones who should make amends. But Indigenous communities need to be able to call the shots, to decide and act on what they feel is best for their future well-being—economic, social and environmental. And it’s about respecting that there are differences in ways of being and doing—from Iqaluit to Tiotià:ke (Montreal), from Tkaronto (Toronto) to K’emk’emeláy (Vancouver), from Waskasoo-Seepee (Red Deer) to Tuktuuyaktuuq.

Gladu and Bull and Gale—everyone interviewed for this story—want to reassure Canadians there is nothing to be fearful of. But there is an important lesson to keep in mind about how we approach economic reconciliation. Gladu recalls the Mi’kmaq fishers whose boats and nets, along with a storage facility, were burned in 2020 by a mob of non-Indigenous fishers pissed off about Indigenous rights to harvest and sell lobster. “It was awful to watch from afar. I can only imagine what it was like up close,” Gladu says. Now, the Mi’kmaq own 50% of the largest fishery in Nova Scotia thanks to the $1-billion purchase, with Premium Brands, of Clearwater Seafoods. “Those racist, fearful, non-Indigenous people who were harassing them now have to sell their fish to the very people they were harassing. Be careful about your actions today, because the future is going to be a lot different.”

Derrick Neeposh of the Cree Nation of Quebec, is president of Creeco. “We’re putting Indigenous culture front and centre in Canada’s second-largest city,” says Mr. Neeposh.KATHERINE TAKPANNIE/The Globe and Mail

Creeco

Cree Nation of Quebec (Eeyou Istchee, Que.)

Project: ODEA real estate development, Old Montreal | Largest Indigenous real-estate development in eastern Canada

Lay of the land

Leveraging the 1975 James Bay and Northern Quebec agreement—a $225-million mea culpa from the province for Hydro-Québec’s flooding of Cree territories—the Cree Nation of Quebec created the Board of Compensation and Cree Regional Economic Enterprises Co. (shortened to Creeco) to kick-start economic development that would bring long-term prosperity to its nine communities. The nation now owns and operates an airline (Air Creebec); camp management services and infrastructure for hydro and mining operations; the Quality Inn & Suites in Val d’Or; and several other businesses. In 2020, it broke ground on ODEA, a residential-commercial tower under construction in Old Montreal.

Bold move, fair deal

Creeco’s first sizable foray into real estate development, ODEA was conceived by Douglas Cardinal—the Indigenous mastermind behind the curvilinear Canadian Museum of History in Gatineau, Que.—with input from Cree Nation Elders. The 26-storey design riffs off a canoe, a mode of transport that unifies First Nations. “We’re putting Indigenous culture front and centre in Canada’s second-largest city,” says Derrick Neeposh, Creeco’s president. But the project is more than a bold statement; it’s a move toward independence. “It was important for us to have control,” says Neeposh. Creeco negotiated 95% ownership of the project; Cogir, its Montreal-based real estate management partner, owns the remaining 5%. That was key to creating revenue for the long term. “We wanted a partnership with a company that was willing to work with us not only on this project but also on future developments,” says Neeposh. “If we wanted fast cash, we could’ve just sold the property.”

Return on investments

While revenue from ODEA is still months away (move-ins are slated for spring 2024), it will add to the income generated by the various divisions under the Board of Compensation–Creeco umbrella. The Board of Compensation is already running a growth fund, an economic development fund and a community fund that support its citizens through housing developments, infrastructure projects, education and employment training, plus social, cultural and language programs. “In the Cree Nation right now,” says Neeposh, “we have very modern facilities—arenas, health centres, clinics in every community, justice buildings, new band offices. And that growth happened because we demonstrated we can manage our own affairs without a political third party watching over us.”

Creeco is committed to going after big projects, says Neeposh, not just to generate revenue, but also to create jobs. To that end, Creeco is working on its next big thing. “We can’t say what yet,” he says, “but we’re planning something very big in the real estate division.”

Self-determination vs. economic reconciliation

Neeposh stresses the importance for First Nations to demand majority ownership of projects, be it in mining, hydro, real estate or other sectors, and to look for meaningful partnerships with Indigenous and non-Indigenous companies alike. “Don’t fear taking those steps, and always be mindful that you have the capability to build your own independence,” he says. “When you gain that independence, reconciliation is secondary—secondary to what the government wants to do.” As for the government? “Allow us to flourish. Allow us to grow. Allow us to develop.”

Natural Resources

Crystal Smith, chief councillor of the Haisla First Nation of Kitamaat Village, B.C.Alison Boulier/The Globe and Mail

Haisla Nation

(Kitamaat Village, B.C.)

