Briefing highlights

- Seniors struggling with delinquencies

- Stocks, loonie, oil at a glance

- Required Reading

Seniors struggling

The numbers are small. It’s how they’re growing that’s worrisome.

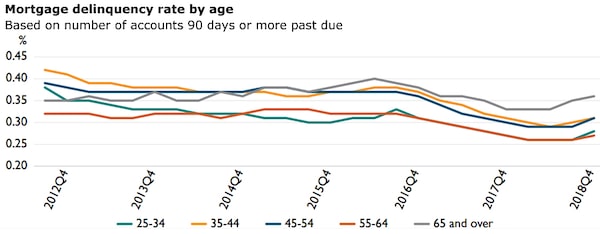

Canadian seniors, who are supposed to be enjoying those so-called golden years, are struggling with mortgage delinquencies like no other age group.

Mortgage delinquency rates among those 65 and up have been climbing, according to Canada Mortgage and Housing Corp.

“They have also been the highest amongst all age groups since late 2015, suggesting that there is a share of consumers over 65 with a mortgage loan that may be more financially strained and vulnerable,” the agency said in its report on credit trends in the fourth quarter of last year.

“This could lead to potential situations are they could be less able to meet their payment obligations on time, for example, in case of life events affecting their income,” it added.

Source: CMHC

“That being said, mortgage delinquency rates remained relatively low for all age groups.”

Read more

- Why so many Canadians could be in so much trouble in an economic shock (notably in B.C., Ontario)

- Barrie McKenna: Household debt, housing worries easing but other concerns persist, Bank of Canada says

- David Parkinson: Bank of Canada’s Poloz’s housing musings speak to the bank’s biggest risk factor

- Ian McGugan: Canada needs a better picture of how households are faring

- Debt and wealth: So many Canadians are either messed up or poor

- Half of Canadians say they’re struggling to meet daily expenses: OECD

- Rob Carrick: This is why Canadians are so stressed out about money despite good economic times

- ‘You may not be as rich as you think’: Canadian families face a long road back to financial health

- Tim Shufelt: Canadian household debt to income ratio rises to historical high, Statistics Canada says

- Many Canadians say they’ll have to tap RRSPs, take second mortgages, sell assets as debt burden rises

- ‘The worm is turning’: More Canadians are going broke, defaulting on their debts

Markets at a glance

Read more

Ticker

China slams Pompeo

From Reuters: China denounced U.S. Secretary of State Mike Pompeo for fabricating rumours after he said the chief executive of China’s Huawei Technologies Co. was lying about his company’s ties to the Beijing government.

Torstar to close Hamilton print outlet

From The Canadian Press: Torstar Corp. said it will close its Hamilton printing and mailroom operations this summer and look at selling the property. It said printing work done at the facility will be transferred to TC Transcontinental Printing and other Torstar-owned facilities, as well as other external printers.

Brent rises

From Reuters: Brent crude rose towards US$69 a barrel after two sessions of losses, but remained on track for its biggest weekly drop this year due to rising inventories and concerns of an economic slowdown.

Required Reading

CMHC backs stress test

Canada’s mortgage stress test must be maintained because it is helping prevent a potential financial crisis from a ‘debt-fuelled real estate boom,’ CMHC chief Evan Siddall says in a letter to the Commons finance committee. Real estate writer Janet McFarland reports.

Investment banks to lose millions

A syndicate of investment banks is expected to lose tens of millions of dollars after repricing a secondary offering of Corus Entertainment shares due to lower-than-expected demand. Alexandra Posadzki, Tim Kiladze and Andrew Willis report.

Profiting from analysts

Here, writes investment reporter Tim Shufelt, is a way to actually profit from using analyst recommendations.