Lindy Haukedal, manager of the Circle K Bamble station in Norway, charges a car on Feb. 6.Nathan Vanderklippe/The Globe and Mail

One hundred and seventy-four kilometres from Oslo, on a snowy bank above the E18 expressway, the Circle K Bamble filling station serves up things Norwegian motorists have come to expect on a trip to the western fjords. Inside, the hot dogs are served with toppings of shrimp, potato salad and onion marmalade. The coffee is hot, the drinks cold and the shelves stocked with snacks.

Outside, there are plenty of pumps for gasoline and diesel – but also, beneath an elevated lightning-bolt sign, nearly three dozen spots designed to stuff electrons into electric vehicle (EV) batteries as fast as possible, some chargers equipped with liquid-cooled cables that can fling electricity in at a 300-kilowatt pace.

Sixty per cent of the customers who arrive here come for a charge, not a fill-up.

“The future,” says station manager Lindy Haukedal, gesturing toward the charging spots. “We have cars standing there all the time,” she adds. She nods toward the gas pumps. “But not so much there.”

It’s all been good for sales. A battery takes longer to fill than a tank, and as a result people buy more food, Ms. Haukedal said. “They will often take a burger with fries or a pizza instead of a hot dog. So that’s nice.”

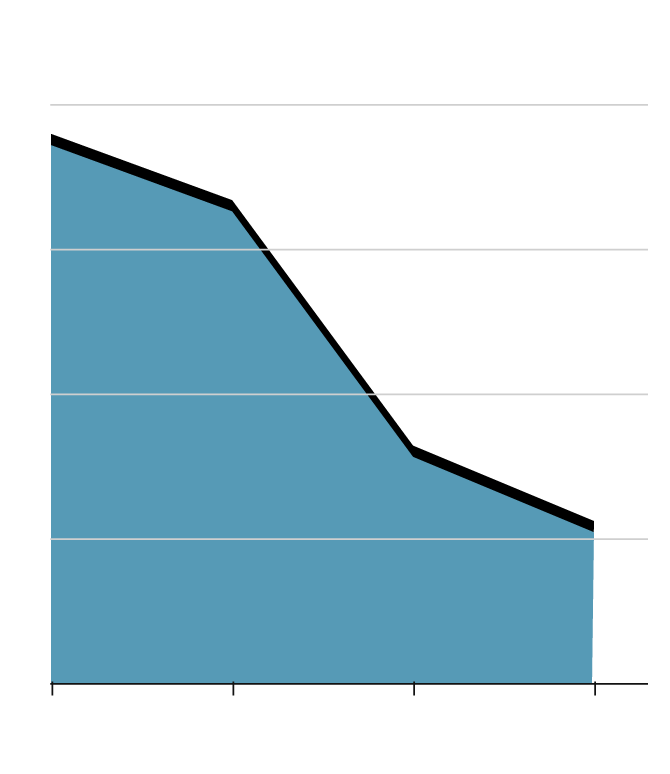

European gas station market in 2050

Evolution of gasoline and diesel volume sold between 2019 and 2050

-42%

Diesel

-21%

Gasoline

Reduction of fuel volume sold between 2019 and 2050

-42%

European average

Highest reduction

-63%

Sweden

Germany

-52%

European gas stations will close between 2020 and 2050

-43%

European average

the globe and mail, Source: sia partners

European gas station market in 2050

Evolution of gasoline and diesel volume sold between 2019 and 2050