Project: cedar LNG facility | First majority Indigenous–owned liquified natural gas export facility in Canada

Lay of the land

For the first time since European contact, the Haisla Nation has taken control of a major industrial project that would otherwise have fallen under the purview of—and with profits going to—settler-colonialists on their territory. This past March, the B.C government granted an environmental assessment certificate for Cedar LNG, a planned LNG export facility it’s developing in partnership with Pembina Pipeline Corp. The $3.2-billion project is a floating loading facility in Kitimat, on Haisla territory, that will have the capacity to produce an estimated three or four million tonnes of LNG annually from TC Energy’s Coastal GasLink pipeline. (Neighbouring LNG Canada, also on Haisla land, will receive 14 million tonnes when it goes online.)

The long road to approval

Crystal Smith, chief councillor of the Haisla Nation, says it took more than a decade of discussion before a majority of community members agreed to the project, looking forward to a future of economic self-determination rather than government reliance. While critics will point out that LNG is a fossil fuel that should be phased out sooner rather than later, Smith argues LNG is a bridge fuel to help reduce global emissions when exported to countries that would otherwise use coal. “We can add our Indigenous values and become part of the solution by displacing higher-polluting commodities,” she says. The Cedar LNG facility will itself also run on renewable energy from BC Hydro. Smith stresses that the decision to build Cedar LNG on Haisla land was not taken lightly. “We take care of our land, our territory, and we are always taking into account the environment. The key to our success is having the membership with us.” With majority support from members, council voted in favour of the project, as well as allowing the last 8.5 kilometres of the Coastal GasLink pipeline to traverse its territory to the coast.

Big gains for the community

Over the past few years, the Haisla Nation has leveraged revenues from impact-benefit agreements with LNG Canada and Coastal GasLink, which operate on their territory, to build a high-tech health facility able to accommodate teleconference medical appointments with remote patients. The Nation has been able to move members into a 23-unit housing complex on reserve, and it has purchased eight 10-unit apartment buildings off reserve, in Kitimat. There’s a $7-million youth facility that’s become a sort of living room. All these infrastructure undertakings form part of healing a community fragmented on several levels by colonialism. And once Cedar LNG is completed—the final investment decision will happen this quarter—it will bring long-term benefits to the region. Smith notes there’s an increase in dementia, for instance, but the region lacks specialized resources to care for these people. Thanks to Cedar LNG, the Haisla Nation is already helping make such a facility a reality with a $500,000 donation to the Kitimat Valley Housing Society this past March; ground-breaking for the 12-room Kitimat Dementia House Project is planned for 2025. “When Indigenous communities thrive, we can contribute to broader society,” Smith says.

These are just the physical projects. The Haisla are also investing in saving their language and culture; out of 2,000 members, only 145 still speak Haisla. “We finally have the funds to create our first-ever culture and language department, with a full-time manager,” says Smith. But she sees the project overall as a conduit to independence—a legacy project. “The revenue generated from Cedar LNG will solidify and sustain our programs for many generations,” she says. “This is a new era: of relationship building and of rebuilding partnerships with other First Nations that existed prior to first contact. And I hope all corporations take into account whose territory they are on, and who benefits from them being there.”

Alfredo (Fred) Di Blasio, a member of the Huron-Wendat Turtle clan, is the CEO and founder of Longhouse Capital Partners. The Huron-Wendat community has 10 per cent ownership of LCP.Andrej Ivanov/The Globe and Mail

Finance

Longhouse Capital Partners

(West Vancouver)

Project: $1-billion investment fund | Largest Indigenous asset manager in Canada

Lay of the land

Considering UNDRIP, FPIC and Call to Action No. 92, Canada has an obligation to involve Indigenous communities and businesses in resource and other economic development on their traditional lands. But without access to capital, their level of involvement is limited, and so the commitments made by Canada—and good-faith pledges by corporations—risk becoming platitudes. A report by the Assembly of First Nations and Indigenous Services Canada pegs the infrastructure gap for First Nations at $349 billion to reach parity with the rest of the country. (For the rest of Canada, estimates of the gap vary widely, from $150 billion to as high as $1 trillion.) Enter Longhouse Capital Partners, the Indigenous-led investment fund with a $1-billion target.

