Briefing highlights

- Consumer insolvencies on the rise

- Stocks, loonie, oil at a glance

- Obsidian launches strategic review

- Encana changes up executive team

- Housing starts rise in August

- Fortis boosts dividend

- WeWork IPO seen lower

- What to watch for today

- Required Reading

Insolvencies climb

Insolvencies among Canadian consumers are surging, though many are opting to renegotiate their debts rather than sink into outright bankruptcy.

The number of insolvencies in Canada rose in July by 16.9 per cent to 11,489 from 9,829 a year earlier, according to the Office of the Superintendent of Bankruptcy. The latest number is also up from 10,916 in June.

Insolvencies come in two forms: The first is outright bankruptcy, while the second is what’s known as a “proposal,” under which a struggling consumer negotiates new terms with a lender.

The number of bankruptcies rose 2.6 per cent in July from a year earlier, to 4,552, while the number of proposals climbed 28.7 per cent to 6,937.

The latter, said David Rosenberg, chief economist at Gluskin Sheff + Associates, is the fastest pace since September, 2010.

Mr. Rosenberg noted how the Bank of Canada gave no real signal last week that it is poised to cut interest rates, though some economists believe it could as early as the end of next month.

“It’s clear that there are Canadians out there struggling with elevated debt loads and could use lower interest rates,” Mr. Rosenberg said of the latest insolvency numbers.

On a seasonally adjusted basis, the key measure of household debt to disposable income now stands at an elevated 155.6 per cent in Canada, which means we owe $1.78 for each free dollar we have.

This has been a key concern of the Bank of Canada for years, prompting some observers to suggest the central bank would not lower rates lest it fan the flames.

But “the argument for the BoC to not move in order to avoid more debt accumulation and another speculative round of housing fever similar to 2015 has some holes,” said Benjamin Reitzes, Bank of Montreal’s Canadian rates and macro strategist.

“First, the macroprudential mortgage rule tightening in recent years should help dampen speculation (as the BoC noted in the policy statement),” he added, referring to the central bank’s comments last week as it held its benchmark overnight rate steady at 1.75 per cent.

“Second, five-year mortgage rates have already fallen sharply. While a drop in the overnight rate will provide more stimulus, it won’t be quite as much as usual with term mortgage rates already sliding. Lastly, domestic demand was still solid at the tail end of 2014, so there was greater risk for domestic overheating.”

While insolvencies are rising, the level of loan defaults is still small.

Read more

- Matt Lundy: Canadian households are spending more than ever on debt payments

- More Canadians are drowning in debt, filing for insolvency

- Why so many Canadians could be in so much trouble in an economic shock (notably in B.C., Ontario)

- David Parkinson: Bank of Canada’s Poloz’s housing musings speak to the bank’s biggest risk factor

- Ian McGugan: Canada needs a better picture of how households are faring

- Debt and wealth: So many Canadians are either messed up or poor

- Rob Carrick: This is why Canadians are so stressed out about money despite good economic times

- ‘You may not be as rich as you think’: Canadian families face a long road back to financial health

- Many Canadians say they’ll have to tap RRSPs, take second mortgages, sell assets as debt burden rises

Markets at a glance

Read more

Obsidian launches strategic review

Obsidian Energy Ltd. has launched a strategic review that could include a sale of the company formerly known as Penn West.

“Such strategic alternatives may include, but are not limited to, a corporate sale, merger or other business combination, a disposition of all or a portion of the company’s assets, a recapitalization, refinancing of its capital structure, or any combination of the foregoing,” it said in a statement.

“While the outcome of the strategic review process will depend on the opportunities which arise within such process (and there is no assurance of any particular outcome), Obsidian Energy believes that, given the company’s position as the largest producer and holder of Cardium acreage, the initiation of the strategic review process will allow for consideration of consolidation within the Cardium play in Alberta,” it added.

“Furthermore, such consolidation if possible, may allow for the creation of additional scale, efficiency and financial strength.”