-42%

Diesel

-21%

Gasoline

Reduction of fuel volume sold between 2019 and 2050

-42%

European average

Highest reduction

-63%

Sweden

Germany

-52%

European gas stations will close between 2020 and 2050

-43%

European average

the globe and mail, Source: sia partners

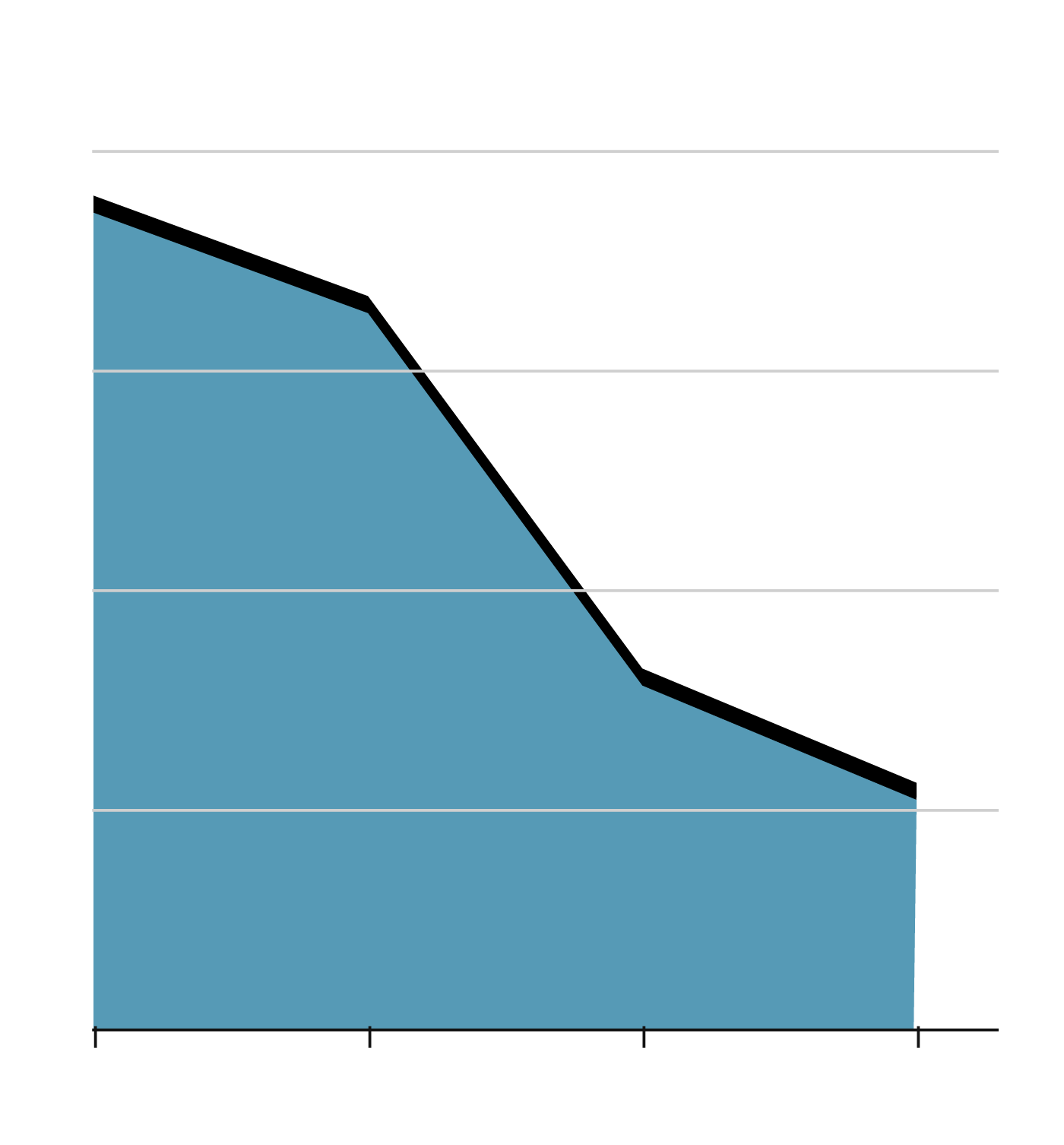

European gas station market in 2050

Evolution of gasoline and diesel volume sold between 2019 and 2050

-42%

Diesel

-21%

Gasoline

Reduction of fuel volume sold between 2019 and 2050

-42%

European average

Highest reduction

-63%

Sweden

-52%

Germany

European gas stations will close between 2020 and 2050

-43%

European average

the globe and mail, Source: sia partners

This vision of the future, unsurprisingly, is situated in Norway, a country with an unmatched enthusiasm for battery-powered cars. Last year, four in five cars sold in Norway were electric. Boosted by favourable tax policies and a government that has mandated 100 per cent zero-emission car sales by 2025, Norway has become the best place on Earth to peer into the dawning age of electric mobility.

That includes sculpting what it will look like to fill up for decades to come.

Circle K is owned by Laval, Que.-based Alimentation Couche-Tard Inc., the global convenience store and gas station giant, with more than 14,000 outlets in 24 countries and territories. The company has made Norway into an internal laboratory for the gas station of the electric age – or, as it is already dubbing them, energy stations.

If that notion conjures something with a science fiction flair, though, reality has so far been less scintillating, and the most pressing concerns more pedestrian, such as how to simplify payment and manage queues of cars with empty batteries. Circle K wants to make charging a car as simple as filling one.

