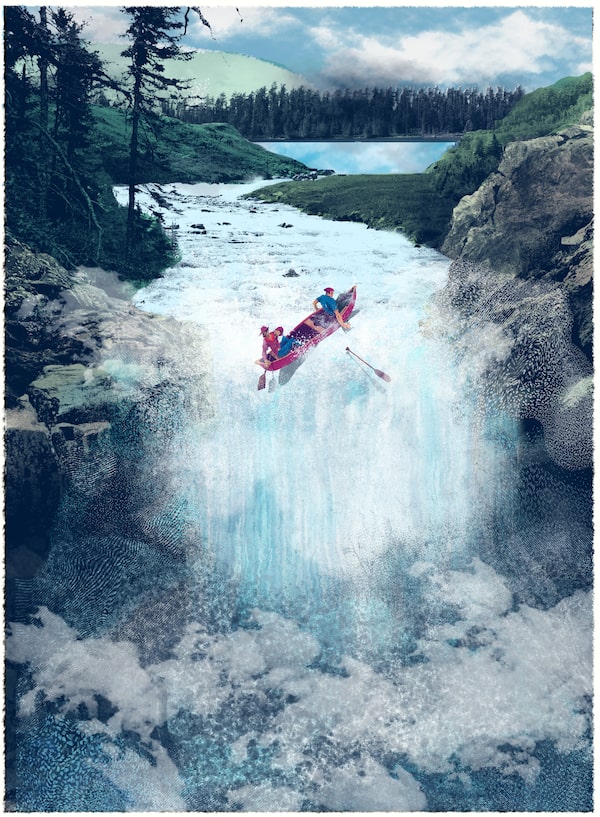

Illustration by Dushan Milic/The Globe and Mail

Sustainable finance in 2024 is a study in contrasts when what we need more than ever is solidarity.

There’s never been greater urgency for business to align on reducing emissions on the path to net zero. The numbers tell the story: Last year was the hottest on record, [1] and climate scientists say a global imperative to keep temperatures to no more than 1.5°C above preindustrial levels looks more elusive than it was just a year ago, despite massive increases in renewables. [2] And the effects are being felt globally in the form of ever-more-devastating floods, wildfires and other calamities. [3]

Despite this, Canada’s quest for leadership on the climate file is getting bogged down. Still highly dependent on fossil fuels, we’re considered a climate laggard in many areas, rather than a forceful global leader like the Scandinavian countries.

Even so, many sectors and companies in Canada are pioneering innovative technologies. Just one example: Carbon Engineering, the Squamish, B.C.-based startup that devised a scalable way to suck carbon straight from the atmosphere using off-the-shelf equipment. Last year, Occidental Petroleum, the U.S. oil giant, bought the company for US$1.1 billion. That shows it’s much more than a science project. The deal is good for Carbon Engineering and its long-time backers, and it’s a vote of confidence for Canadian know-how. But it transfers ownership of another promising Canadian technology to the U.S., which is offering hundreds of billions of dollars in green subsidies.

Ranking 30 Canadian companies on the Road to Net Zero

Canadian expertise is also making its mark in finance. Montreal serves as the North American headquarters for the International Sustainability Standards Board (ISSB), which is charged with aligning the finance world on reporting climate and other environmental factors. In the private sector, a large group of institutional investors, under the banner of Climate Engagement Canada, is taking matters into its own hands by cajoling large publicly traded emitters to meaningfully reduce greenhouse gas emissions. [4]

Government policies to permanently raise the price of carbon and promote energy alternatives are taking hold, as well. Ottawa’s new Canada Growth Fund has started to plow taxpayer dollars into geothermal energy and carbon capture, utilization and storage (CCUS). It’s also providing carbon contracts for difference—essentially taxpayer-backed carbon-price guarantees to give project developers financial stability—and has bought carbon credits so companies will invest in CCUS developments. This is aimed at making sure no future government will scuttle plans for reliably rising carbon prices.

Not everyone is pleased. Environmentalists complain that a dependence on CCUS will only provide cover for the oil and gas industry to increase fossil fuel production, which they say must be phased out if there’s any chance of achieving net zero by 2050 and preventing the worst effects of climate change.

