The Globe and Mail

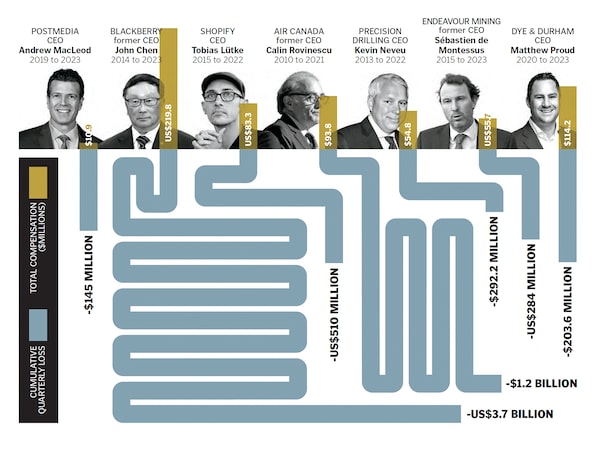

This past October, John Chen declared his 10-year turnaround of once-mighty BlackBerry BB-T a success and hastily retired four days later. The company’s long-suffering investors were in less of a back-patting mood, with BlackBerry’s share price down 25% from where it was when Chen took over back in 2013. Along the way, the struggling tech firm racked up loss after quarterly net loss, interspersed with only the occasional quarter where BlackBerry ended in the black. Despite the company’s poor financial performance, Chen’s total reported compensation over his time as CEO added up to nearly US$220 million.

Chen is hardly alone in out-earning the company he ran. We looked at the cumulative quarterly net income—in other words, we added up all net profits and losses—from when a CEO took the helm to either the last quarter covered by the company’s compensation disclosure documents or the last quarter when the CEO held the post. And while it’s true that one or two outsized quarterly losses can dent a company’s profit picture in the short term, even when CEOs were on the job for years, the cumulative losses piled up.

A CEO’s total compensation reported in a company’s annual proxy filings with regulators isn’t necessarily what was paid out in salary. It also includes bonuses, as well as equity rewards like stock options, restricted stock units and performance stock units that only vest if certain conditions are met. But total compensation does reflect the value a company’s board places on its CEO and speaks to the perceived worth of a chief executive over time—including, perhaps, minimizing the losses in a less-than-profitable sector.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.