Briefing highlights

- Cutting rates may not do that much

- Stocks, loonie, oil at a glance

- What analysts are saying today

- BlackBerry sinks to Q2 loss

- Volkswagen executives being charged

- Google wins major case in EU

- What to watch for today

- Required Reading

CIBC on rate cuts

The Bank of Canada might not accomplish all that much if it trims interest rates down the road, as some economists expect, CIBC World Markets says.

There are several reasons for this, CIBC chief economist Avery Shenfeld and senior economist Royce Mendes said in a study.

For one thing, Canadians are stretched thin. For another, we’re getting older. And so are our cars.

“While capital spending responded only weakly to low rates, both consumer spending and housing investment received substantial lifts when the Bank of Canada cut rates in the last recession,” Mr. Shenfeld and Mr. Mendes said.

“But we might well be in for a weaker response if rates fall again in the near term,” they added in their broader report on whether monetary policy is “broken” globally.

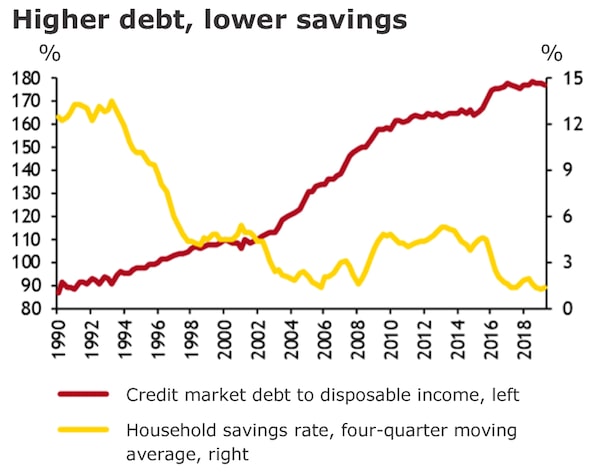

“After being stalwarts during the recovery by opening their wallets, households’ savings rates are now trending around the lowest levels since the early 1960s, and well publicized debt ratios are among the highest in the world.”

Source: CIBC World Markets

That, they said, could mean there’s “less room” for lower rates to spur spending.

First up, Canadian households are deep in debt, owing about $1.77 for every dollar of disposable income. Not only that, but the household debt service ratio stands at a record 14.93 per cent. So how much are we willing to spend?

Second, “looking at the fundamentals of the most interest rate sensitive household purchases also suggests that the economy may not be as sensitive to rate cuts in the future,” the CIBC economists said.

“The pace of home building has been running a bit ahead of demand, with completed but unfilled units beginning to climb.”

Then there’s that bit they mentioned about our cars, and the fact that we don’t have to get new ones as frequently as we did 20 years ago.

“As a result, the share of durable goods consumption in Canadian GDP hasn’t really done much despite the rock bottom rates of the current expansion,” Mr. Shenfeld and Mr. Mendes said.

Demographics is also a major factor, Mr. Mendes added.

“As both interest rates fall (i.e., a smaller stream of income from owning bonds) and the population ages, more people are thinking about saving more for retirement ... rather than spending, meaning for those people interest rate cuts could actually work in the opposite direction,” he said.

Some economists believe the Bank of Canada will, for insurance, trim its benchmark overnight rate, now at 1.75 per cent, by one-quarter of a percentage point later this year or next year. The Federal Reserve, of course, has been cutting rates, most recently as of last week.

“The Bank of Canada still talks about the use of negative rates as an option, one that [Fed chair Jerome] Powell now has largely ruled out for the U.S.,” Mr. Shenfeld and Mr. Mendes said in their report.

“Fortunately, in Canada, there’s a political consensus towards fiscal stimulus in such circumstances.”

Read more

- Loan defaults in Canada are low. But they’re rising. Where and how they’re rising

- Rachelle Younglai: Household wealth drops for first time since financial crisis

- Rachelle Younglai, Chen Wang: How Canada’s suburban dream became a debt-filled nightmare

- Insolvencies among Canadian consumers are surging

- Matt Lundy: Canadian households are spending more than ever on debt payments

- Why so many Canadians could be in so much trouble in an economic shock (notably in B.C., Ontario)

- Debt and wealth: So many Canadians are either messed up or poor

- Rob Carrick: This is why Canadians are so stressed out about money despite good economic times

- Many Canadians say they’ll have to tap RRSPs, take second mortgages, sell assets as debt burden rises

