Briefing highlights

- The market, economic toll of coronavirus

- What analysts are saying about the coronavirus

- What to expect from the Fed, BoE this week

- What else to watch for this week

- Required Reading

Coronavirus toll

Analysts are trying to tally the potential economic and market toll of the Wuhan coronavirus, largely using the 2003 SARS crisis as a benchmark.

The human toll is most important, of course, and economists say the virus, known as 2019-nCoV, should play out at least somewhat differently.

"It is still very early days, with analysts looking back at the SARS outbreak in 2003 for guidance," said Toronto-Dominion Bank senior economist Leslie Preston.

"However, the global health system is now much better prepared to contain an outbreak like this," she added in a report.

“The containment restrictions in China will hopefully help, but the disruption is likely to hold back economic growth there in the short term.”

The impact will go beyond China, but should be temporary.

“The rising number of new cases of the Wuhan coronavirus … and news of the disease’s spread to other countries have gripped markets, just when the global economic slump appeared to be easing and trade policy risks were settling down,” said Bank of Montreal senior economist Sal Guatieri.

"Like all health scares, this one is unpredictable and investors are unlikely to relax until the tail risk is contained. But if the outbreak follows the course of past ones this century, the global economy faces just a temporary stumble. Let’s hope so."

The SARS-like sickness is spreading, including to Canada, which has seen the first “presumptive” case, as The Globe and Mail’s Kelly Grant and Laura Stone report. About 80 people people have died.

The outbreak has unfolded as China celebrates the Lunar New Year, and Beijing has put in place unprecedented travel restrictions to try to contain the virus.

“From an investors’ standpoint, the virus has clearly recently caused a risk-off market tone,” said Derek Holt, Bank of Nova Scotia’s head of capital markets economics.

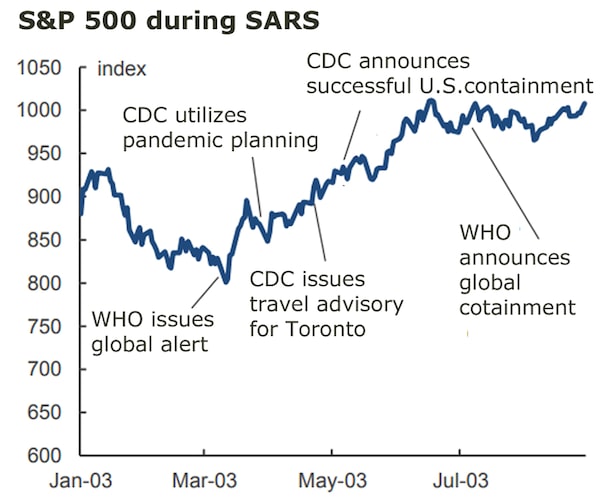

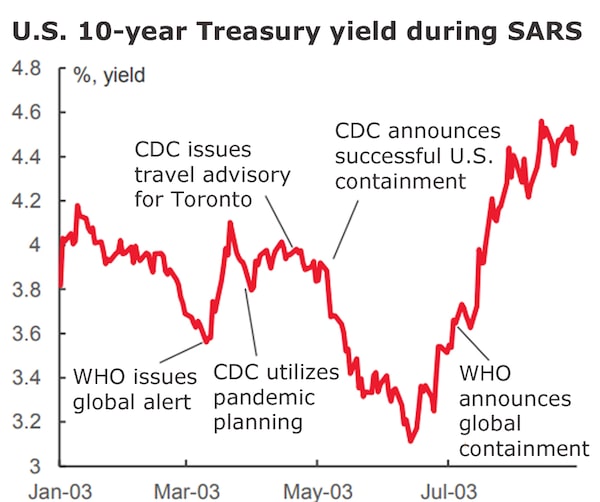

He cited the impact of the SARS virus on the S&P 500, the yield on the 10-year Treasury, the U.S. dollar, corporate credit spreads and high-yield debt markets amid the various findings of the World Health Organization and the Centers for Disease Control and Prevention.

Source: Bank of Nova Scotia

Source: Bank of Nova Scotia

“In all cases, the effects upon markets were fleeting,” Mr. Holt said.