At the moment “it’s easier to be a fuel customer than being an EV driver,” said Hakon Stiksrud, Circle K’s head of global e-mobility. Changing that is the “top one priority.”

Cars line up in two directions at a gas station in New York City, on Dec. 23, 1973. In the golden early days of U.S. motoring, gas stations were design landmarks, and remain a cornerstone of modern life.Marty Lederhandler/The Associated Press

The gas station, even redolent with fossil fuel fumes and occasionally plagued by plugged toilets, is a cornerstone of modern life, a place to launch a road trip, grab a late-night snack or meet a seller for an Internet marketplace purchase. In the United States alone, gas stations employ more than a million people, with estimated revenues this year of more than US$800-billion.

In the golden early days of U.S. motoring, gas stations were design landmarks, with buildings at some chains designed to look like English cottages, complete with landscaped grounds and pumps that became collectors’ items.

There was some “ceremony involved with going to fill up the car,” said Michael Karl Witzel, author of several books about historic gas stations. These days, gas stations are icons of a different sort, talismans of the age of convenience, where “you pull in real fast, get the gas and get out as fast as you can.”

Even so, they remain fixtures of the way we move. The Canadian Fuels Association counts one for every 3,200 Canadians, making them nearly as numerous as public schools.

Gas station market environment

Many service station sites may be unprofitable by 2035

SITES AT RISK

Scenario 1

Scenario 2

100%

25%-30%

45%-60%

Limited EV penetra-

tion results in only

a slight reduction in

gasoline demand

Internal combustion

engines still dominate,

but the rise of EVs cuts

gasoline demand by

nearly half

Scenario 3

Scenario 4

60%-75%

60%-80%

The rise of EVs and

other alternative

fuel vehicles causes

gasoline demand

to virtually disapear

The rise of EVs and

mass adoption of

shared autonomous

vehicles cause

gasoline demand

to virtually disappear

the globe and mail, Source: boston consulting group

Gas station market environment

Many service station sites may be unprofitable by 2035

SITES AT RISK

Scenario 1

Scenario 2

100%

25%-30%

45%-60%

Limited EV penetra-

tion results in only

a slight reduction in

gasoline demand

Internal combustion

engines still dominate,

but the rise of EVs cuts

gasoline demand by

nearly half

Scenario 3

Scenario 4

60%-75%

60%-80%

The rise of EVs and

other alternative fuel

vehicles causes

gasoline demand

to virtually disapear

The rise of EVs and

mass adoption of

shared autonomous

vehicles cause gaso-

line demand

to virtually disappear

the globe and mail, Source: boston consulting group

Gas station market environment

Many service station sites may be unprofitable by 2035

SITES AT RISK

Scenario 1

Scenario 2

Scenario 3

Scenario 4

100%

25%-30%

45%-60%

60%-75%

60%-80%

Limited EV penetra-

tion results in only

a slight reduction in

gasoline demand

Internal combustion

engines still dominate,

but the rise of EVs cuts

gasoline demand by

nearly half

The rise of EVs and

other alternative

fuel vehicles causes

gasoline demand

to virtually disapear

The rise of EVs and

mass adoption of

shared autonomous

vehicles cause gaso-

line demand

to virtually disappear

the globe and mail, Source: boston consulting group

But there is good reason to question whether the gas station’s economic and cultural stature is peaking. Governments around the world are prodding consumers to buy the battery-powered vehicles that have asserted a growing presence on dealer lots. Most EVs require no gas at all.

In 2019, Boston Consulting Group predicted that large parts of the current global network of fuel retailers “may be unprofitable in about 15 years.” Two years later, Sia Partners, a Paris-based management consultancy, predicted a 43 per cent decline in European gas stations by 2050.

Planners and designers around the world have already begun to think of ways to remake gas stations, or retire them altogether.

With the right political push, today’s diesel pump could be tomorrow’s park or affordable housing block in a city such as Los Angeles, suggests Russell Fortmeyer, global sustainability leader for Woods Bagot, an architecture firm. The land beneath the city’s hundreds of urban gas station sites could be used to “move the needle on issues that seem to just be intractable,” he said.

“This is a once in a lifetime opportunity to think about remaking the fabric of the city.”

As for the gas stations, “get rid of them,” suggests Kara Kockelman, a scholar of transportation engineering at the University of Texas at Austin, where she has written about future needs for charging infrastructure. “They are eyesores and they are toxic.”

