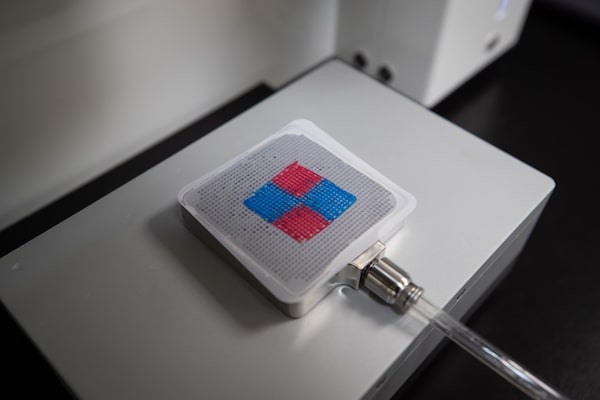

A 3D tissue patch is seen after being made with a RX1 bioprinter at Aspect Biosystems, in Vancouver, in October, 2021.DARRYL DYCK/The Globe and Mail

The federal and B.C. governments are providing $72.75-million to a University of British Columbia spinoff that 3-D prints live tissue implants, the latest in a string of taxpayer-funded contributions to help Vancouver’s teeming life sciences sector.

Ottawa will contribute $49-million and B.C. will kick in $23.75-million to help fund a $200-million project by Aspect Biosystems Ltd. that includes the building of a manufacturing plant capable of producing materials for its clinical trials and investments to further develop its technology.

“A big focus of this project is to bring everyone under one roof to maximize on the value of our team’s interdisciplinary nature,” said Aspect CEO Tamer Mohamed, whose company is spread out across three buildings in Vancouver. He said Aspect is looking at sites to the south and east of the city’s False Creek area, where many life sciences companies are located.

Aspect uses customized 3-D printers to create synthetic tissues composed of living cells and hydrogel polymers, which can be implanted in people with impaired pancreases or livers, replacing the functions of those organs.

After proving its implants effectively treated diabetes in rodents, Aspect inked a blockbuster development deal last year with Danish metabolic drug giant Novo Nordisk AS. Novo, one of the world’s largest insulin makers and the developer of weight-loss drug Wegovy and diabetes treatment Ozempic, agreed to pay US$75-million upfront to fund Aspect’s research and development and take an undisclosed ownership stake.

Novo also received an exclusive global licence to use Aspect’s technology to develop as many as four products to treat diabetes and/or obesity. Each program could deliver up to US$650-million in milestone payments to Aspect, plus royalties on any eventual Novo product sales.

Mr. Mohamed acknowledged that his 100-person company faced pressure to move some or all of its operations out of Canada and said the government funding will help Aspect stay put as it builds manufacturing capacity, which has been in chronically short supply in B.C. and Canada.

“The pressures we face are not so dissimilar to those any Canadian company faces,” he said. “There will come a point in time because you don’t have the capability and infrastructure to support scale, where you will have to make those hard types of decisions.”

“This scale of a project sends a strong signal to not just Novo Nordisk but the industry at large that we’re here to stay and we’ll manufacture these products here.”

Brenda Bailey, B.C.’s Jobs, Economic Development and Innovation Minister, said in an interview that “B.C. has a long history of being an incubator of technology and science for other jurisdictions. Quite frankly, we want to be an incubator of science and technology for B.C. and Canada. That’s what we’re trying to buy here – and we’re also buying high-quality jobs.”

Aspect is one of a group of bold, up-and-coming Vancouver-area companies leading a renaissance in the region’s life sciences sector and bent on establishing Canada’s West Coast metropolis as a major player in the global pharmaceutical industry.

Vancouver is already Canada’s fastest-growing biotech centre, with 8,000 jobs added over the past 10 years. The area is home to several other promising life sciences companies, including AbCellera Biologics Inc., Acuitas Therapeutics Inc., Xenon Pharmaceuticals Inc., Clarius Mobile Health Corp., Canary Medical Inc., Kardium Inc. and Stemcell Technologies Canada Inc., a leading supplier of media and tools for drug developers.

But it’s not lost on industry observers that Vancouver has seen past successes founder and disappear – or that the country has never produced a major research and development pharma giant. Instead, Canada has a reputation for producing cutting-edge medical research that gets commercialized elsewhere. The country lacks the necessary infrastructure, including a shortage of wet lab space for doing drug research.

“We have the next generation of companies with Stemcell, AbCellera and Aspect, which are already global leaders in their fields. Now it’s about scale,” said federal Innovation, Science and Industry Minister François-Philippe Champagne. “Our role as government is to make sure we can help them grow exponentially. My dream is to have 100 more Shopifys in Canada, and in the life sciences sector I think we can.”

Other local companies that have received significant government funding in recent years include AbCellera, Stemcell and Precision Nanosystems. The province and Ottawa have also funded the expansion of AdMare Bioinnovations, a national biotechnology incubator headquartered at UBC. B.C. has also provided hundreds of millions of dollars to build a new research hospital at the edge of False Creek Flats, a former industrial and rail yard zone that is earmarked to become a life sciences centre.