Markets at a glance

Read more

What analysts are saying today

“Boris Johnson suffered another crushing defeat after the Supreme Court ruled that prorogation was void and of no effect. The highest court stated that the PM’s advice to the queen was void and unlawful … The British pound is slightly higher as some expect this could make it harder for Boris Johnson to deliver a no-deal Brexit.” Edward Moya, senior market analyst, Oanda

“Okay, everyone, back to work. Single file. Let’s go. The highest court in the U.K. has spoken and its decision was unanimous … So the uncertainty continues, and financial markets are also feeling it.” Jennifer Lee, senior economist, BMO Nesbitt Burns

“Optimism over a potential U.S.-China breakthrough [is] taking us into what seems like another temporary period of gains for global stocks. Steven Mnuchin has laid out plans to resume high level trade talks between the U.S. and China in two weeks’ time, and while stocks are likely to rise in anticipation of a deal, the sense of deja vu also brings scepticism over whether such a deal is there to be made.” Joshua Mahony, senior market analyst, IG

“U.S. stocks will once again attempt to make a run toward record territory after the U.S. and Chinese were able to outline a schedule for high-level talks in early October. Markets have been here before, mounting optimism ahead of critical trade talks, but for many, this time feels different. A complete breakdown in talks this go around will possibly see too much damage in some key demographics for President Trump’s 2020 hopes. Business investment has stalled and the strain on farmers and manufacturing jobs could see this be a critical juncture for avoiding a recession come next fall.” Oanda’s Mr. Moya

“Questions still hang over the health of the euro zone economy, and seeing as stocks haven’t rebounded that much today, it seems as if traders are still a little cautious … The trade situation between the U.S. and China has calmed down compared with late August, but a certain level of unease remains, which is why the FTSE 100 plus the DAX remain below the July highs.” David Madden, analyst, CMC Markets

BlackBerry sinks to loss

BlackBerry Ltd. swung to a second-quarter loss.

The Waterloo-based company posted a loss of US$44-million, or 10 US cents, diluted, compared to a profit of US$43-million or 9 cents a year earlier.

Revenue rose to US$244-million from US$210-million.

Read more

Ticker

Volkswagen executives being charged

From Reuters: German prosecutors are pressing criminal charges against the CEO, chairman, and a former CEO of Volkswagen, saying they intentionally delayed telling investors about the carmaker’s cheating of U.S diesel emissions tests. Lawyers for the three accused said they would contest the charges.

Google wins case

From The Associated Press: Google won a major case in the European Union when the bloc’s top court ruled that the U.S. internet giant doesn’t have to extend the EU’s “right to be forgotten” rules to its search engines globally.

Nissan recalls 1.3 million vehicles

From The Associated Press: Nissan is recalling 1.3 million vehicles mainly in the U.S. and Canada to fix a problem with the backup camera displays. The recall covers the 2018 and 2019 Nissan Altima, Frontier, Kicks, Leaf, Maxima, Murano, NV, NV200, Pathfinder, Rogue, Rogue Sport, Sentra, Titan, Versa Note and Versa Sedan. Also included are the Infiniti Q50, Q60, QX30 and QX80 vehicles.

No rush, says China’s central bank

From Reuters: China is in no rush to follow other countries in significantly loosening monetary policy but has ample options to help prop up slowing growth, its central bank head said, maintaining a cautious approach to stimulating the economy

Morale perks up

From Reuters: German business sentiment rose in September as companies took a better view of current conditions but their expectations deteriorated as Europe’s largest economy teeters on the brink of recession, a survey showed. The Ifo institute said its business climate index rose to 94.6 from 94.3 in August, snapping a run of five consecutive falls.

Uber gets two-month licence

From Reuters: Uber received only a two-month London operating licence, failing to secure a maximum five-year term in a battle with the regulator that has previously stripped the app of its right to take rides.

What to watch for today

Watch for quarterly results from Nike Inc.

“Nike share price has been flirting with all-time highs for most of this year, held back to some extent by concerns about finding itself in the firing line in the U.S., China trade war,” said CMC Markets chief analyst Michael Hewson.

Required Reading

Tories pledge to boost mortgage repayment periods

Conservative Leader Andrew Scheer said a Tory government would review the mortgage stress test and expand repayment periods, proposals that would partly reverse Ottawa’s efforts to discourage homebuyers from taking on too much debt. Janet McFarland and Kristy Kirkup report.

Liberals take aim at cellphone prices

Politicians looking to win favour with voters have taken aim at Canada’s telecom industry, but experts question whether the Liberal Party can make good on a vow to simply persuade companies to reduce Canadians’ cell phone and internet bills, Alexandra Posadzki writes.

Hands off

Personal finance columnist Rob Carrick argues that politicians should keep their hands off stress tests for first-time home buyers.