"While the human toll and dangers are real, strained valuations in some markets may just be making room for another leg up although it’s likely as premature to sound alarmist as it is to dip in just yet."

Here’s how things played out in the past, involving SARS, swine flu and Ebola, according to BMO’s Mr. Guatieri, following a “standard playbook” in the economy and markets:

“Share prices of airlines, restaurants, and hotels get notably slammed. Safe-haven buying lifts the yen and Swiss franc at the expense of resource-based currencies, such as the loonie, which plumbed a four-week low (with no help from the Bank of Canada’s dovish pivot)," he said.

"Government bonds strengthen – the 10-year U.S. Treasury rate slid 10 basis points [last] week. Commodity prices fall in anticipation of weaker global demand. Oil prices plunged 6 per cent [last] week to six-week lows on fears the virus will hammer travel in China, the world’s largest energy consumer, while copper prices rode a six-day losing streak in anticipation of weaker global demand.”

This ripples through economies, Mr. Guatieri said:

"People shop less, delay travel and stay home. Companies turn cautious and delay investments. While some of the adverse economic impact is offset by increased demand for health care services and government measures to control the crisis, the economy slows nonetheless."

The Bank of Canada, Mr. Guatieri noted, estimated that SARS cost the economy 0.6 of a percentage point in annualized growth in the second quarter of 2003. And it cut annual gross domestic product by just about 0.1 per cent that year.

“As health-care authorities work to contain the outbreak and the number of new cases falls, financial markets subsequently rally and the economy rebounds. After the three earlier viral outbreaks this century, U.S. equities quickly recovered.”

CIBC World Markets chief economist Avery Shenfeld agreed.

"When Canada was disproportionately hit with SARS, GDP fell in both March and April and its airline stocks clearly underperformed their U.S counterparts," he said.

“When it was all over, those stocks and the economy had fully rebounded. For now, we’ll use that sort of shortlived shock as our base case in affected areas, but this story clearly bears watching as the facts on its spread and fatality rate play out.”

It’s all premature, added Rebekah Young, Scotiabank’s director of fiscal and provincial economics, and her colleague, senior economist Nikita Perevalov.

But “we estimate that a SARS-equivalent pandemic today could have a similar impact on the Canadian economy with an estimated hit of just over 0.1 per cent on the level of GDP by mid-2020, at which point a pandemic should be contained,” they said in a report today.

“This estimate is subject to a significant degree of uncertainty with risks skewed to a potentially larger impact,” they added.

“The effect should not be significant enough to trigger a broader economic malaise, but could this finally push [Bank of Canada governor Stephen] Poloz over the line to proactively stimulate the economy in his next rate call?”

Read more

- Kelly Grant, Laura Stone: Canada announces first confirmed ‘presumptive’ case of coronavirus in Toronto

- China extends Lunar New Year holiday in bid to contain spread of coronavirus as death toll rises to 80

- André Picard: What Ontario didn’t learn from SARS: During a public-health crisis, we need good information, clearly communicated

- Oil drops below $60 as coronavirus drives demand concern

- Nathan VanderKlippe: Weeks before lockdown, Wuhan authorities used 'refrigerating strategy’ to play down coronavirus

- Marcus Gee: Toronto is ready for the coronavirus

- The Wuhan coronavirus: What we know so far about the new disease from China

- Eric Reguly: As the coronavirus spreads, only the brave and foolish would bet oil prices have hit bottom

What analysts are saying

“The coronavirus fears have gripped the markets this morning as all the major European equity benchmarks are nursing big losses. The situation in China is particularly bad as at least 80 people have passed away from the virus and there have been more than 2,700 confirmed infections. Stocks that are connected to China are feeling the pain this morning as traders are afraid the health crisis will curtail economic activity. Beijing have extended the Lunar New Year holiday in a bid to help tackle the problem.” David Madden, analyst, CMC Markets

“The WHO continues to refer to the coronavirus risk as being moderate at the global level, but the tone may change after it meets with officials in Beijing today. It’s a little scary, frankly, not knowing the extent that this virus has spread.” Jennifer Lee, senior economist, Bank of Montreal