On the road to net zero: Introducing the Morningstar Sustainalytics Low-Carbon Transition Rating

In an ominous move, the Trudeau government blinked on its policy to apply carbon levies equally across the country, giving Atlantic Canadians a break on paying the tax for heating oil as prices for the fuel surge. [5] That triggered revolts from provincial governments elsewhere seeking similar treatment, and added fuel to already smoldering anti-carbon-tax movements in Alberta and Saskatchewan. Alberta Premier Danielle Smith is feuding with federal Environment Minister Steven Guilbeault over Ottawa’s plan to cap oil-patch emissions and transform the power grid to a carbon-neutral network. She has vowed to keep fighting.

The banks tout their sustainable finance programs, setting net-zero targets, announcing plans to devote hundreds of millions of dollars to climate-related debt and equity financing, establishing in-house research institutes, and vowing to push corporate clients to decarbonize. The Big Five say they’ll dedicate $2 trillion to the efforts, but climate-focused shareholder advocates accuse them of greenwashing. [6] The advocacy group Investors for Paris Compliance started off the year by lodging a complaint with securities regulators, accusing institutions of providing financings under green and transitionary banners that, at times, have actually increased emissions.

Canada should be a leader in making a dent in the climate crisis, rather than flinching when change starts to hurt. Yes, there are logjams to break through, but there are options we haven’t tried yet. Some initiatives we can steal from other jurisdictions. Others that we’ve tried to implement so far without success need to get back on track. Here are some ideas for taking the next steps to direct capital at the climate crisis.

Double materiality

Canadian companies and regulators are focused on disclosure standards that deal with risks to investors. That is, upcoming requirements to pump out enough data and analysis so that financial experts can judge whether climate, and companies’ strategies for dealing with tougher policies, offer promise or peril in buy-or-sell decisions.

Under guidelines developed by the ISSB, that info will be presented alongside financial filings. The standards, which started coming into force globally at the beginning of this year, call for disclosure of material information about sustainability-related financial, market and legal risks. These include risks tied to the transition to lower-carbon energy and physical damage to company assets from natural disasters, as well as opportunities that arise from technological advances. Companies will eventually be required to report data on all three scopes of emissions. [7]

Regulators in other jurisdictions are already moving forward. California is requiring companies with annual revenues of more than US$1 billion to report their Scope 3—or value-chain-derived—emissions by 2027. Europe is moving even faster, with a first group of companies required to report more complete emissions data for their current fiscal year.

We’re not there yet, but securities commissions and other regulators are waiting for the related Canadian Sustainability Standards Board (CSSB) to recommend how to tailor ISSB’s growing list of international climate-related criteria to our economy. The CSSB has said that it’s studying how the standards will affect Canada’s large proportion of small and medium-sized enterprises and natural-resource extraction companies. It’s not yet known if that means regulations that could be less stringent than those being adopted around the world. If regulators are, say, giving fossil fuel producers a pass on some aspects, that will add more fuel to the long-running debate over the commitment of business to adequately reduce climate risk.

A big question remains, though: Does the minutiae of sustainable finance go far enough if its main reason for being is to protect the investing public and not society at large?

A guide to understanding how Canadian companies are managing the shift to a net-zero future

The Europeans say the rules are inadequate and have taken the next step: demanding corporations also disclose their impact on the environment and society. Yes, investors should be kept up to speed on material climate-related developments that could influence securities prices. Now, the environment and communities affected by corporate operations will also loom large in reporting requirements, under the banner of double materiality. For instance, the impacts of a cement company’s emissions on the climate, a chemical producer’s management of hazardous waste on the surrounding community, or an oil and gas producer’s conservation of fresh water could all be part of such “inside-out” disclosures. Many of those could also affect the value of a corporation (“outside-in”) if it’s hit with legal or regulatory penalties, or makes a donation of land that improves its reputation.

It didn’t come easy—some members of the European Parliament fought against the move, arguing it only meant heaping more regulatory burdens on business. But at the start of 2024, the European Union put the Corporate Sustainability Reporting Directive, or CSRD, into force. It will eventually require up to 50,000 companies to provide spreadsheets’ worth of details about how their operations are affecting the world around them—the good and the bad.

Not all those affected by the regulation are based in Europe. Because they have operations or subsidiaries there, a great many companies from outside the continent will have to report as well. According to Refinitiv, more than 1,300 Canadian companies could be affected. [8] Some have a head start. A lot of domestic corporations, especially those in natural resource sectors, already compile much of this data, though they don’t yet present it in a uniform format. Perhaps it’s time to start. This is an opportunity to benefit from a positive feedback loop.

