Briefing highlights

- Loan defaults low but rising

- Stocks, loonie, oil at a glance

- OECD revises growth forecasts

- Alberta returning CannTrust products

- Bank of England warns on Brexit

- Powell’s job safe: Trump

- Norway’s central bank boosts rates

- Required Reading

Low but rising

The rate of loan defaults in Canada is low. But it’s rising.

Any rise in delinquencies is obviously a troubling trend, but the increase comes from markedly low levels. And luckily for those who are buried in debt, the Bank of Canada isn’t likely to raise interest rates any time soon.

Indeed, the central bank could well trim its benchmark overnight rate, which now stands at 1.75 per cent.

An Equifax Canada report on credit, released this week, showed consumers getting their act more in gear in the second quarter, slowing the pace of increase in borrowing.

Borrowing still rose, as debt per consumer climbed 1.9 per cent to $71,970, but that marked a slower rate than the “robust” 2.6-per-cent gain in average debt in the first three months of the year, Equifax said.

Breaking it down, mortgage debt grew at a slower 1.8 per cent, and non-mortgage credit by 2 per cent, also a reduced pace.

“There were some troubling signs in the first quarter, with credit card usage and average debt rising sharply for some vulnerable consumer groups,” Bill Johnston, Equifax’s vice-president of data and analytics, said in releasing the numbers.

But “consumers were able to get back on a more reasonable track through the spring.”

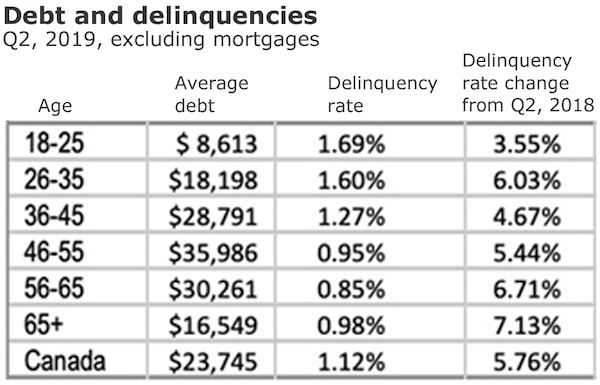

Still, rates of delinquency of 90 days or more “turned slightly higher again,” reaching 1.12 per cent for non-mortgage debt and 0.18 per cent for mortgages. Defaults are still near their longer-term low points, Equifax said.

Here’s how it breaks down by age:

Source: Equifax Canada

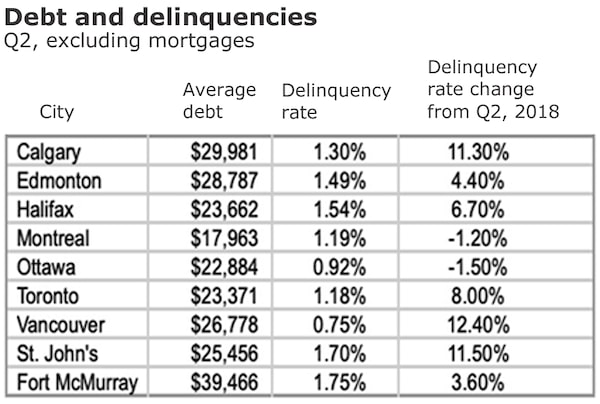

And by region:

Source: Equifax Canada

British Columbia, Alberta and Ontario chalked up the “most significant increases” for mortgage defaults, Equifax said, but “in the case of Ontario and British Columbia, the magnitude reflects the very low levels of delinquency.”

The latest report from Statistics Canada, released earlier this month, showed the key ratio of household debt to disposable income easing in the second quarter, for the third three-month period in a row, as “income grew slightly faster than debt.”

That level of 177.1 per cent, though, which means Canadians owe $1.77 for each dollar of disposable income, is still high.

What’s more, the household debt service ratio, which tracks principal and interest owing as a percentage of disposable income, rose to a record 14.93 per cent in the second quarter.

“A larger proportion of income is now swallowed by interest payments – 7.5 per cent, the most since [the second quarter of 2009],” Bank of Montreal economic analyst Priscilla Thiagamoorthy said of that report at the time.

“Still, with interest rates more likely to go down than up, we should see some reprieve on this front, with mortgage rates already falling about 100 basis points this year.”

