The Shopify office in Toronto on Feb. 12, 2020.Chris Donovan/The Globe and Mail

Stores on Shopify Inc. SHOP-T shut down or left the e-commerce platform at an increasing rate in each of the past three years, with just 34 per cent of stores surviving a full year on average, according to a Globe and Mail analysis, showing the company is facing a growing problem with customer retention.

Ottawa-based Shopify provides tools to set up and operate online stores, and has quickly become the leader in its field. Shopify is one of the easiest platforms on which to launch an e-commerce business, and the company attracts a high volume of new store sign-ups. That has helped to boost Shopify’s business, but analysts have long noted it obscures the underlying long-term success rate of the company’s customer base.

Shopify has faced criticism over the years for a suspected high rate of customer losses – or churn – but it has never publicly disclosed survival rates of its stores.

The surge in the company’s store volume became even more pronounced during the COVID-19 pandemic. The number of Shopify stores exploded as lockdowns drove many traditional small businesses to pivot to online sales, and wider economic shocks powered a wave of budding entrepreneurs to try e-commerce ventures for the first time.

But new data show many of those stores did not last.

The Globe analyzed data from more than five million online stores that used Shopify’s technology and looked at how long they used the platform. Among the findings is that the average store that opened in 2021 lasted just 143 days, down from 220 days in 2019, meaning stores shut down or left Shopify at an increasing pace over that time. Merchants who paid for a Shopify Plus account – an enterprise option with more features – had a substantially higher survival rate.

The data support the wider view, acknowledged by Shopify leaders themselves, that the e-commerce boom that exploded in the first two years of the pandemic has proven to be unsustainable. Hundreds of thousands of would-be entrepreneurs discovered that setting up an online business is the easy part. Keeping it going and making money is much harder.

The data also show Shopify’s customer survival rate is substantially lower than its rivals, raising questions about how it can maintain its long-term dominance in the crowded e-commerce industry.

“One of the core things Shopify does is both a blessing and a curse,” said Rick Watson, chief executive of RMW Commerce Consulting, an e-commerce consultancy firm based in New York. “Because while it keeps the cost of entrepreneurship down, doing so doesn’t mean that the quality of merchants is going up.”

According to Shopify’s annual reports, it had “over one million merchants” as of Dec. 31, 2019; about 1.7 million as of Dec. 31, 2020; and about 2.1 million as of Dec. 31, 2021. (Shopify refers to stores as “merchants” in its annual report, but the company does not track the number of unique people behind those stores, and one person can set up multiple stores.)

The increase in merchants was consistently cited as a major reason for the company’s revenue growth during the pandemic, according to Shopify’s financial reports. From US$1.6-billion in 2019, Shopify’s revenue jumped by 86 per cent to US$2.9-billion in 2020 and increased a further 57 per cent in 2021 to US$4.6-billion. But so far in 2022, growth has slowed sharply.

For The Globe’s analysis of Shopify data, journalists worked with Lochside Software Inc., a Victoria-based tech company, which operates a database of e-commerce stores called Store Leads. The database is built by collecting information from the Domain Name System, a central internet repository of domain names akin to a constantly-changing digital phone book.

Store Leads has done a weekly snapshot of that phone book since 2019 and logged domains that contain data indicating they were set up through e-commerce platforms. According to The Globe’s analysis of Store Leads data, 1.2 million Shopify domains were set up in 2019, 1.8 million were set up in 2020 and 1.6 million were set up in 2021.

The Globe then performed a survival analysis on the database by writing a computer script that tracked the lifespan of domains on Shopify from January, 2019, to July, 2022. The analysis indicated the median survival time for a store – or the length of time after which only half of stores were still active – was 220 days for stores that registered in 2019, 164 days in 2020 and 143 days in 2021.

For stores that signed up in 2019, 36 per cent survived a year, and for 2020 stores, 34 per cent survived. For 2021 stores, 32 per cent were likely to survive a year. (Not all 2021 stores had a full year to be open because of the date cutoff in the data, and The Globe’s statistical modelling accounted for this.) In other words, Shopify’s stores have been closing or leaving the platform faster in recent years.

