An engine block on display at the Martinrea International head office in Vaughan, Ont., is photographed on Wednesday, April 14, 2021.Tijana Martin/The Globe and Mail

Martinrea International Inc.

Vaughan, Ont.

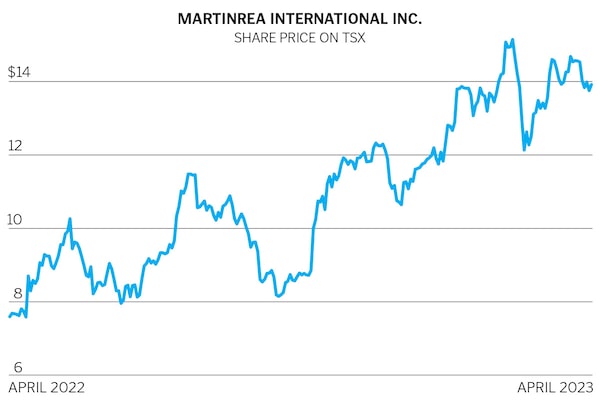

Revenue (2022) $4.8 billion | Profit (2022) $132.8 million

Three-year share price gain 82% | P/E ratio (trailing) 8.6

Among Canada’s Big Three auto parts makers, Magna and Linamar get a lot of attention, but third-ranked Martinrea? Not so much. Part of that is due to the lustre of the Magna and Linamar founding families, the Stronachs and the Hasenfratzes (and some very public bickering among the former).

But over the past year, Martinrea’s share price has left its rivals in the dust, rising more than 80% as the company posted record revenue for 2022. Yet, Martinrea is still trading at lower share price multiples than the other two.

Much of the company’s success has been driven by co-founder and executive chairman Rob Wildeboer. Now 63, Wildeboer says he and CEO Pat D’Eramo “do some leadership from behind, like Nelson Mandela.” Imagine that said by a friendly guy who sounds like you met him at Tim Hortons, and you have an idea what an intriguing mix Wildeboer is.

In the early 1990s, Wildeboer was a crusading young Bay Street securities lawyer who also helped a lot of entrepreneurial companies raise money, including a small metal-forming company named Royal Laser Tech. After Frank Stronach fired Fred Jaekel, a protégé, in 2001, Wildeboer and Jaekel decided to go into the auto parts business together, with Jaekel as CEO.

Lawsuits quickly flew between Magna and Martinrea (as the company renamed itself in 2002). “It was the best advertising we ever could have had,” Wildeboer recalls. Yet, he and Jaekel (who died in 2014) still admired much about Magna, including the emphasis on treating employees well. Martinrea has 10 guiding principles, and the first is its “Golden rule: Treat everyone with dignity and respect.” It also strives to stay entrepreneurial and lean.

Growth over the past two decades has been impressive, with revenue rising from about $40 million in 2001 to $1.7 billion in 2010, and then more than doubling again. Martinrea now has 58 plants in 10 countries, although about 75% of its business is in Canada, the United States and Mexico. But there have been setbacks, some external (the 2008-09 financial crisis and COVID-19) and some internal (a shareholder proxy battle in 2014).

These days, many investors are still rattled by the impact of the pandemic on the auto sector. Share-price multiples are depressed for all parts makers. There’s also uncertainty over the shift to electric vehicles. But Wildeboer says 80% of the parts Martinrea produces are “completely agnostic”—they could work in gasoline-powered cars or EVs. Many are frame components that lighten the weight of either.

He’s planning to stick to fundamentals. “If you keep earning more, pay down debt and buy back stock, your share price is going to go up.”

John Daly

John Daly