Putting your money where your mouth is

Many of Canada’s largest corporations have led the way in reporting their emissions using the Task Force on Climate-Related Financial Disclosures (TCFD) framework, the accepted global standard. That’s good, because at some point, it’s going to be mandatory. According to the sustainability consultancy Millani, the number of companies listed in the S&P/TSX Composite Index that had adopted the framework by the end of 2022 had more than doubled in four years, to 64%. [9]

Billionaire and former New York mayor Michael Bloomberg and former Bank of Canada and Bank of England governor Mark Carney led the effort to standardize climate risk reporting for investors, lenders, insurers and others. The framework deals with governance, risk management, strategy, targets and scenario analysis, and a host of subcategories within those. It also requires forward-looking disclosure about climate plans and future impact.

The new ISSB standards borrow heavily from TCFD, and executives from the banking and pension industries have called on the government to institute mandatory climate-related reporting—and soon—calling it an urgent issue that could leave Canadian business at a competitive disadvantage if they don’t comply. As it stands, 81% of Canadian companies do not quantify their climate-related risks, according to a recent survey by PricewaterhouseCoopers that also showed a wide gap between large and small corporations.

Analysis provided to us by Morningstar Sustainalytics, a ratings firm focused on ESG and corporate governance (more about them in the pages that follow), shows that TD Bank, Power Corp. of Canada and TransAlta Corp. are among those that excel at disclosing climate-related risks, while Restaurant Brands International is in the process of bolstering its efforts.

But a frequent complaint among climate-minded investors is that regulators aren’t forcing companies to take the next step—actually reducing emissions. Activists have called on the Office of the Superintendent of Financial Institutions (OSFI), which regulates banks and insurers, to go beyond disclosure by mandating cuts, as well. OSFI, in turn, has said that’s not its job. Even in the EU, which has led the way on climate regulation, 92% of emissions disclosed by companies are in the Scope 3 category, and just 37% of those are being targeted with decarbonization measures, according to CDP, formerly the Carbon Disclosure Project.

Many companies trumpet strategies to get to net zero by 2050. Why shouldn’t they back their public proclamations with a little green? One coalition of large and small institutional investors is urging just that. Climate Engagement Canada (CEC) members—including AGF Management, TD Asset Management, RBC Global Asset Management, Alberta Investment Management Corp., University Pension Plan Ontario, Manulife Investment Management and several others—manage a total of $5.2 trillion in assets. The group says none of the 41 largest emitters in the country has gone so far as to devote capital spending to emission-reduction targets. That will be the true measure of corporate Canada’s commitment to shifting to a low-carbon economy, says the Responsible Investment Association, a founding member of CEC.

For some, notably the country’s biggest oil sands developers, a commitment to shovel tens of billions of dollars into carbon reduction is predicated on taxpayers footing a large part of the bill. A $16.5-billion carbon capture project is planned to be in service by 2030, and that will put the companies on a path to net zero for Scope 1 and 2 emissions by 2050, according to their coalition, the Pathways Alliance. But environmental activists say the outlay won’t deal with the largest source of emissions—end use by consumers—and will lock the country into a carbon-intensive activity.

CEC, which released its inaugural benchmark study into its focus companies’ emission disclosures and strategies late last year, also pointed out that just 41% of emitters tied portions of CEO and senior-executive pay to meeting specific climate targets. Our Sustainalytics analysis highlights CIBC, RBC, Stantec Inc., CN Rail, Gildan Activewear and, yes, oil sands producer Suncor Energy for linking executive pay incentives to climate and other environmental goals. The trend has picked up steam in recent years, but to keep it going, shareholders—the ultimate owners—must convince boards of directors that dealing with climate risk is as important as meeting sales and cost targets when it comes to bonus pay in the C-suite. Nothing says priority quite like making part of the paycheque dependent on it.

Indigenous partnership

A major part of decarbonizing the economy involves electrifying energy and transport. It will be a multidecade, multibillion-dollar effort that starts with going right to the source—extracting the critical minerals like nickel, copper, lithium and graphite that go into batteries. [10] That means developing mines and processing facilities, and none of that can be done without building roads, mines and processing plants through and on traditional Indigenous territories.

