Briefing highlights

- Housing market has troughed, analysts say

- Stocks, loonie, oil at a glance

- Canada’s inflation rate cools

- Manufacturing sales rise

- Amazon faces EU probe

- Required Reading

Market trough?

Economists believe Canada’s housing market has troughed, creating “almost dream conditions” for policy-makers who moved forcefully to head off a price and debt bomb.

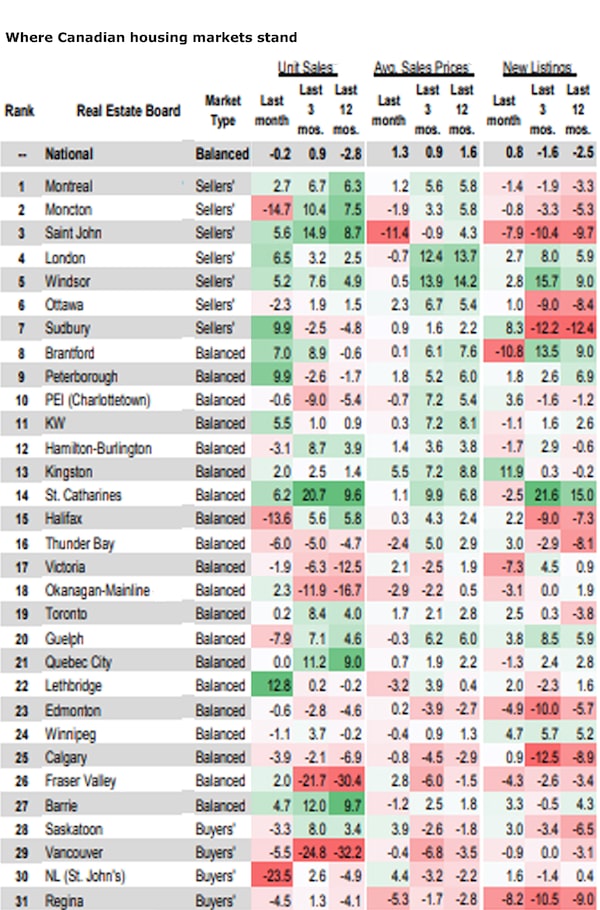

Analysts were commenting on the latest numbers from the Canadian Real Estate Association, which, despite big regional differences and trouble spots, suggest stability after the introduction of provincial tax measures and federal mortgage stress tests.

As The Globe and Mail’s Janet McFarland reports, home sales rose 0.3 per cent in June from a year earlier, with average prices up 1.7 per cent.

On a month-over-month basis, sales dipped 0.2 per cent from May.

Those numbers show the market was basically flat, said Royal Bank of Canada senior economist Robert Hogue, and “provided further evidence that the market has passed its cyclical bottom.”

Bank of Montreal chief economist Douglas Porter looked at what’s happening and dubbed it “almost dream conditions for policy-makers,” based on certain half-year figures.

There’s still a big East-West divide, with Vancouver slumping, in particular.

And don’t count on a big rebound, observers said.

“We see little in the near term – not even recent drops in mortgage rates – to fire up the market significantly,” said Mr. Hogue.

“We expect demand-suppressing policy measures, as as stretched affordability in key markets, to keep things relatively cool,” he added.

“This is sure to disappoint those hoping for a snapback in activity, especially out west. But it should be viewed as part of the solution to address issues of affordability and household debt in this country.”

Now, if you’re looking to buy or sell, you’ll be interested in this from Bank of Nova Scotia.

Source: Bank of Nova ScotiaThe Globe and Mail

“Halfway through 2019, the data continues to point to near-term stability in most regional housing markets,” said Scotiabank provincial economist Marc Desormeaux.

“Demand-supply conditions have stayed roughly balanced in most major centres, and sales and prices are generally recovering from a broad-based slump in February,” he added.

“Of course, long-term challenges remain, but this year looks set to be a relatively steady one after multiple years of adjustment to higher interest rates and federal and provincial policy.”