This pace of closings is also much faster than in the wider economy. According to a federal government study of 2001 to 2018 data, 92 per cent of businesses with one to four employees survived their first year; half survived eight years. In fact, according to Statistics Canada, businesses were actually less likely to close during most of 2020 and 2021 than the years before, a finding many economists credit to pandemic aid propping up businesses.

In a statement to The Globe, Shopify communications manager Jackie Warren said the company has kept “the cost of failure so low” that more individuals are able to try their hand at entrepreneurship. She said Shopify knows “many businesses, or ideas, may not succeed for a variety of reasons the first time, the second time or even the 12th time.” Shopify is able to provide businesses their start with reduced barriers, she said.

Shopify said The Globe’s data were different from the company’s internal numbers, but would not specify why that is or provide those figures.

“While we do not share specific proprietary data, we can tell you that the churn analysis is drastically different from our own and the conclusions drawn are false,” Ms. Warren said. “We encourage extreme caution when using third-party data as it is often inaccurate and incomplete.”

Tom Forte, managing director and senior research analyst at D.A. Davidson, a Montana-based investment bank, who watches global e-commerce companies closely, reviewed The Globe’s analysis and said it was in line with his expectations based on his research. Mr. Watson from RMW Commerce Consulting agreed.

“The data is consistent with the long-held view about Shopify and e-commerce in general, in that some people will succeed at it and last longer on a platform, while others just simply won’t,” Mr. Forte said.

Customers using Shopify Plus, a premium extension to the e-commerce platform’s standard offerings, have a higher survival rate. For a higher pricing scheme, Shopify Plus provides additional features and support systems for merchants.

The extension has been geared toward large businesses with bigger revenues than the bulk of those that use Shopify’s platform. Companies and brands that use Shopify Plus include Staples Inc., Netflix Inc., Kraft Heinz Co., Buzzfeed Inc. and Fashion Nova. Shopify touts case studies on its website about how Shopify Plus has helped well-established businesses migrate from other platforms, such as WooCommerce, Oracle Commerce Cloud and Netsuite.

Shopify reported its Plus service accounted for 31 per cent of its monthly recurring revenue in its second-quarter earnings, the most recent it has reported this year.

According to The Globe’s analysis, from 2019 to 2021, the median survival time for a store operating on Shopify Plus was 646 days. The data suggest 62 per cent of the merchants on Plus make it beyond a year, a much higher survival rate compared with merchants who do not use Plus.

