Robert CohenMike Neal/The Globe and Mail

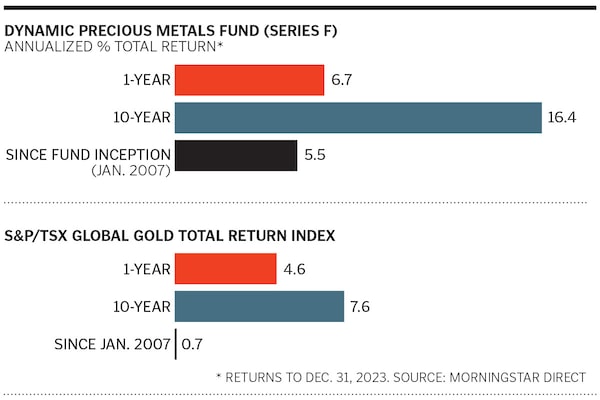

As a teenager, Robert Cohen’s bonding time with his dad often took place at a Vancouver Island gold mine. Tagging along with the elder mine engineer and geologist, he’d go underground, shovelling blasted rock into rail carts and even running a bulldozer. Over time, he got hooked. After studying to become a mining and mineral processing engineer, he worked for copper producers before joining the investment industry in 1998. Cohen now runs several funds, including the $485-million Dynamic Precious Metals Fund, whose F series has outpaced the S&P/TSX Global Gold Total Return Index since its inception in 2007. He also runs Dynamic Strategic Gold Class, which invests in bullion and stocks. We asked the 55-year-old manager how his fund has beaten the index and why he likes K92 Mining.

What is your strategy to outperform?

We are not index huggers. The gold index tracks producers and royalty companies, but we invest in senior and mid-cap producers, as well as exploration and development companies. We don’t see explorers as risky. We have the technical side covered with my background, as well as that of my co-manager, Nawojka Wachowiak, who is a geologist. We are usually the largest and first institutional manager in exploration plays, and have had about 80 takeovers in the fund. We do in-house research and usually own about 25 companies. Australian-listed companies make up over 30% of the assets.

What is your outlook for the gold price?

With the U.S. Federal Reserve signalling three possible rate cuts this year, that is positive for gold, especially if inflation doesn’t go away. I believe that gold is headed higher over time. If you look back 10 years, gold was about US$1,200 an ounce, but has since climbed to the US$2,000 range. Loose monetary and fiscal policy around the world will push gold higher, and a major financial crisis or geopolitical event could cause it to move up even faster. But whether gold is up or down, we can still make money by picking good stocks.

Gold is seen as a hedge against inflation, but the commodity price barely budged in recent years. Why?

During the COVID-19 pandemic, governments globally were printing money to pay people who were in lockdowns. When western governments expanded their money supply, the gold price moved up immediately. Gold doesn’t wait for the price of eggs at the store to rise.

Is there a major gold miner that you like?

I prefer to own a basket of three smaller senior producers. One is Kinross Gold, whose Great Bear Resources acquisition I think will prove to be the next Hemlo. Great Bear’s Ontario gold mine is one of the biggest in Canadian history. Another is Alamos Gold. It operates the Mulatos mine in Mexico and has embarked on a major expansion at its Island Gold mine in Ontario. The third is Agnico Eagle Mines, which has made smart acquisitions in Quebec and northern Ontario.

Royalty and streaming companies provide miners with cash up front in exchange for a percentage of the metal produced. Do you like them?

We don’t tend to own them because they are typically expensive and trade at premiums compared with miners. People like royalty plays because they think they don’t represent operational risk, but they can run into problems. One of Franco-Nevada’s royalties is on the Cobra Panama copper mine in Panama. When its owner, First Quantum Minerals, was ordered to shut down its mine recently by a court ruling, Franco-Nevada’s stock tumbled.

K92 Mining is a bit under the radar. Why do you like it?

K92 operates the low-cost, high-grade Kainantu gold mine in Papua New Guinea and has been ramping up production in phases. Its total resources measured in gold-equivalent ounces (since it has copper, too) are 7.1 million and growing. It faced labour challenges during the pandemic and had problems getting equipment. We believe that has been ironed out, and it will meet its targets in 2024. K92 has two more phases to ramp up, and it will eventually produce well over 400,000 ounces of gold a year. That would put it in the top tier of producers globally by about 2026.

The Globe and Mail

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.