Indeed, Mr. Johnston noted that consumers could use the Bank of Canada’s “holding pattern” to spruce up their books, which could keep a lid on defaults.

“The concern, particularly if rates are cut, is that consumers could overextend themselves further,” he said in his report.

“Any rate cuts are likely short-term. Locking into low fixed rates and avoiding overusing credit cards is a prudent strategy to follow if rates drop.”

Read more

- Rachelle Younglai: Household wealth drops for first time since financial crisis

- Rachelle Younglai, Chen Wang: How Canada’s suburban dream became a debt-filled nightmare

- Insolvencies among Canadian consumers are surging

- Matt Lundy: Canadian households are spending more than ever on debt payments

- Why so many Canadians could be in so much trouble in an economic shock (notably in B.C., Ontario)

- Ian McGugan: Canada needs a better picture of how households are faring

- Debt and wealth: So many Canadians are either messed up or poor

- Rob Carrick: This is why Canadians are so stressed out about money despite good economic times

- ‘You may not be as rich as you think’: Canadian families face a long road back to financial health

- Many Canadians say they’ll have to tap RRSPs, take second mortgages, sell assets as debt burden rises

Markets at a glance

Read more

OECD revises forecasts

The OECD has set new economic growth forecasts for Canada and the world.

For Canada, the Organization for Economic Co-operation and Development now sees growth of .5 per cent this year, better than its earlier projection. But for 2020, the group projected in its updated forecast today growth of .6 per cent, weaker than it first said.

Global growth is now pegged at 2.9 per cent this year, and 3 per cent next.

Among other things, the OECD warned that “trade growth is stalling as restrictions bite” and that “uncertainty is dragging down manufacturing and investment.”

Read more

Ticker

Alberta returning CannTrust products

From Reuters: Marijuana producer CannTrust Holdings Inc said on Thursday the Alberta Gaming, Liquor and Cannabis Commission will return products worth $1.3-million. Health Canada suspended the troubled pot grower’s license to produce and sell cannabis on Tuesday, after the regulator found out about illegal cultivation by the company.

Bank of England stands pat, warns on Brexit

From Reuters: The Bank of England said Brexit uncertainty was causing slack to re-emerge in Britain’s economy and damaging productivity, and a failure to reach a transition deal by Oct. 31 could lead to further weakness. The nine members of the BoE’s Monetary Policy Committee all voted to keep rates on hold at 0.75 per cent.

Trade talks resume

From Reuters: U.S. and Chinese deputy trade negotiators were resuming face-to-face talks for the first time in nearly two months as the world’s two largest economies try to bridge deep policy differences and find a way out of a bitter and protracted trade war. The negotiations on Thursday and Friday are aimed at laying the groundwork for high-level talks in early October.

Powell’s job safe: Trump

From Reuters: Federal Reserve chair Jerome Powell’s job is safe, President Donald Trump said in a Fox News interview, adding that he was “not thrilled” with the U.S. central bank. Mr. Trump had wanted the central bank to make a deep cut to interest rates Wednesday, when it trimmed its benchmark by one-quarter of a percentage point.

Federal Reserve chair Jerome PowellSARAH SILBIGER/Reuters

Norway raises rates

Norway’s central bank bucked the trend by raising its key rate by one-quarter of a percentage point to 1.5 per cent. BMO senior economist Jennifer Lee said of this fourth rate hike in a year: “Norway did it. It defied those who were starting to doubt a little that it would follow through on those warnings of more rate hikes … But that may be it, according to the official statement.”

Bank of Japan holds steady

From Reuters: The Bank of Japan kept monetary policy steady but signaled the chance of expanding stimulus as early as its next policy meeting in October by issuing a stronger warning over the risks threatening the economy.

Required Reading

Minister intervened in decision

Infrastructure Minister François-Philippe Champagne intervened in a decision by the Canada Infrastructure Bank’s independent board regarding the performance pay of the bank’s CEO, according to documents obtained by The Globe and Mail. Bill Curry reports.

U.S. move creates uncertainty

The Trump administration’s move to revoke California’s longstanding power to set vehicle-emissions standards threatens to cause confusion for North American auto manufacturers while casting doubt on the Trudeau Liberals’ climate-change agenda, Tamsin McMahon writes.

AGF scores windfall

Canadian mutual fund company AGF Management Ltd. scored a $320-million windfall from the planned merger of two large British money managers. Andrew Willis reports.