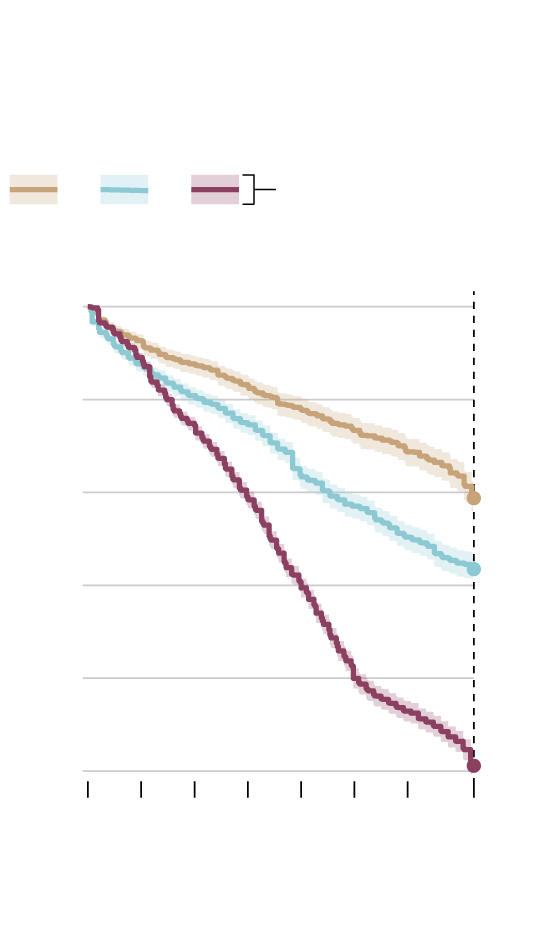

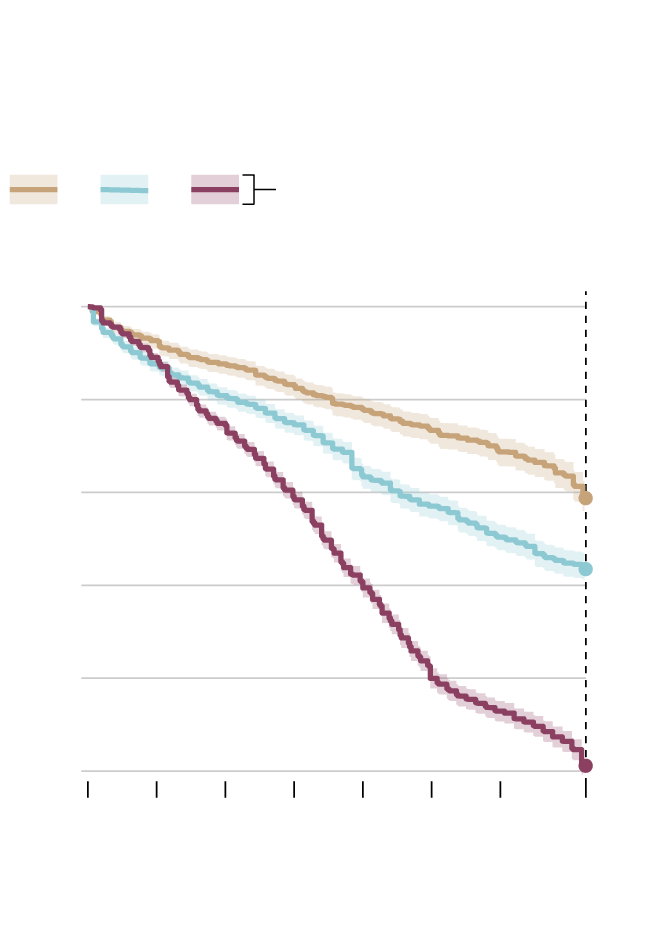

However, Shopify Plus customers are a relatively small share of the total – more than 14,000 as of the fourth quarter of 2021 according to Shopify – and the survival rate has been dropping. For Shopify Plus stores that opened in 2019, the survival rate was 80 per cent after a year; for 2020, that number was 72 per cent; and for 2021, the number was 51 per cent.

Percentage of Shopify Plus domains that survive

By number of days after sign-up

2019

2020

2021

95% confidence range

Survival rate

after one year

100%

90

80

80%

72%

70

60

50

51%

0

50

100

150

200

250

300

365

Days from sign-up

MURAT YÜKSELIR AND MAHIMA SINGH / THE GLOBE AND MAIL, SOURCE: GLOBE AND MAIL ANALYSIS

Percentage of Shopify Plus domains that survive

By number of days after sign-up

2019

2020

2021

95% confidence range

Survival rate

after one year

100%

90

80

80%

72%

70

60

50

51%

0

50

100

150

200

250

300

365

Days from sign-up

MURAT YÜKSELIR AND MAHIMA SINGH / THE GLOBE AND MAIL, SOURCE: GLOBE AND MAIL ANALYSIS

Percentage of Shopify Plus domains that survive

By number of days after sign-up

2019

2020

2021

Survival rate

after one year

95% confidence range

100%

90

80

80%

72%

70

60

50

51%

0

50

100

150

200

250

300

365

Days from sign-up

MURAT YÜKSELIR AND MAHIMA SINGH / THE GLOBE AND MAIL, SOURCE: GLOBE AND MAIL ANALYSIS

Mr. Forte said the trend is a concern because he expected the survival rate to be higher for Plus.