Correcting the imbalance

“From a financial standpoint, we like to refer to things as TAM—total addressable market. And we think there’s a huge market,” says Fred Di Blasio, Longhouse’s CEO and co-founder with Bernd Christmas, Christian Sinclair and Paul Cugno. To tap into that market, Longhouse will provide risk-adjusted returns for its investors while delivering capital to Indigenous communities on an equal basis to ensure long-term economic self-determination. With a target of $1 billion, Longhouse is aiming to close its first $500-million round in the first quarter of 2024. There are obvious challenges. “We’re a first-time fund working in this system,” says Di Blasio (a member of the Huron-Wendat Nation near Quebec City), referring not only to structural inequalities but also negative stereotypes. So the focus leading up to the fund’s launch in May was to assemble a team that would build confidence with investors who want to make a difference while making money. Strategic advisors include former Liberal cabinet minister Martin Cauchon and Walt Jackson, formerly of Goldman Sachs and Onex. The investment team includes co-founder Cugno (Lehman Brothers, Jefferies, Barclays); Kelly Marshall (OMERS, Brookfield Asset Management); and Yanick Blanchard (formerly of National Bank of Canada). “We’ve got the experts,” Di Blasio says. “We’re prepared to play hard and win.”

Ancient wisdom for new times

Playing hard in these times must include ESG principles—an area where Canada has a lot to learn from Indigenous values. “ESG is essentially taking our seven sacred teachings—respect, bravery, truth, honesty, humility, love and wisdom—and casting them in marketing speak,” says Di Blasio. “If colonial business had heeded our advice on how to treat Mother Earth, we wouldn’t find ourselves in this rather difficult climate crisis.” Longhouse created its own ESG framework to ensure investments and allocations are made on a holistic basis. “Indigenous people have always been stewards of the land. Now we can be stewards of capital,” Di Blasio says. As for reaching net zero? “We’re part of the solution—and we’re open for business.”

Giving back to grow stronger

In their combined 200-plus years of experience, Longhouse’s management and investment teams have conducted more than 1,000 job interviews in finance. “In our collective careers, we’ve never seen another Indigenous person,” says Di Blasio. One of Longhouse’s objectives is to change that—by putting an emphasis on scholarship and mentorship opportunities for Indigenous youth. Di Blasio calls this “finance for good,” creating a positive impact by increasing financial literacy, building capacity and providing opportunities.

PFN Group of Cos. Pasqua First Nation (Pasqua, Sask.) PROJECT: PRO METAL INDUSTRIES IS THE ONLY 100% INDIGENOUS- OWNED DEFENCE CONTRACTOR IN CANADA. PFN Group, the business division of Pasqua First Nation, bought Pro Metal in 2015. Today, one-third of the steel manufacturer’s workers are First NationsMarcel Petit/The Globe and Mail

Manufacturing

PFN Group of Cos.

Pasqua First Nation (Pasqua, Sask.)

Project: Pro Metal Industries | Only 100% Indigenous-owned defence contractor in Canada

Lay of the land

Not content with temporary local contracts and joint ventures, Pasqua First Nation started seeking long-term business opportunities, especially after settling a $20.6-million flood claim in 2013, to build up its economy and expand social programs. So in 2015, PFN Group of Cos., the Nation’s business division, tapped into the interest earned on the flood-claim investments to purchase Regina-based Pro Metal Industries for $4 million, giving the Nation a foot in manufacturing. Soon after, it embarked on a market study to gauge Saskatchewan’s economic outlook and identify growth sectors. Thanks to the acquisition of Pro Metal, PFN Group could now pinpoint—and go after—prospective clients in agribusiness, construction, oil and gas, mining and defence, to name a few.

Pedal to the metal

The acquisition made Pro Metal one of only a handful of 100% Indigenous-owned steel manufacturers in Canada. It would also boost the Nation’s revenues, especially after it started going after defence contracts—a strategic move stemming from figuring out where government, for instance, would allocate spending. “Even in a recession, every country needs to defend itself,” says Chief Matthew T. Peigan. Its first defence partner was General Dynamics Land Systems, or GDLS-Canada, which supplies armoured vehicles, including LAVs, to the Canadian Army. (GDLS has Progressive Aboriginal Relations certification from the Canadian Council for Aboriginal Business.) “They put in a purchase order for $1 million for components,” says Peigan, adding the defence sector now accounts for 33% of Pro Metal’s business.

Return on investments

Pro Metal brings in the bulk of PFN Group’s millions in annual revenue; that’s set to grow when a 44,000-square-foot manufacturing plant opens next spring. The facility will almost double the size of the metals business and expand specialized manufacturing with new laser and water cutters. “With that equipment,” says Peigan, “we’ll be able to create spin-off business.” Add to that a new metals-painting shop designed to handle military-grade powder coating. These developments mean opportunities to better members’ lives. “Now, 38% of Pro Metal’s employees are First Nations people working as machinists, welders, pipe benders, office staff. Our goal is to increase that number,” Peigan says. “With the expansion, we’ll add employment. And the more opportunities, the better the process for people to provide for their families.”

