Leon’s Furniture Ltd.

System sales (2022) $3.05 billion

Profit (2022) $179.4 million

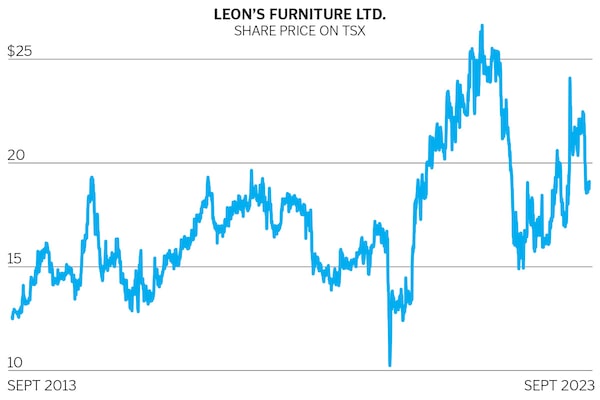

Three-year share price gain 4.6%

P/E ratio (trailing) 8.8

Leon’s CEO Mike Walsh, the first non-family member to run Canada’s largest furniture, mattresses and appliance chain since it was founded in 1909 by Lebanese immigrant Ablan Leon, is refreshingly candid about his company’s lacklustre stock price in recent years.

Other CEOs say they manage the business and try to ignore the stock market. Not Walsh. “Of course we’re undervalued,” he says. “When you’re a public company, you’re checking the share price frequently.”

Walsh joined Leon’s in 2015 after a long career at Canadian Tire and succeeded Edward Leon as CEO in 2021. The share price was $13 in April 2013, just after Leon’s acquired The Brick furniture and electronics chain. Lately, it’s been around $19. “We haven’t told our story,” Walsh says.

He then reels off a list of Leon’s strengths—a long one. Revenue has grown by more than $500 million and profit has more than doubled since 2014. Including The Brick, the company has 300-plus stores coast to coast. It also owns the Appliance Canada chain, and finance and warranty businesses. “We have no debt and a clean balance sheet,” Walsh says.

“Families are strategic in nature,” says Leon’s CEO Mike Walsh. “They’re not about the latest trend.”

And Leon’s has been through every market condition. During the COVID-19 pandemic, stores shut down in many areas. Yet demand surged, and e-commerce sales shot up from 4% of revenue to 15%, before settling back to near 12% lately.

Leon’s has also returned $615 million to investors over the past three years in the form of dividends (regular and special) and share buybacks. That brings up the sometimes-controversial subject of family control. The Leon family owns about 70% of the company’s stock.

But like many academics and money managers, Walsh argues that family involvement is a good thing. “Families are strategic in nature,” he says. “They’re not about the latest trend.” Four of the company’s seven directors are Leons, and Walsh boasts that he has “three previous CEOs on the board.”

So, what will move the needle on share price?

In May, Leon’s announced it would create a real estate investment trust for its property holdings. Other Canadian retailers have done it. But so far, the company has only issued a news release. It has to wait for the right market conditions for an IPO to proceed.

Maybe some pizazz from the marketing whizzes who come up with Leon’s and The Brick TV commercials would help. The “Lay-onz” hipster couple and The Brick’s “get down, get down” spots have been particularly effective. Walsh says he vets ads, but he doesn’t get involved in the creative. “I’m a manager. My job is to coach people.” Good answer.