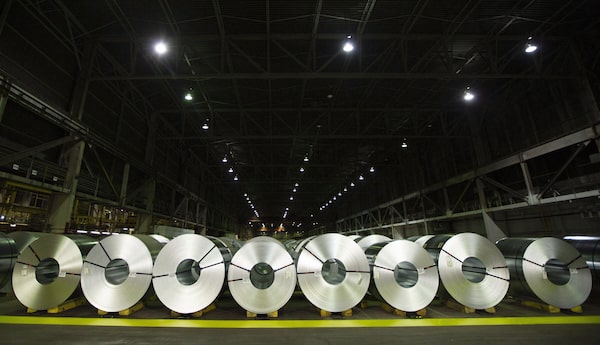

Stelco went into this crisis with the luxury of $232-million of cash, no debt and a balance sheet that analysts say is strong enough to weather the storm - even with the extra expenses.Peter Power/The Canadian Press

Around the globe, steel makers are coping with the pandemic by slashing capital spending.

With sales in free fall, Europe’s ArcelorMittal S.A. cut planned investments by US$800-million last week, a 25-per-cent trim, while United States Steel Corp. recently chopped $125-million out of its budget, a 14-per-cent reduction. Meanwhile, Japan’s Kobe Steel Ltd. ratcheted down spending by a third.

Alan Kestenbaum is taking the opposite approach at Stelco Holdings Inc., despite being chief executive of a business that’s gone bust twice in the past two decades. He’s hiked spending on the Hamilton-based company’s facilities. In the midst of a global downturn, Mr. Kestenbaum decided to make a $110-million wager on a rebound in North American manufacturing and construction.

If he’s made the right call, Stelco will head into next year as North America’s most efficient steel maker. If the 56-year-old CEO has got this wrong... Well, Stelco went into this crisis with the luxury of $232-million of cash, no debt and a balance sheet that analysts say is strong enough to weather the storm - even with the extra expenses.

“You have to have the audacity to spend money at a time like this,” Mr. Kestenbaum said in an interview from his home office in Miami. “I understand the instinct to say ‘let’s be cautious, let’s not spend money,' but we decided we had to spend on the things that really matter,” said the Brooklyn-born son of a Wall Street commodities trader.

Two things really mattered at Stelco when the COVID-19 crisis hit, beside keeping employees healthy. The first was the planned once-in-a-generation refurbishment of 35-year-old blast furnaces. The second was locking in a long-term supply of iron ore, a key raw material. Stelco’s existing iron ore contract expires in 18 months. Completing the two projects is central to Mr. Kestenbaum’s strategy of making Stelco a low-cost North American producer. The goal is a steel company able to make money during even the low points in the cycle of an industry known for its deep valleys.

Rather than simply maintain its furnaces – a process known as relining – the CEO wanted to update them with the latest technology. Prior to the COVID-19 outbreak, Stelco executives toured European and Asian steel mills and equipment manufacturers. They compiled a 13-point plan to dramatically upgrade Stelco’s operations on Lake Erie, near Nanticoke, Ont., potentially adding 300,000 tons a year of steel-making capacity, a 13-per-cent increase in the company’s overall production.

When COVID-19 began shutting down North American manufacturing in March, Stelco had already sunk $35-million into the furnace upgrade. It will take another $85-million to complete the job. Mr. Kestenbaum said the company had three choices: postpone the work, do a low-risk partial upgrade or move forward with the whole job. The middle option would have cost just $30-million but only produced half the increase in capacity and would have needed to be revisited within five years. The CEO went for door number three, a decision rooted in three decades of building successful industrial companies on the back of someone else’s mistakes.

Mr. Kestenbaum started his career as a commodity trader at global mining company Glencore PLC, then struck out in his own in 1985. Bankrolled in part by his father-in-law, a former Wall Street executive, he founded a company called Marco International Inc. that shipped aluminum from producers in South America, Romania and Russia. Then he bought a second business out of bankruptcy, Globe Specialty Metals, and built it through the acquisition of a series of troubled companies before cashing in 2015 as part of a US$3.1-billion merger.

The experience gave Mr. Kestenbaum an approach – avoid debt and be bold in tough times – that he brought to Stelco after his private equity firm, Bedrock Industries Group LLC, acquired the company out of creditor protection in 2017. It also gave the steel tycoon the cash needed to join one of the world’s most exclusive clubs: He is part owner of the National Football League’s Atlanta Falcons.

To feed iron ore into those upgraded furnaces, Stelco used the current downturn to strike a US$600-million supply deal with U.S. Steel. The contract, announced at the end of April, locks in supply for eight years and gives Stelco the option of buying a 25-per-cent stake in a massive iron ore mine in Minnesota. Stelco put down just US$20-million to strike the deal. It owes another US$80-million over the next eight months, then US$500-million if it chooses to close the transaction next year.

Stelco opted to go forward with the full furnace rebuild, a 75-day process scheduled to take place this fall, and sign the long-term iron ore deal partly because Mr. Kestenbaum is relentlessly optimistic and partly because Stelco customers are snapping up steel, despite the economic downturn. The CEO says a nimble sales force, largely working from home, found new clients in sectors such as construction when demand from traditional sectors such as auto making dried up in March.

Stelco expects to operate at 100-per-cent capacity this quarter. Mr. Kestenbaum said employees moved swiftly to redesign work spaces, cafeterias and locker rooms to ensure they could work safely, but keep working. No Stelco employee is known to have contracted the novel coronavirus at work.

Bank of Nova Scotia analyst Michael Doumet said despite all the economic headwinds, Stelco is projected to post $9-million in earnings before interest, taxes, depreciation and amortization in the current quarter. This, in a time when most steel makers will be losing money and idling facilities. “While we acknowledge the name isn’t for the faint of heart, we believe the shares offer an attractive risk/reward,” Mr. Doumet said.

Looking ahead, Mr. Kestenbaum is confident the political winds are blowing Stelco’s way. The company was rocked by 25-per-cent tariffs that U.S. President Donald Trump slapped on Canadian steel and aluminum makers during recent trade negotiations. With those tariffs now history, Stelco’s CEO said the United States-Mexico-Canada Agreement holds the potential for greater demand from automakers, pipelines and appliance companies that need to use more North American-produced steel to meet government regulations. Mr. Kestenbaum said he also expects to see a renaissance in domestic manufacturing, as companies revisit global supply chains and outsourced operations in the wake of the pandemic.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.