“The real question I have, when it comes to the churn associated with Shopify Plus, is how many of those merchants that leave are actually going to other platforms,” Mr. Forte said. “Because if large players are leaving your platform like that, they are not doing it because they are closing their doors. It’s probably because they don’t have a reason to stay with your platform any more.”

In 2016, Justin Blase, a web developer in Sioux Falls, S.D., launched his passion project: Ted’s Vintage Art. The family-owned business digitally restores vintage maps and makes prints on archival paper for customers.

Since it was his first online store, Mr. Blase went with an easy option to set it up: Shopify.

But over time, he found costs on the platform grew as his sales volume increased. This is because Mr. Blase needed access to new features called add-ons or apps, he said, which are made by third-party developers and appear on the Shopify App Store.

These add-ons charged Mr. Blase in addition to his subscription for Shopify. And fairly quickly, they became unaffordable for him.

“The No. 1 thing that it all comes down to for a small-business owner like myself is the cost of things,” Mr. Blase said. “And for us, the price was just too high for what we were getting with Shopify.”

That’s why, in 2019, Mr. Blase switched to a Shopify competitor, WooCommerce, an open-source platform with no fixed fees.

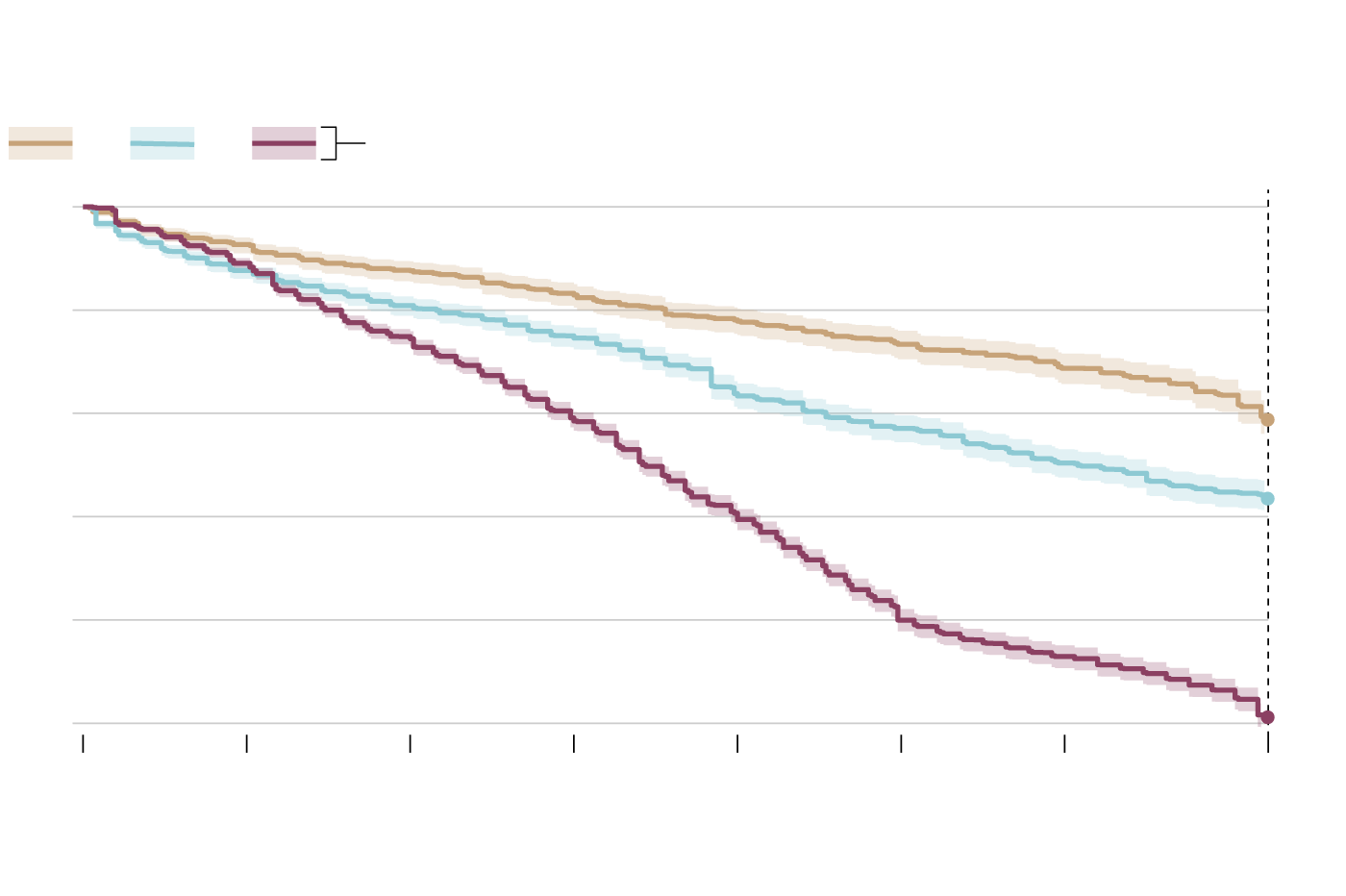

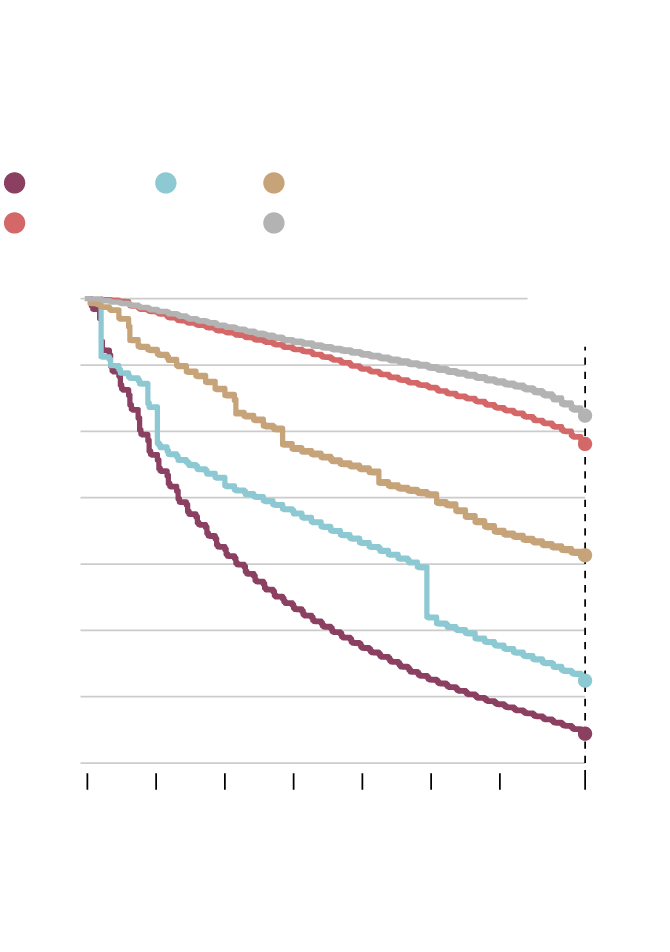

Shopify may be the biggest e-commerce platform for small businesses, but it isn’t the only one. In addition to its survival analysis of Shopify, The Globe also looked at how some of the company’s nearest competitors stacked up.

The analysis examined domain-name information for 5.4 million Shopify stores; 4.6 million WooCommerce stores; 2.1 million Wix stores; 400,000 Squarespace stores; and 200,000 Prestashop stores. The numbers showed other e-commerce platforms had substantially higher survival rates, meaning those merchants stuck around on those platforms far longer than stores do on Shopify.

