Briefing highlights

- How TSX has fared in elections

- Oil prices edge down

- Stocks, loonie at a glance

- Manufacturing sales slide

- European Parliament backs Largarde for ECB

- What to watch for today

- Required Reading

How TSX has fared

If you invest in Toronto-listed stocks, and don't much care about the outcome of the Oct. 21 federal election, you just might pray for a minority government.

Bank of Montreal isn't saying that, but my comments are based on the work of BMO chief investment strategist Brian Belski.

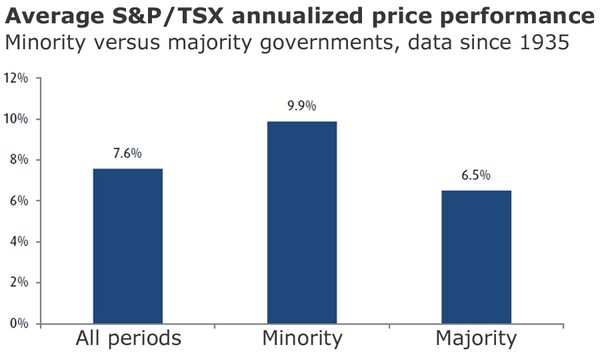

What Mr. Belski found is that the Toronto stock market appears to care little about the outcome of federal elections, though minority governments seem to have a more positive impact than majority ones.

"Although politics rarely plays a meaningful role in equity performance, we found there is some evidence to suggest minority governments can be positive for markets, particularly when the valuation starting point is low, as it is currently," Mr. Belski said.

"Ultimately, we believe investors should ignore any noise and remain focused on the fundamentals, which remain strong and supportive of continued equity strength," he added in a report on elections and the performance of the Toronto Stock Exchange.

"Although on average the market has posted relatively strong performance post federal elections, there appears to be little to no performance preference around the outcome," Mr. Belski said.

"The only potentially meaningful outcome appears to be a minority government versus a majority government," he added.

The Toronto market has gained more than 9 per cent 12 months after an election, on average, since 1935, Mr. Belski found, eclipsing the 7.8-per-cent annualized rally over that period.

Here's where the big difference comes into it:

"The average annualized TSX performance is 9.9 per cent during minority governments, well ahead of the 6.5-per-cent average performance seen during majority governments, Mr. Belski said.

Source: Bank of Montreal

There are reasons for that, of course.

“Minority governments are more stimulative on average,” Mr. Belski said.

"Indeed, federal governments tend to loosen fiscal position in the first 12 months of a minority government (by 0.3 per cent of GDP), while fiscal position usually remains static during first 12 months of majority governments."

There's a but here.

"When we look at the fundamentals around elections, valuation starting points can be meaningful on near-term performance," Mr. Belski said.

“In fact, our work shows that when the LTM PE is below the long-term average (17.3x) heading into the election, as it is currently, the market tends to outperform over the next 12 months whether a minority or majority government is formed,” he added.

By LTM PE, he was referring to the price to earnings ratio in the last 12-month period.

And, as this shows, TSX performance is still slightly better under that scenario.

Source: Bank of Montreal

"However, the market also tends to perform relatively well when a minority government is formed and the LTM PE is above the long-term average," Mr. Belski said. "This is likely due to the fact that earnings growth has been higher on average during minority governments."

Indeed, the BMO strategist said average growth in earnings has been more than 10 per cent under minorities since 1956, double that under majority governments.

Source: Bank of Montreal

"Multiples have tended to be lower heading into minority governments and Conservative wins," he added.

"A decisive majority win when S&P/TSX LTM PE is above the long-term average tends to be negative for markets."

It's early days yet heading toward the election, but Stephen Brown, senior Canada economist at Capital Economics, cited the chance of a minority government.

"While that might act as a barrier to policy making in normal times, experience from elsewhere suggests that it won’t necessarily prevent a fiscal response during a downturn," he said.

"If anything, the concessions necessary to win opposition support could make any eventual fiscal stimulus larger."

Read more

Oil prices edge down

Oil prices pulled back somewhat today, but concern is running high after the weekend attacks on Saudi crude production.

“How long will oil supply be restricted?” said Kit Juckes of Société Générale.

“Our concern is still that prices can remain elevated for a while given the nature of the shock.”

Indeed, there are fears of how this could affect the broader economy.

“Geopolitical uncertainty is certainly nothing new in the Middle East, however even by recent standards, yesterday’s sharp rise in oil prices in the wake of the attack on Saudi Arabia’s production infrastructure, was a historic move,” said CMC Markets chief analyst Michael Hewson.

“The size of the move has raised concerns that if sustained a rise in prices could prompt further weakness in a global economy already vulnerable to concerns about slowing demand.”

And there’s more going on here, of course.