The First Nations Major Projects Coalition (FNMPC) has 145 members, from the Lax Kw’alaams Band on B.C.’s Pacific Coast to Miapukek First Nation in Newfoundland, and as far North as the Inuvik Native Band in the Northwest Territories. The group, which seeks long-term economic benefits for member communities, has been laser-focused on the issue of critical minerals. It has looked at markets, supply sources, future demand and potential roadblocks to development. A major one is the inability of developers and First Nations, Métis and Inuit communities to agree on real participation. That means bringing Indigenous communities in as project partners right from the planning stage.

There are sad examples in this country of large energy projects that faced staunch opposition, or that were stopped in their tracks, over failure to properly consult with communities or where courts decided that efforts to ensure consent weren’t taken seriously enough. [11] But there’s a right way to do it, and it involves taking the principles of free, prior and informed consent to heart. Key to that is equity ownership, says Mark Podlasly, the FNMPC’s chief sustainability officer.

To open the door to such partnerships, First Nations want supportive financing that allows them to access capital at competitive interest rates, and government backstops are one way of doing it. It seems like a fair trade-off if access to critical minerals to get to net zero is at stake. There’s no reason the original stewards of the land shouldn’t reap benefits from the shift to a new economy, when they were denied them before.

Green taxonomy

Okay, this was actually a 2022 trend, but Ottawa has been dragging its feet on this important initiative. Other jurisdictions are zooming past us, and that’s not a good thing as competition for capital in climate-change-fighting technology heats up.

The corporate and investment worlds have been clamouring for a formal guidebook that spells out which investments are considered green and which are deemed necessary for the energy transition. The providers of capital answer to investors who are putting their money to work for that express reason. But the federal government has been slow to take the advice it ordered two years ago to advance the cause. For more than a year, it’s had in hand an innovative road map for implementation—a made-in-Canada approach to directing private investment dollars to reaching the country’s net-zero emissions targets.

We’re talking major coin. The government-appointed Sustainable Finance Action Council, or SFAC, which is in charge of the effort, says Canada needs an additional $115 billion a year in targeted investment capital to get to net zero by 2050. Late last year, the federal Liberals gave the group $1.5 million to continue its work but has yet to commit to implementation.

Here, green investments aren’t the holdup. Non-emitting activities that respect Indigenous rights and avoid other environmental harms are eligible for investments within that category, according to the taxonomy. The tricky part is, what constitutes activities that are part of the low-carbon transition? For instance, there needs to be agreement on how long an energy source or carbon abatement technology is eligible for such a label before greener alternatives emerge to take their place.

Ottawa is facing pressure from Western provinces to include natural gas in its transition category. Backers of the gas industry say the fuel will lower emissions if it replaces dirtier sources such as coal. Opponents argue that including it would lock in reliance on the fossil fuel beyond scientifically agreed limits. They also insist there’s no ban on financing such energy production—it just shouldn’t get the seal of approval provided by a taxonomy.

At the COP28 climate summit late last year in Dubai, “transition finance” was heralded as the next big wave in climate-focused investment. Still, SFAC leaders have been frustrated that other jurisdictions, including the EU, Association of Southeast Asian Nations and Australia, have pushed ahead with taxonomies, with Australia using Canada’s work as a guide. It’s past time to put the work into action.

1. Earth’s average land and ocean surface temperature in 2023 was 1.18°C above the 20th-century average, the highest global temperature recorded since 1850. And it beats the next-warmest year, 2016, by a record margin of 0.15°C.

2. 510 gigawatts

Total global renewable energy capacity in 2023—more than three times Canada’s total power capacity. Three-quarters of that was solar, according to the International Energy Agency, with China accounting for the largest increase.

3. US$120 billion

Total insurable losses globally in 2022 due to climate-related disasters.

4. CEC represents 43 participants, including asset managers, pension funds, insurers and shareholder advocacy groups.

5. The federal carbon tax on home heating oil, used almost exclusively in Atlantic Canada, was supposed to be 17.38¢ per litre. The reprieve will save the average Atlantic Canadian household about $261 this year.

7. Scope 1: Carbon emissions from a company’s own operations.

Scope 2: Emissions from the energy a company buys to power its buildings and factories.

Scope 3: Emissions along a company’s value chain and from the end use of its products.

11. The $7.9-billion Northern Gateway oil pipeline proposal was stalled before it even got started when Enbridge failed to win support from several B.C. First Nations. The Federal Court of Appeal quashed its federal approval in 2016, ruling the Conservative government of the day failed in its duty to properly consult and accommodate First Nations. Enbridge cancelled the plan and took a $373-million writedown.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.