Pascal Lee/The Globe and Mail

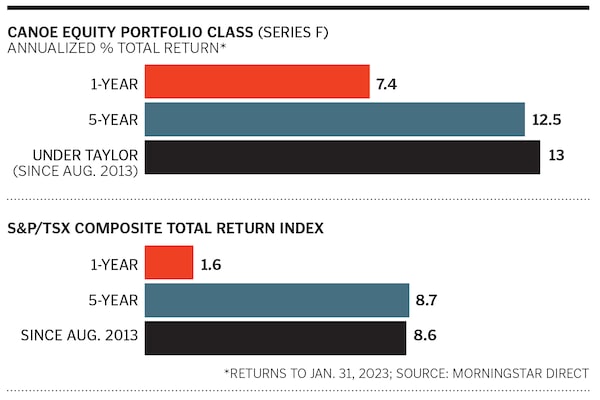

Robert Taylor enjoys playing a game of pickup hockey and knows how to skate to where the puck is going, not to where it has been. The portfolio manager applies that strategy to picking stocks, too. He avoids crowded trades and seeks companies with potential value surfacing in the future. So far, he’s scoring. His $1-billion Canoe Equity Portfolio Class fund gained 6% in 2022, when the U.S. and Canadian markets sank into the red. This Canadian-focused equity fund, which he co-runs with Sajan Bedi, has also outpaced the S&P/TSX Composite Total Return Index for nearly 10 years. We asked Taylor, 50, why investors need a new playbook now and why he’s bullish on MEG Energy.

You advise ditching the old investment playbook. Why?

Over the past decade, low interest rates and significant central bank intervention led to growth stocks, such as technology plays, doing well. But we are moving into a higher interest-rate period, with inflation remaining high. The 40-year bond bull market is over, higher-multiple stocks will see valuations compress, and index investors are likely to find the next decade challenging. Stock picking, which benefits active managers, and value investing will be key for the next decade. This trend started last year, but it won’t be in a straight line. Growth stocks have bounced since the start of the year, but that’s not sustainable. I think we are also moving into a bull market for commodities.

What is your outlook for North American markets?

We expect a choppy year as higher rates and inflation make their way into earnings expectations. Markets could be strong for the first half but give up some gains in the back half. Canada is in the early innings of outperforming the U.S. market over the next decade. It is less exposed to expensive growth stocks and is cheap relative to the U.S.

Why are you bullish on the oil and natural gas sector?

We think energy prices are higher for longer. Companies are returning cash to shareholders, and stocks are cheap. Oil prices likely have a floor between US$70 and US$80 per barrel. The mid-cycle price could be closer to US$100 in a strong economic recovery. For gas, the long-term opportunity is as a transition fuel for renewables because it can be a source of baseload power for the electricity grid. A much warmer winter has caused gas prices to fall sharply, but they should move higher in anticipation of a more normal winter in 2024. Significant liquefied natural gas plant capacity coming onstream will also lift gas prices closer to global levels, which are higher than in North America.

You like MEG Energy, a mid-cap oil sands play. What’s the attraction?

MEG is a Canadian heavy-oil producer constrained by a lack of pipeline capacity. It should get a boost from higher future oil prices. It will also benefit from the narrowing of the Canadian heavy-crude price differential to West Texas Intermediate crude in 12 to 18 months. That’s when it gains access to world markets because of the Trans Mountain pipeline expansion. We think the market will also pay a higher value for MEG because of its abundant reserves relative to peers, and it could be a potential takeover target.

Given that your fund owns Agnico Eagle Mines and Barrick Gold, what’s your outlook on gold?

We own these miners because we view them as an insurance policy. They can act counter to other equities during periods of stress. Higher metal prices are possible because the U.S. financial position is likely to deteriorate as it rolls over its debt at higher interest rates and the costs of social programs rise with an aging population. The U.S. dollar could come under pressure, which is generally good for gold.

Where are you finding opportunities in the U.S. market?

We bought FedEx more recently. The courier’s earnings are depressed after a shipping boom during COVID-19, but they should improve as the economy recovers. Its biggest competitor is UPS, which has higher margins and has historically been better run. But FedEx can also cut its costs to increase its margins and move into a period where its earnings power could increase dramatically.

The Globe and Mail