“The longevity of this oil rally is likely to come down to the geopolitical aspect as much as supply, with the sizeable knockout in output likely to be made up through backup inventories from both the U.S. and Saudi Arabia,” said IG senior market analyst Joshua Mahony.

“However, it is the impact it has on Middle East relations that could provide the longer lasting shift in sentiment, with the prospect of military conflict ramping up once again,” he added.

“While relations seemed to have calmed after the Iranian attack on a U.S. drone in June, Saudi Arabia could seek to take retaliatory action if this attack was proven to come from Iran.”

Read more

- David Berman: Drone strikes sent oil prices surging, but rally unlikely to last with weak demand

- Eric Reguly: The oil geopolitical risk premium that should never have disappeared is suddenly back

- Bessma Momani: After Saudi oil attack, hopes dim for international Iranian sanctions

- Saudi Arabia says oil facilities were hit with Iranian weapons

Markets at a glance

Read more

Manufacturing sales slide

Canada’s manufacturing sector chalked up another losing month as sales fell 1.3 per cent in July, having tumbled 1.4 per cent in June.

July’s drop was primarily because of depressed sales in the primary metals and motor vehicle sectors, Statistics Canada said.

Shipments declined in 11 of the industries measured, accounting for almost 67 per cent of total sales.

In volume terms alone, sales sank 1.6 per cent.

New orders declined 1.6 per cent, and unfilled orders by .4 per cent.

Ticker

No end in sight to GM strike

From The Associated Press: Talks continued into the night but there was no end to the strike against General Motors in the U.S. The walkout by upward of 49,000 United Auto Workers members has brought to a standstill more than 50 factories and parts warehouses in the union’s first strike against the No. 1 U.S. automaker in over a decade.

Kruger to retire

Rich Kruger plans to retire as chief executive officer and chair of Imperial Oil Ltd. at the end of the year, paving the way for successor Brad Corson, the company said today. It named Mr. Corson president, with the other duties to follow on Jan. 1.

European Parliament backs Lagarde

From Reuters: The European Parliament backed Christine Lagarde as the next president of the European Central Bank, paving the way for her to become the first woman to hold the post. A shrewd negotiator who has run the International Monetary Fund but has little monetary policy experience, Ms. Lagarde was selected in July by EU leaders to replace Mario Draghi from Nov. 1 at the helm of the bloc’s most powerful financial institution.

Mood in Germany improves

From Reuters: The mood among German investors improved more than expected in September, a survey showed, but the ZEW institute warned that the outlook for Europe’s largest economy remained negative amid trade disputes and Brexit uncertainty.

AB InBev revives plan

From The Associated Press: AB InBev, the world’s largest brewer that produces Budweiser and Corona, has revived plans to list its Asian business in Hong Kong but halved the size of its initial public offering. The move comes two months after it temporarily shelved plans to raise US$9.8-billion in what would have been the world’s biggest IPO this year, citing market conditions due to prolonged, sometimes violent protests in Hong Kong.

WeWork owner delays IPO

From Reuters: WeWork owner The We Company has postponed its initial public offering, walking away from preparations to launch it this month after a lackluster response from investors to its plans. The U.S. office-sharing startup was getting ready to launch an investor road show for its IPO this week before making the last-minute decision on Monday to stand down, people familiar with the matter said.

Apple fires back

From Reuters: The European Union’s order for Apple to pay €13-billion in back taxes to Ireland “defies reality and common sense,” the U.S. company said, as it launched a legal challenge against the 2016 ruling.

What to watch for today

Economists generally expect Statistics Canada to report manufacturing sales dipped 0.2 per cent in July, though some expect to see an increase of a similar amount.

"In Canada, the manufacturing sector has looked a little stronger year-to-date than might have been expected given the softening in the U.S.," Royal Bank of Canada economists said in a lookahead to the report.

"But sales in the sector pulled back in June and we’re not expecting any significant rebound in July – or indeed over the second half of the year with softer U.S. activity eventually expected to spill over more significantly into Canada."

Watch, too, for quarterly results from Adobe Systems Inc. and FedEx Corp.

Required Reading

Alberta eyes boosting oil output

Alberta is considering relaxing oil production cuts to allow companies to export more crude following the weekend attacks that reduced Saudi Arabian output, Jeffrey Jones writes.

U.S. strike threatens Ontario plants

A strike by 48,000 General Motors Co. workers at 33 auto factories and 22 parts distribution warehouses in the United States threatens to halt production at several Ontario vehicle parts and assembly plants. Eric Atkins reports.

Toronto home buyers pay more in taxes, fees

Home buyers in the Toronto region are paying significantly more in taxes and development charges on newly constructed homes than purchasers in other major Canadian and U.S. cities, according to a new study. Janet McFarland looks at the issue.