BRE ELBOURN/The Globe and Mail

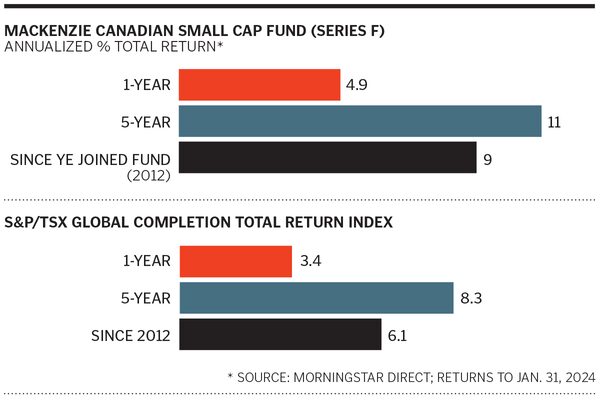

Dongwei Ye, who grew up in China’s Inner Mongolia region, was 14 when she saw the 1987 Black Monday global stock market crash unfold on TV. Given there was no stock market yet in China, she was mesmerized. Her curiosity about markets led her to earn an MBA in finance at McGill University, and land a job later with Howson Tattersall Investment Counsel, a small-cap-focused firm acquired by Mackenzie Investments. Since 2012, Ye and Scott Carscallen have co-managed the $160.3-million Mackenzie Canadian Small Cap Fund, which has outpaced the S&P/TSX Global Completion Total Return Index over the long term. We asked Ye, 50, why she is upbeat on small-cap stocks this year, and how gold and silver miners fit in her portfolio.

How has your fund managed to beat the index?

We look for quality, Canadian companies with visible growth opportunities. Their stocks need upcoming catalysts, such as potential acquisitions, and trade at a discount to their intrinsic value. We also have low exposure to the cyclical, resource sectors.

Small caps began rallying in October. Is that sustainable?

We are positive on Canadian small caps this year as inflation continues to normalize. Valuations in some pockets of this sector have bounced back sharply from their lows, but they are still cheap by historical measures and compared to large caps. Falling interest rates will help companies reduce borrowing costs, but how many rate cuts there will be is the question. Because we want to own companies that can do well whether there is a hard or soft landing in the economy, we focus on companies with strong balance sheets.

What sector is attractively valued now?

Small caps have been beaten down in the real estate space. The disconnect between their strong underlying fundamentals and depressed valuations, I think, will correct itself. For example, we own Killam Apartment and InterRent real estate investment trusts. These multifamily REITs benefit from strong rent growth due to a housing shortage and rising demand from immigrants. These REITs are better positioned today because they’ve sold buildings that aren’t core to their strategy. They’ve reduced variable debt, and their balance sheets are in better shape.

Some names were winners last year despite higher interest rates and recession fears. Why?

We focus on companies with pricing power. They can pass on raw-material price increases to customers to protect their margins. If they can do that in a downturn, they will do even better in the upcycle. Some Canadian firms also do a lot of business in the larger U.S. market, where consumers are in better shape. Infrastructure spending and the transition to renewable energy have been tailwinds there, too. Our names with big exposure to the U.S. market include Stantec, an engineering firm; Boyd Group, a collision-repair shop operator; and Stella-Jones, a supplier of railway ties and utility poles.

Your fund owns precious metals stocks, such as Alamos Gold, New Gold and Wheaton Precious Metals. What’s the attraction?

It’s more like crisis insurance and represents about 5% of the fund. There are times when nothing works but gold. In the first four months of 2016, the metal rose 20%, and many gold stocks doubled. The headline risk from the Brexit referendum and China’s slowdown helped push some investors into gold as a safe haven. Still, you also need a weaker U.S. dollar for gold to work. And the metal doesn’t do well when interest rates rise. If there is monetary easing this year, precious metals stocks will do better.

Shares of Canada’s big banks have struggled. Why do you like EQB Inc., owner of Equitable Bank?

EQB has generated a 15% to 17% return on equity over business cycles—the highest among Canadian banks. Its stock gained 54% last year and was the group’s best performer. Equitable Bank has done well in its niche, lending to the self-employed and immigrants whose credit scores don’t meet the big banks’ standards. Because EQ Bank is digital, it doesn’t have the cost burden of branches. Its acquisition of Concentra Bank in 2022 was a big boost to assets, and the recent purchase of a majority stake in ACM Advisors gives it wealth management exposure.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.