A warehouse at 2350 Rue Cohen in Montreal was converted to lab space by HarveyCorp.Francois LeClair

Just more than three years ago, commercial real estate developer HarveyCorp did its first conversion of an industrial warehouse in Montreal into a custom-built research laboratory for a life sciences client. The building’s floor space was outfitted with dozens of research stations connected to ample power for equipment and a high-efficiency ventilation system.

Other similar conversions from warehouse to research lab followed and the niche has now become a significant part of the company’s business, with competitors getting into the game. “The market was growing even before the pandemic, but the past year has definitely brought this industry to the forefront,” says Hugues Harvey, president of Montreal-based HarveyCorp.

The company currently has two large projects on the go, converting former light industrial warehouses in western Montreal into labs customized for contract research organizations. “We can buy empty buildings from the 1980s and 1990s and convert them into lab space in as little as six to eight months,” Mr. Harvey says.

Montreal has the country’s highest concentration of biotech research facilities, but a growing demand for lab space is a phenomenon across the country, says Jeremy Kenemy a vice-president and life sciences team lead of commercial real estate company CBRE in Montreal. Growth is also brisk in scientific and environmental support services. An example is Avi-Life Lab Inc., a recent addition to the cluster of tech companies in Saint-Laurent known as the Technoparc Montréal. Its labs offer contract analysis and testing to the food, clinical and pharmaceutical industries.

“I’ve been in this sector for 20 years and I’ve never seen more urgent interest from developers and users for sophisticated high-quality research and development laboratories,” Mr. Kenemy says. And investors are taking notice. “Part of the challenge for risk-averse landlords and investors in the past has been that they aren’t familiar with lab operations, which require considerable up-front costs to build or retrofit spaces,” he adds. But a cooling of the office and residential markets is shifting attention to investment in life sciences facilities.

Among Mr. Kenemy’s suggestions to stimulate growth of investment in research and development facilities is to set longer amortization times than for office tenants. “There may be less immediate return on their investment with the first tenant. But new market entrants who break the trail and face the biggest challenges are also setting themselves up to reap high rewards.”

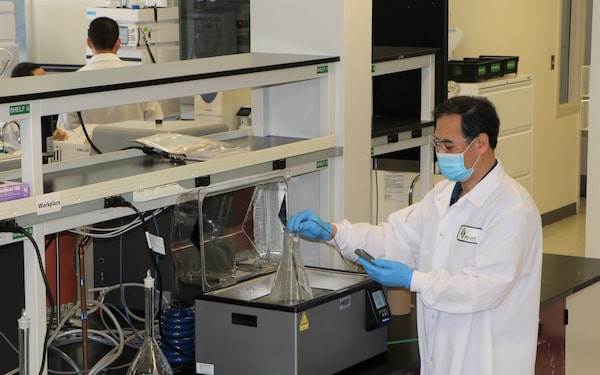

Every lab station at Avi-Life Scientific Solutions in Montreal has different equipment and power requirements.

The continued pandemic has been spurring unprecedented investments. To address Canada’s lack of vaccine production facilities, the federal government is financing construction of the $126-million Biologics Manufacturing Centre adjacent to the National Research Council’s Biotechnology Research Institute on Royalmount Avenue in Montreal. Scheduled for completion in July, it aims to be operational by the fall with a production capacity of approximately two million doses of a vaccine a month, a government release claims.

Another big project accelerated by vaccine development is happening in Vancouver. AbCellera Biologics Inc. is building two new buildings totalling about 330,000 square feet. The company made a deal with U.S.-based pharmaceutical Eli Lilly and Co. in December to co-develop antibody products for the treatment and prevention of COVID-19, after the monoclonal antibodies treatment they are working on made headlines when it was given to former president Donald Trump.

However, big gaps continue to exist in Canada, particularly for biotech startups ready to scale up from research to development, analysts say.

For the past decade or so, there has been a significant growth of life science incubator spaces in Calgary, Montreal, Ottawa and Toronto, says Ty Shattuck, chief executive officer of the McMaster Innovation Park in Hamilton. “But when companies need to move from a startup of a dozen people in the lab to what we call the graduation phase, where they scale up to 100 or 200 staff, there’s almost nowhere in Canada to go – with Montreal [being] the small exception,” he says.

“It’s a problem for Canada as a nation because we put in all the heavy lifting in discovery and startup but just as these companies gain traction, they have to leave the country, often to the Boston or San Francisco areas,” which have substantial hubs of research facilities, Mr. Shattuck says.

Historically, research labs have been difficult to finance in Canada because they are not only up to three times more expensive to build than office or residential space, they’re also more specialized, Mr. Shattuck explains. “But now that COVID has taken the shine off condos and office towers, developers are at least kicking the tires of life sciences.”

The McMaster Innovation Park, a collaboration with McMaster University, is proof of the demand, as it is in the process of adding just more than two million square feet of new life sciences space on its campus to meet demand, which has doubled in the past year, Mr. Shattuck says. Half of it is devoted to graduation space for startups that are at the stage where they need extra space.

Lab spaces have high requirements for ventilation and power.

The research facility, an hour drive from Toronto, only partly solves the challenge in Canada’s largest city, where there are no new labs being developed in the downtown core, says Daniel Lacey, CBRE’s practice lead for life sciences in the Toronto region. The need is greatest in the area nicknamed Bedpan Alley, a stretch of University Avenue south of the University of Toronto that’s dominated by research hospitals and health services. Researchers who are connected with the institutions downtown could expand operations in the suburbs or Hamilton, but most prefer to have lab space close to their primary research location, he explains.

A constraint is that there are few sites available for new construction in Toronto’s core, and the infrastructure and conversions of existing buildings are challenging because standards for research labs are different from offices.

“An office typically circulates fresh air six times an hour, while a basic wet lab space has to double that to 12 times an hour. For a facility manufacturing pharmaceuticals, the level in clean rooms would reach 45 to 60 times an hour,” Mr. Lacey explains. That can require more ceiling height for duct work than many offices have. And there are other issues in upgrading including electricity and floors so that they can support heavy equipment.

Another constraint is the high cost of retrofitting, and he says some form of government incentive program would encourage redevelopments. “One idea being discussed is to have the government offer favourable financing packages for lab projects, as the banks often don’t want to touch them.”

But while office conversion poses significant challenges, they are solvable, Mr. Lacey says. An innovative approach was the not-for-profit MaRS Discovery District complex, which built modern towers of research space at either end of a historic former wing of Toronto General Hospital at University Avenue and College Street. There may be other opportunities for redeveloping existing office properties in the core and the spaces around them, Mr. Lacey says.

“All of a sudden, people with struggling office properties in downtown Toronto are looking at some buildings and saying, ‘We have a lead tenant moving out of this building at the end of 2022 or 2023 and what are we going to do with it?’ It’s the perfect storm right now. COVID-19 has created an atmosphere where people are beginning to think outside the box.”