Frame grab of Fred Sharp in a scene from Cliff, a short film about an executive caught up in stock fraud, directed by his son Alexander.Sharp Art Pictures

If there is such a thing as a spokesperson for the shadowy offshore finance industry, Canadian businessman Frederick Sharp is it.

For years, Mr. Sharp unabashedly operated a Vancouver business that helped create companies in far flung jurisdictions for those who wanted to conceal their wealth. He was linked to more than 1,000 offshore companies through the Panama Papers scandal in 2016. At that time, he decried all of the negative coverage, complaining to a reporter that the affair had unfairly made it “politically incorrect to be offshore.”

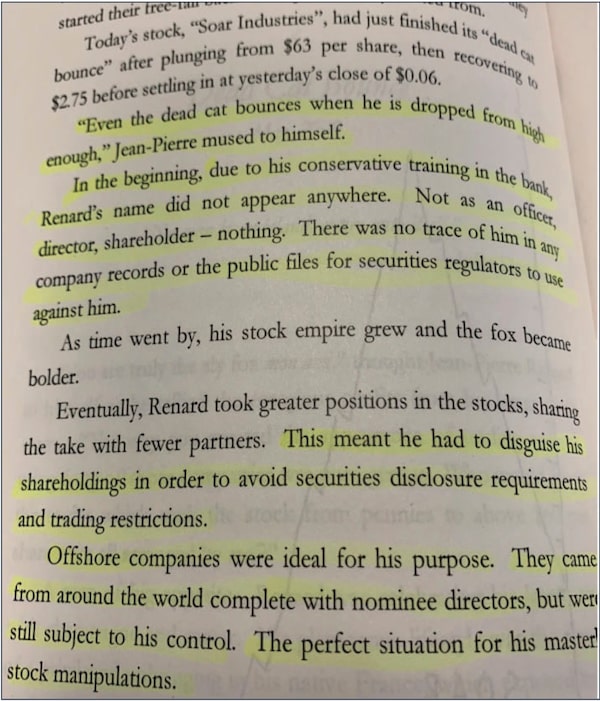

The 69-year-old’s passion for moving money abroad has even inspired artistic side projects: He wrote a novel that includes a fictional character who uses offshore companies to perform “masterful stock manipulations,” and once acted in the lead role in a short film about an executive caught up in a massive securities fraud.

Last week, United States prosecutors alleged in court that these works are not entirely fictional.

In a criminal complaint unsealed on Aug. 9, the U.S. Federal Bureau of Investigation contended that Mr. Sharp and one of his Vancouver-based employees were part of a “sophisticated and lucrative securities fraud scheme” that generated illicit proceeds of tens of millions of dollars. He has been charged with securities fraud and a warrant for his arrest has been issued.

Investigators allege that Mr. Sharp, and one of his B.C.-based staffers, Courtney Kelln, 41, used a network of offshore companies to help company insiders – which includes directors and substantial shareholders – at various companies sell large amounts of stock without disclosing the sale, as required by securities law. One example cited by the FBI saw Mr. Sharp’s system allegedly help a majority shareholder sell millions of dollars of stock in Garmatex Holdings Ltd., which purported to be developing “scientifically engineered fabric technologies.”

Mr. Sharp allegedly outfitted these insiders with special encrypted Blackberry phones that communicated through a computer server housed in the Caribbean island of Curacao. In one electronic exchange of messages, Mr. Sharp allegedly assured a client that the services he offers are “comprehensive” and include “keeping clients out of jail.”

None of the allegations have been proven in court. Mr. Sharp could not be reached for comment.

The FBI’s complaint offers insight into the murky world of penny stock promotion and reveals how company insiders can take advantage of various jurisdictions, and technology, to dispose of millions of dollars of stock without informing regulators.

Canada and the United States have rigorous disclosure requirements for company insiders, as well as individual shareholders that hold large amounts of shares. This is so the investing public can see whether unscrupulous company executives, or other large stockholders, are selling their stakes while, simultaneously, proclaiming their long-term commitment to the companies they control. This transparency is supposed to act as a safeguard against insiders getting an upper hand and unloading overvalued shares on unsuspecting retail investors.