Read more

- Janet McFarland: Southern Ontario housing market sees strong growth, while sales still languish in parts of Western Canada

- Brent Jang: Vancouver real estate market experiences dramatic drop in foreign buying following tax

- Rob Carrick: We need to come clean with millennials on big-city home ownership dreams

- B.C. home prices won’t hit bottom until 2020, TD says

- ‘Green shoots’ in the housing market: A cross-Canada look that shows if you’re in buyers’ or sellers’ territory

- CREA hikes forecast as Canadian home sales post biggest annual increase since 2016

- Canada’s housing market tumbles in global ranking, but ‘opportunistic buyers’ are afoot

- Carolyn Ireland: A fickle housing market with price-sensitive buyers

- Hitting market bottom: A five-year forecast for house prices in 33 Canadian cities

- How Toronto’s housing market shrank by billions

Markets at a glance

Read more

Inflation cools

Inflation is cooling in Canada, largely because of a hefty drop in prices at the gas pump and lower costs for other fuel.

“This was due in part to falling oil prices amid rising fuel inventories in the United States and the elimination of carbon pricing in Alberta and the end of May, Statistics Canada said in releasing the numbers.

Canada’s annual inflation rate dipped in June to 2 per cent from May’s 2.4 per cent.

If you strip out energy, prices climbed 2.6 per cent from a year earlier.

“After a big upside surprise in May, Canadian inflation released some pressure in June, with almost all major measures dipping back close to the key 2-per-cent mark,” said Bank of Montreal chief economist Douglas Porter.

“While gasoline prices have since moved back up again, headline [annual inflation] still looks set to dip further next month (and the BoC expects inflation to average just 1.6 per cent in Q3),” he added.

“Still, the underlying trends in Canadian inflation are notably firmer than stateside, offering another reason (alongside the expected GDP rebound in Q2) for the BoC to stay on the sidelines, watching the global easing parade go by.”

Read more

Manufacturing shipments rise

Canada’s manufacturing sector scored a winning month in May as sales rose 1.6 per cent after April’s drop of 0.4 per cent.

Stripping out prices, sales were up 1.7 per cent.

The gains were driven largely by the transportation equipment sector, which chalked up increases to the tune of 8.1 per cent, Statistics Canada said.

Sales in that sector climbed 8.1 per cent.

“This increase was due to higher sales in the motor vehicle (+13.3 per cent) and motor vehicle parts (+7.3 per cent) industries,” Statistics Canada said.

“The increase in motor vehicle sales was the result of more units produced at all assembly plants, and in particular, those that had shutdowns in the previous month. In constant dollars, sales volumes rose 13.1% in the motor vehicle industry in May. The gain in motor vehicle parts stemmed from many plants returning to full production after temporary shutdowns in April.

Ticker

Amazon faces EU probe

From Reuters: Amazon became the target of an antitrust investigation by the European Union over its use of merchants’ data, underlining the increasing regulatory scrutiny over how tech companies exploit customers’ information. Amazon said it would co-operate fully.

Bank of America profit rises

From Reuters: Bank of America Corp reported a 10-per-cent increase in quarterly profit as a healthy U.S. economy boosted demand for loans.

WTO rules against U.S.

From Reuters: The United States did not fully comply with a World Trade Organization ruling and could face Chinese sanctions if it does not remove certain tariffs that break WTO rules, WTO appeals judges said in a ruling.

U.K. employers want change

From Reuters: A coalition of British industry groups and education bodies, worried by the prospect of Brexit worsening skills and labour shortages, has called for the next prime minister to relax proposed reforms of the immigration system.

Fortis inks deal

From The Canadian Press: FortisBC is considering further expansions to its liquefaction facility on the Fraser River near Vancouver after landing its first term contract to send Canadian LNG to China.

Required Reading

Pizza chain sales hurting

Sales are slowing at several North American pizzeria chains as customers gain access to a widening array of foods available at their fingertips through delivery apps such as Uber Eats, Foodora and Skip the Dishes. Megan Devlin reports.

Firing back

Aimia Inc.’s largest shareholder is firing back at the loyalty-rewards company after two new directors were appointed, setting up a public clash between the New York-based fund and the company’s leadership, Tim Kiladze writes.

BoC to take control

The Bank of Canada will take over as administrator of a key interest-rate benchmark that is undergoing an overhaul as part of global reforms to benchmarks, some of which have been vulnerable to manipulation. James Bradshaw examines the issue.