PFN Group’s activities are enabling the construction of 46 new homes (the goal is to boost the on-reserve population from 800 to more than 1,000, of a total membership of 2,600); expansion of the high school; and the opening of a 12-suite long-term-care facility. PFN Group also oversees land acquisitions, both urban and agricultural—steps toward not only economic independence but also energy and food sovereignty. “We want to produce our own food on land we own rather than rent; we want to build solar and wind power so we can get off our dependency on SaskPower,” Peigan says.

Contribution to broader economy

Pro Metal’s facility under construction is located off reserve, bringing in property and employment taxes to provincial and federal coffers, not to mention jobs for non-Indigenous people. And the Nation’s growth spurt puts it in a good position when it comes to Canada’s new public services and procurement policy, aimed to increase diversity among suppliers. Of its $24-billion annual budget, a minimum of $1.2 billion is earmarked for Indigenous businesses. “We’re ahead of the game even before Canada implements the policy in 2024,” says Peigan. “We want a piece of that cake.”

Clean Energy

Chief Wayne McQuabbie of the Henvey Inlet First Nation in Pickerel, Ont.JOHN PAILLÉ/The Globe and Mail

Nigig Power Corp.

Henvey Inlet First Nation (Pickerel, Ont.)

Project: Henvey Inlet Wind | Largest on-reserve wind installation in Canada

Lay of the land

Swept by the prevailing westerly wind, Henvey Inlet First Nation is located on the northeast shore of Georgian Bay. More than a decade ago, band members and council alike started thinking of that breeze as a potential resource—and a source of revenue that could lift the Nation out of poverty. But the idea didn’t gain traction in a real way until after a regional chiefs’ meeting in 2008, when Paul Boreham, president of the wind-power company 401 Energy, was invited to speak. Boreham, whose business model favoured a 51% equity portion for local partners (mainly southern Ontario farmers), urged the First Nations to go after partnerships with equal equity. “I was intrigued,” says Chief Wayne McQuabbie. “That’s when it all started.”

Going 50-50

When Henvey Inlet’s band council went looking for partners, the only way forward would be a 50% equity stake. At one point, three companies were shortlisted, but McQuabbie says none of them were the right fit. He instructed Nigig Power’s then CEO, Ken Noble, to go after the largest renewable-energy proponents in the world. “We did a sort of beauty contest,” he says. The winner was Pattern Energy, which has renewables projects across North America and in the Caribbean. Henvey Inlet ensured its partner would respect the Nation’s treaty and inherent rights, including hunting and gathering. What it got was a partner that also gave the Nation veto powers on anything related to the land, such as safeguarding heritage sites, habitat and species at risk, and it pitched in for the community’s powwow and youth fishing derby. Pattern even helped, along with the First Nations Finance Authority, to secure bridge financing (90% financing, 10% down). “That kind of deal was unheard of,” McQuabbie says. But not impossible: “Do your due diligence, and never give up,” he advises other Indigenous communities. The agreement with Pattern was signed in 2014; the blades on the project’s 87 wind turbines started spinning in October 2019.

Windfalls of change

Churning out 300 megawatts of power, the 132-metre-tall turbines are connected to the grid, keeping the lights on in 100,000 homes. Under a 20-year renewable feed-in tariff contract with the province’s Independent Electricity System Operator, the band receives annual revenues of roughly $20 million, both from electricity generation (the amount varies depending on wind conditions) and leasing fees for the transmission line that crosses its land. At the peak of construction, some 1,000 people worked on the project, one-third of them First Nations citizens; $25 million in contracts went to local Indigenous businesses. While the finished project only requires 20 staffers for maintenance, the income from it has changed life for the Nation, with upgraded on-reserve infrastructure, including new housing, a new access road and a new ceremonial building, and more jobs. Neighbouring First Nations also receive leasing fees for the portion of the 104-kilometre transmission line on their traditional territories.

The majority of revenues are funnelled into a trust, managed by the First Nations Bank, for future generations. “But our members also receive quarterly distributions from the trust. It’s not to get rich, but to improve quality of life,” says McQuabbie. While he isn’t prepared to discuss other major initiatives—planning made possible thanks to the income from the wind project—he says the Nation is in early talks with Pattern on future revenue-generating projects. “We’re seeing the fruits of our labours now. We’re able to do more for our members,” McQuabbie says, adding that before the wind project, the Nation’s only income was from cottage leasing and government funding. “We’re done dealing with poverty.”

Based in Montreal, Susan Nerberg is a Sámi journalist who zooms in on Indigenous issues, science and the environment, culture and nature. She’s completing a master’s in governance and entrepreneurship in Northern and Indigenous areas through the University of Saskatchewan and University of Tromsø in northern Norway.