According to the FBI, Mr. Sharp’s system offered a complete workaround, one that likely would have gone undetected had investigators not seized four computer servers from Curacao containing, they say, “hundreds of thousands of messages” from his company’s phone network.

Large shareholders in various penny stocks – who are supposed to file forms with the U.S. Securities and Exchange Commission disclosing ownership of more than 5 per cent of a company’s registered shares – would divvy up their holdings among scores of offshore corporations with the help of Mr. Sharp and his staff, the FBI alleges. The distribution of these shares across so many companies – which the FBI refers to as “sham entities” – gave the false appearance of broad ownership, the criminal complaint alleges.

Court exhibit of a book written by Fred Sharp about a fictional swindler who uses offshore corporations to execute stock manipulations.Supplied

Mr. Sharp, the FBI alleges, provided holders of such stock with Blackberry phones that he referred to as “xPhones.” Mr. Sharp and Ms. Kelln also employed code names to refer to each other and their clients, investigators contend. Mr. Sharp, who allegedly had an affinity for James Bond spy movies, used the code name Bond, the criminal complaint states. That wasn’t the only 007 reference. Mr. Sharp’s proprietary accounting system, which tracked clients’ stock holdings and sales, was allegedly called “Q” – the same name as the fictional British spy who outfits James Bond with high-tech gadgets and vehicles.

Whenever these insiders secretly disposed of their shares, the FBI alleges, the trades usually coincided with a major promotional campaign designed to inflate the price of the stock – what is often referred to as a “pump and dump.”

One of the clients of Mr. Sharp, and who has also been charged criminally, is a former U.S. lawyer, Luis Carrillo.

According to investigators, Mr. Carrillo sold millions of dollars worth of shares in various penny stocks through Mr. Sharp’s offshore companies, without disclosing that he was the beneficial owner and seller of those shares.

One of the companies Mr. Carrillo allegedly targeted was B.C.-based Garmatex Holdings Ltd. According to the complaint, in 2017 Mr. Carrillo messaged two individuals who worked for a Switzerland-based based asset management company – both of whom have since become co-operating witnesses for the government – about a large sale of Garmatex stock. Those two witnesses also used the xPhone system allegedly offered by Mr. Sharp.

The FBI alleges that the witnesses helped Mr. Carrillo sell 7.2 million shares in Garmatex, or 50 per cent of the total amount of unrestricted securities, in less than two months without any disclosure of his beneficial ownership.

The authorities also allege that this sell-off, which resulted in proceeds of US$5-million, took place shortly after Mr. Carrillo launched a multifaceted promotional campaign designed to attract retail investors. This included the distribution of press releases highlighting Garmatex and its technology, as well as phone calls touting the stock to unsuspecting investors from an office in Medellin, Colombia – an operation often referred to as a “boiler room.” In fact, the FBI alleges, Mr. Carrillo messaged the co-operating witnesses in advance of the sell off, instructing them to have his shares “ready at the open” because he was “gonna drop that s---.”

The scope of Mr. Sharp’s alleged operation is unclear. The Q accounting records seized by the FBI show that from 2014 to 2018, Mr. Sharp’s offshore companies traded stock in 70 different issuers through the Swiss asset management firm, resulting in total proceeds of US$140-million.

As for how much Mr. Sharp profited, the FBI alleges that he directed his proceeds from the scheme to an offshore company called Cortona Equity Inc. One of the co-operating witnesses described this as Mr. Sharp’s retirement fund, and records seized by authorities show that between 2017 and 2018, US$6.8-million flowed to Cortona. On paper, Cortona is registered to an individual who investigators allege is the tennis coach of Mr. Sharp’s wife.

In a parallel civil court action, the Securities and Exchange Commission is suing Mr. Sharp. That lawsuit alleges that an Indian-Canadian doctor, Avtar Dhillon, used Mr. Sharp’s offshore system to illegally sell the stock of two publicly traded companies, Vitality Biopharma Inc. and Arch Therapeutics, Inc., while he was serving as the companies’ chairman.

Mr. Dhillon could not be reached for comment.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.