Revenue (2023) $3.7 billion | Profit $174 million

Three-year share price gain 45% | P/E ratio (trailing) 17

Depending on your point of view, Methanex MX-T either falls through several cracks or fills a number of intriguing niches. It’s not an Alberta oil patch play. It’s not one of Canada’s largest companies—it has just 1,500 employees. But it’s something rarer: a true global leader, the world’s No. 1 producer and supplier of methanol.

“We’re this company with a big global reach, but we’re small, which makes us agile in our decision making,” says CEO Rich Sumner, 49, who’s been with Methanex for 20 years and assumed the top job in January 2023. And he says the company’s new Geismar 3 processing plant in Louisiana, which is coming onstream later this year, will be a game changer in an industry poised for the energy transition and strong demand growth. “I think there’s lots of opportunities there.”

First, though, a bit about what methanol is. It’s basically a specialty chemical, derived from natural gas, that goes into products such as clothing, carpets, phone screens, paints and acrylics. It’s also a promising marine fuel. About a decade ago, Methanex and Germany’s Man Energy developed a dual-fuel engine for ships (methanol and diesel). Methanex runs 19 of its own 30 tankers on methanol, Danish logistics giant Maersk ordered a dozen new dual-fuel container ships in 2022, and Disney has ordered a dual-fuel cruise ship.

Methanex is now operating nine plants in Canada, the United States, Egypt, Trinidad and Tobago, New Zealand and Chile. Its largest markets are China, Europe, the U.S. and South Korea. Natural gas costs are the biggest factor in deciding where to build new plants, and Sumner says that for the past decade, Methanex has been “capitalizing on the shale gas revolution in North America.”

True, there were fits and starts in constructing G3. Methanex halted the project in 2020, then restarted it in mid-2021, having procured long-lead items before inflationary pressuers took hold. “That helped us,” Sumner says. He’s also proud that it will have one of the lowest carbon emissions intensity profiles in the industry.

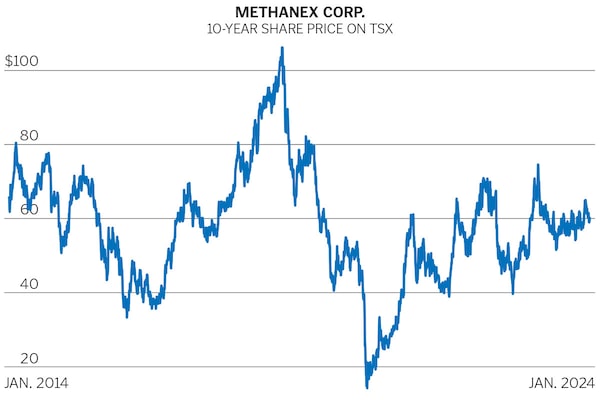

Methanex’s revenues and profits have been mostly solid over the past decade, yet its share price is lower than it was. But two factors that loom large for investors are prices for methanol and natural gas, and despite occasional surges, both are also lower.

Looking at the potential of G3 and the methanol market, however, Sumner sees “a pretty big gap in terms of the intrinsic value of the company versus where we’re trading today.” Besides, he says, “I’m the CEO, so I’m naturally inclined to say that we’re undervalued.”

The Globe and Mail

The Globe and Mail

Five things we learned from Justin Krieger

Streaming is such a normal way of watching movies, bingeing series and listening to music that it’s hard to believe it’s only been around since 2007 or so. As businesses mature, they get more competitive. We asked Justin Krieger, senior analyst and director of technology, media and entertainment, and telecommunications at audit, tax and consulting firm RSM Canada, where the sector is headed.

1. Consumers and investors often look at Netflix Inc. as a proxy for the sector, and its stock price peaked at US$691.69 in 2021, then sank in 2022 as it lost subscribers, but has climbed again since then. “There currently is a very clear industry-wide emphasis on profitability,” Krieger says. That includes boosting revenue by running ads and raising prices, curbing password sharing and containing content costs.

2. Subscriber levels remain important, but Krieger looks at other metrics, too. One is pricing. “If you abruptly increase pricing, it may lead to a loss of subscribers. It’s vital to consider that trade-off,” he says. Then there’s content. Costs dropped in 2023, but largely due to Hollywood strikes. How much does content actually cost and will it retain long-term appeal?

3. Another sign of a mature business: no hot new players. “We haven’t really seen any new incumbents in the space” for some time, Krieger says. In Canada, the most popular video streaming services are Amazon Prime, Netflix and Crave, and Spotify, Apple Music and SoundCloud for music. That raises challenges for investors: Many platforms are not stand-alone companies.

4. How come old-style ads have crept in? Krieger says they’re better ads—for advertisers and for users. “It’s a more targeted model allowing advertisers to more precisely seek out their customer,” he says. Users benefit from fewer commercials per hour than traditional TV, ads that appeal to their tastes rather than random ones, or no ads at all if they pay extra.

5. If streamers are competing for the same customers, content libraries and content producers, how will any one platform get ahead? Krieger says two interesting areas are sports and entertainment rights, and the push beyond mobile gaming to cloud gaming. “What that’s showing me is that these streaming channels are still thinking about the future,” he says.