“Markets have a risk-off tone to start the week. While some analysts argue the fear will be worse than reality with the coronavirus (pointing to the low mortality rate), no one is anticipating a Spanish flu repeat - the bigger worry is the economic impact of containment and quarantine strategies, particularly in China.” Elsa Lignos, global head of foreign exchange strategy, Royal Bank of Canada

“If the current outbreak reaches the severity of the SARS, it would likely still have a similarly small and transitory impact on the Canadian economy. Assuming peak severity in the first half of 2020, the main impact on Canada would likely be indirect, from lower commodity prices and a drop-off in travel-related industries. In our simulations using the Scotiabank Global Macroeconomic Model, the combined impact of a 4-per-cent lower oil price and the likely disruption to tourism and air travel could leave the level of Canadian GDP lower by just over 0.1 per cent by mid-2020, before the virus is brought under control and commodity prices and growth rebound, similar to the BoC’s estimate for the impact from the SARS outbreak. The annualized GDP growth is expected to be weaker by about 0.3 of a percentage point in 2020Q1–Q2.” Rebekah Young, director of fiscal and provincial economics, and Nikita Perevalov, senior economist, Bank of Nova Scotia

“Given the focus on China at the epicentre of this health crisis, those same markets that had gained in the wake of the US-China trade deal are now being hit hardest. Thus, traders are looking towards the likes of [China’s yuan] and [the Australian dollar] as potential targets to short in case we see further coronavirus deaths. On the flip side we are seeing further demand for traditional havens such as the yen and gold as traders seek to shield themselves from the potential economic repercussions for this virus.” Joshua Mahoney, senior market analyst, IG

Read more

Ticker

Sorrento rejects proposal

From Reuters: Sorrento Therapeutics Inc. said it rejected a proposal by a private equity fund for a majority or all of its outstanding shares that had valued the drug developer at as much as US$993-million. Sorrento said the proposal of up to US$7 per share received earlier this month undervalued it and was not in the best interest of its shareholders.

AbbVie sells some products

From Reuters: U.S. drugmaker AbbVie’s US$63-billion tie-up with Allergan is getting help from Nestle and AstraZeneca buying up products the Irish-domiciled company is shedding to placate regulators. AbbVie is swallowing Allergan to give it control of the lucrative wrinkle treatment Botox and to diversify a portfolio heavily dependent on its US$19-billion-per-year arthritis drug Humira, the world’s best-selling medicine that is advancing toward U.S. patent expiration.

Key this week

Two major central banks – the Federal Reserve and the Bank of England – take centre stage.

The former isn't expected to make any policy changes, but there is some speculation that the latter could cut its benchmark rate.

“Recent disappointing economic data has raised expectations that the Bank of England could well cut rates this week from 0.75 per cent to 0.5 per cent, over concerns that the slowdown in economic data seen at the end of 2019 has spilled into the early part of this year,” said CMC Markets chief analyst Michael Hewson.

"It is certainly true that some of the data has been disappointing, however there have been some signs that we could see a pick up in the weeks ahead."

With a government budget also coming down in early March, it "certainly wouldn't hurt" for the central bank to stand pat, Mr. Hewson said.

“A 25-basis-point rate cut at this stage would largely be cosmetic in nature and would probably be the monetary-policy equivalent of firing a blank. Rate cuts for the sake of being seen to be doing something are not the way a central bank should be implementing monetary policy.”

Also on tap are two key economic reports, the U.S. government’s reading of fourth-quarter economic growth and what is expected to be a flat measure by Statistics Canada of GDP in November.

Several major companies also report quarterly results, including Microsoft, Apple, Canadian National Railway, Canadian Pacific Railway and many more.

Required Reading

Magna’s future

The future of Magna is as a ‘mobility technology company,’ the new president says. Eric Atkins reports.

Breaking a glass ceiling

Janet Bannister has been named managing partner of Real Ventures, becoming the first woman to lead one of Canada’s largest and most active early-stage venture-capital firms, Josh O’Kane writes.

Canada and 5G

Columnist Andrew Willis has a note to Ottawa: Forget wireless bills, and make sure Canada’s ready for 5G