Read more

- Obsidian Energy launches formal strategic review including possible sale

- Obsidian Energy’s sale of stake in heavy oil project fails to win Chinese partner’s approval

Encana changes up executive team

Encana Corp. changed up its executive team today, promoting chief operating officer Michael McAllister to president.

An Encana veteran of almost 20 years, Mr. McAllister will still report to chief executive officer Doug Suttles.

Encana also named Brendan McCracken executive vice president, corporate development and external relations, while moving Greg Givens in to the COO spot.

Read more

Ticker

Housing starts rise

From The Canadian Press: Canada Mortgage and Housing Corp. says the pace of new housing starts in August climbed 1.9 per cent compared with July. The housing agency says the seasonally adjusted annual rate of housing starts rose to 226,639 units.

Ford in electric push in Europe

From Reuters: Ford Motor Co. said it would launch eight electric vehicles in Europe this year, a key step in its target of achieving a majority of its overall sales from electric cars by the end of 2022.

Fortis boosts dividend

From The Canadian Press: Fortis Inc. raised its dividend as it announced an increased capital investment plan. The utility company says it will now pay a quarterly dividend of 47.75 cents per share, up from 45 cents. The increased payment to shareholders came as the company said it will spend $18.3-billion between 2020 and 2024, up $1-billion from the previous year’s plan.

WeWork IPO seen lower

From Reuters: WeWork owner The We Company is weighing slashing the valuation of its forthcoming IPO to below US$20-billion, two sources said, in the latest headwind for leading shareholder SoftBank Group, whose key group portfolio firms have tumbled in value.

Huawei drops suit

From Reuters: China’s Huawei Technologies Co. has dropped a lawsuit against the U.S. government after Washington released telecommunications equipment it had seized on suspicion of violations of export controls, according to a court filing.

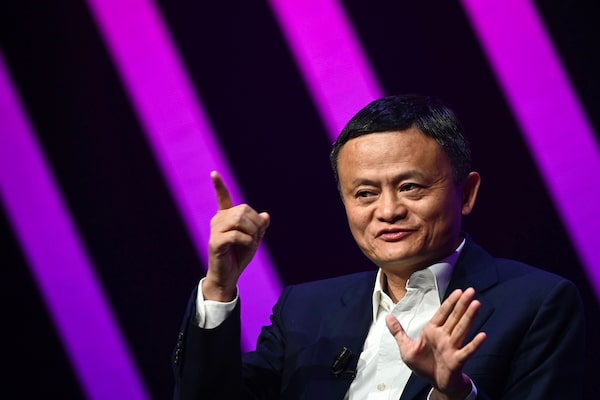

Ma gives up chairman post

From The Associated Press: Alibaba Group founder Jack Ma, who helped launch China’s online retailing boom, stepped down as chairman of the world’s biggest e-commerce company Tuesday at a time when its fast-changing industry faces uncertainty amid a U.S.-Chinese tariff war. One of China’s wealthiest and best-known entrepreneurs, he gave up his post on his 55th birthday as part of a succession announced a year ago.

Jack MaPHILIPPE LOPEZ/AFP/Getty Images

What to watch for today

On the corporate front, Hudson’s Bay Co. reports quarterly results.

Required Reading

Financial wealth declines

After nine years of strong growth, Canadians’ financial wealth, which includes deposits, investment funds and direct holdings of securities, suffered its first decline since the 2008 financial crisis, according to the 2019 Household Balance Sheet Report released on Tuesday by Investor Economics. Clare O’Hara reports.

Andreescu a ‘hot commodity’ for sponsorship

Bianca Andreescu may be a proud Canadian, but becoming the country’s first Grand Slam singles champion in tennis has catapulted her to international fame – and with that comes global sponsorship opportunities, Alexandra Posadzki and Andrew Willis write.

Behind the TSX 60 changes

The index of Canada’s biggest stocks has welcomed a gold company and said goodbye to an energy player, but the changes that weren’t made are even more notable. David Milstead explains why.