SUMI SIDDIQA/The Globe and Mail

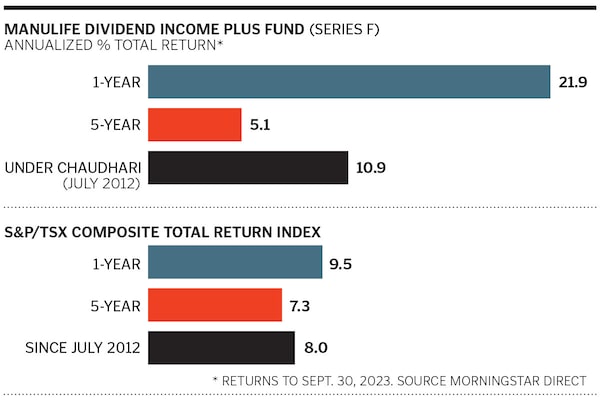

Prakash Chaudhari takes an unconventional approach when running his dividend fund. He’s an active buyer and seller of small- to large-cap securities, so his fund differs from the benchmark index. He can hold up to 20% in cash. He has no limit on owning non-dividend payers, although at least 51% of the assets must be in Canadian stocks. This opportunistic game plan has helped his $1.6-billion Manulife Dividend Income Plus Fund outpace the S&P/TSX Composite Total Return Index since he took the reins in 2012. We asked Chaudhari, 48, how he navigates high interest rates that have hurt many dividend stocks, and why he owns Google’s parent company, Alphabet.

Until 2018, your fund was known as Manulife Canadian Focused Fund. Has the strategy changed?

No, it’s the same. We look for high-quality companies that have a competitive advantage, use limited leverage and have highly capable management teams. We see our portfolio as a conglomerate with divisions that are publicly listed companies. Our investments are diversified across industries to protect against capital loss, and we buy attractively valued stocks. The only difference is that about 63% of the fund has been in dividend securities over the past five years, versus about 48% in the previous five years under the old name.

How are you playing the dividend space given that rising interest rates have hurt many stocks with payouts?

It helps that we don’t exclusively seek out dividend stocks. Higher interest rates cause a problem when you have a lot of debt. By owning companies with limited leverage, it doesn’t have as great an impact. Higher rates are the result of central banks tackling inflation, so we also look for companies with pricing power. They can pass along any inflation-related increase in their costs to their customers. Constellation Software, which we own, can do that because its products are mission-critical to customers.

Your top industry sector weighting is financials. What names do you find attractive?

We like companies that can take market share from competitors, and develop new products and services at a lower cost because they have scale. We own Brookfield, a Canadian investment firm focused on areas like infrastructure, power and real estate. Another is [Warren Buffett’s] Berkshire Hathaway, which is a collection of businesses. One division is Geico, which has a dominant share in property and casualty insurance, as well as auto. It’s a big driver of profitability for Berkshire.

Why is information technology a top weighting, too?

We like these tech companies because they are capital light—that is, they don’t have to invest in assets like plants and equipment. In this sector, we own Microsoft, whose business includes its suite of Office software, its Windows operating system for computers and Azure data centres. It’s a software company at heart and is very profitable.

Alphabet, which does not pay a dividend, is a major holding. Why is it compelling?

We like it because Alphabet has limited leverage, high return on invested capital and strong tailwinds that we believe will allow it to grow its profits for years. Its Google subsidiary, which drives the bulk of Alphabet’s profit, has the dominant market share in search engines, so that attracts advertisers and drives its revenue. Alphabet has the option to pay a dividend but instead uses that cash to reinvest in its other revenue-generating businesses, such as data centres and its artificial intelligence capability. But it’s not unreasonable to expect it will pay a dividend in the future, just like Apple did eventually. Alphabet can do so because it has had cash to buy back its shares for the past five years.

High-yielding telecom giant BCE is a top holding. Why do you like it even though its stock has struggled since early last year?

BCE is a profitable company that is growing its business. It’s investing further in broadband services, while management is working hard to reduce costs. It also produces a lot of cash. If we judge the value of a company to be higher than its stock price, it’s an attractive opportunity.