E-commerce domain survival rates, by platform, 2019–2021

Percentage of domains that survive by number of days after sign-up

Shopify

Wix

Squarespace

WooCommerce

PrestaShop

Survival rate

after one year

100%

90

82%

80

78%

70

61%

60

50

42%

40

34%

30

0

50

100

150

200

250

300

365

Days from sign-up

MURAT YÜKSELIR AND MAHIMA SINGH / THE GLOBE AND MAIL, SOURCE: GLOBE AND MAIL ANALYSIS

E-commerce domain survival rates, by platform, 2019–2021

Percentage of domains that survive by number of days after sign-up

Shopify

Wix

Squarespace

WooCommerce

PrestaShop

Survival rate

after one year

100%

90

82%

80

78%

70

61%

60

50

42%

40

34%

30

0

50

100

150

200

250

300

365

Days from sign-up

MURAT YÜKSELIR AND MAHIMA SINGH / THE GLOBE AND MAIL, SOURCE: GLOBE AND MAIL ANALYSIS

E-commerce domain survival rates, by platform, 2019–2021

Percentage of domains that survive by number of days after sign-up

Shopify

Wix

Squarespace

WooCommerce

PrestaShop

Survival rate

after one year

100%

90

82%

80

78%

70

61%

60

50

42%

40

34%

30

0

50

100

150

200

250

300

365

Days from sign-up

MURAT YÜKSELIR AND MAHIMA SINGH / THE GLOBE AND MAIL, SOURCE: GLOBE AND MAIL ANALYSIS

Data from Store Leads also show how merchants switch between platforms. Those going to Shopify come from a variety of sources, but those going from Shopify are largely pointed in one direction: WooCommerce.

WooCommerce is an open-source platform that works in conjunction with WordPress, one of the most popular tools for building websites. Both pieces of software are free to use, though a small business will need to pay for and arrange its own hosting, website development and other services.

Unlike Shopify, WooCommerce does not take care of payment processing directly. Merchants have to work with other services, such as Square or Stripe, to handle payments from customers.

When it comes to setup, Shopify stores are expensive, but easier to get up and running. WooCommerce, on the other hand, offers a wider array of options, but requires expertise to put a store together.

Adii Pienaar, a South African entrepreneur who co-founded WooCommerce, said stores on that platform and PrestaShop – which have the highest survival rates – are exponentially harder to set up than competitors, so entrepreneurs who go down those roads tend to be very serious about their businesses.

“You probably see an inverse correlation between the ease of use and the survival rate,” he said.

Plenty of Shopify customers are happy with the service and are sticking with it.

Grant Broggi, who runs South Carolina-based The Strength Co., believes the benefits to using Shopify outweigh the costs he incurs.

When the pandemic hit in 2020, Mr. Broggi’s gym business found a new home on Shopify, a platform he used to sell manufactured barbells and plates. Add-ons such as Boxify, a Shopify app that helps with calculating shipping rates by analyzing the size, weight and quantity of products, have been “incredibly helpful beyond my basic subscription,” Mr. Broggi said.

“The reason why I’m such a Shopify fan is because I’m a barbell coach. Why do I need to be learning code?” he said. “It was so user-friendly, so easy to get things going. And now, here I am, just months or so later, with more than US$1-million in sales.”

This past summer, Shopify chief executive Tobias Lutke acknowledged the pandemic’s e-commerce boom had not proven as robust or resilient as he expected, which he said forced the company to slash about 10 per cent of its work force. Shopify’s previously hefty profits turned to an adjusted operating loss of US$41.8-million for the second quarter ended June 30, and the company warned of “materially” higher losses for the third quarter, to be reported on Oct. 27.

Mr. Pienaar, who left WooCommerce in 2013 and has since founded two more companies that support e-commerce stores (including those on Shopify) with sales and operations, said he is even seeing stores with revenue in the low eight digits struggle with the new reality. “The lift that everyone experienced isn’t there any more because the world is back to normal,” he said.

Still, Mr. Pienaar remains bullish on the long-term prospects of e-commerce.

“I think e-commerce as a whole will continue to grow,” he said. “Just not to the extent it did in the last two years.”