Better, she suggests, to have charging posts “nested inside a community,” where drivers can shop, get a massage or even hike as their car charges. There is already a model for this. Tesla Inc.’s Destination Charging program has installed tens of thousands of plugs at hotels, malls and restaurants, in addition to speedier Superchargers it has built along major roads – some of them also at malls.

Gas station owners are in the unenviable position of owning “old-world” assets they don’t want to strand, Dr. Kockelman said.

The Circle K Bramble station with nearly three dozen charging stations on the E18 expressway in Norway, on Feb. 6. Even though EVs have dominated car sales since 2020, Norway’s oil consumption has fallen just 7 per cent.Nathan Vanderklippe/The Globe and Mail

But adding charging to stations is not always simple. Regulations in some places, such as the state of Georgia, block third parties from reselling electricity unless they are themselves power companies. Elsewhere, businesses are charged based on their peak power draw in a billing cycle – peaks that could rise to expensive new levels if gas stations deliver electricity to power-hungry cars.

“Is there a business model for retailers to get into this? Yes,” said Jay Smith, executive director of the Charge Ahead Partnership, a new advocacy group representing U.S. service stations that want to add EV charging. “But it requires us getting past these barriers.”

He argues that drivers are better served when they have access to well-lit service stations that offer food and a measure of safety around the clock.

But even that model may struggle to compete against what might be called domestic competition. In Norway, 82 per cent of EV drivers charge their cars at home, where rates are much cheaper than the prices charged by the operators of fast chargers. Most of the country’s EV drivers use a gas station charger only once a month, The Norwegian Electric Vehicle Association has said.

For gas stations, “the heart of the challenge is as electric vehicles become a bigger part of the fleet, fuelling occasions will be replaced with charging occasions. And charging occasions are more likely to happen at home than anywhere else,” said Mark Petrie, a Canadian Imperial Bank of Commerce analyst who covers Couche-Tard.

Why the future of Taiga Motors, one of Canada’s brightest EV startups, remains fraught with risk

EVs are unlikely to propel a precipitous fall in gasoline sales. Even though EVs have dominated car sales since 2020, Norway’s oil consumption has fallen just 7 per cent.

And even as fuel volumes fall, retailers may be able to replace some revenue simply by raising their margins. In the early stages of the COVID-19 pandemic, over the 12 months that ended Jan. 31, 2021, Couche-Tard reported a 21 per cent decline in U.S. fuel volumes, but a 23 per cent increase in gross profit on U.S. fuel, Mr. Petrie noted.

Circle K operates the largest network of charging stations in Norway.Nathan Vanderklippe/The Globe and Mail

Electrification of the world’s roads nonetheless raises existential questions for retailers whose main business has been built around selling gasoline. Little wonder that Couche-Tard is hoping to learn from Norway.

The effort has brought the company into a maze of new opportunities and pitfalls, with a myriad of openings for novel lines of business and complicated decisions about which are worth pursuing.

“This is a new value chain,” says Hans-Olav Hoidahl, Couche-Tard’s executive vice-president of European operations, one that ranges from electricity production to selling to users at home, at work, at the mall and on the highway. “This is a learning curve that we are currently still on, and will be on for some more years,” he said.

The main question is where, exactly, the company can profitably touch electrons, and Circle K has spent the past few years saying yes to all sorts of possibilities. It has begun selling electricity to homes (Norway’s power market is deregulated). It has installed domestic and office chargers. It has built its own highway charging stations and partnered with Tesla and others, allowing competitors’ chargers onto its own properties.

The company has also experimented with batteries, storing electricity when rates are cheap and using that to charge vehicles when power grid rates are high. Those batteries could even be mobile, to provide power away from the station.

Evolution of gas stations in Europe

Number, in thousands

140

130

120

110

100

2007

2012

2017

‘20

the globe and mail, source: sia partners

Evolution of gas stations in Europe

Number, in thousands

140

130

120

110

100

2007

2012

2017

‘20

the globe and mail, source: sia partners

Evolution of gas stations in Europe

Number, in thousands

140

130

120

110

100

2007

2012

2017

‘20

the globe and mail, source: sia partners

Couche-Tard does not claim pat answers. But it has begun to winnow its thinking. It has no interest in electricity generation or in the electrical grid. It has found that companies appreciate being able to deal with one charging provider that can help with billing for multiple drivers.

With individual customers, meanwhile, it is finding that a strong connection matters – whether that’s by collecting data to better cater services, or merely in the relationships store staff build with customers who come in regularly to charge.

The company has also discovered that it’s best not to move too quickly, lest it install charging technology that either isn’t yet needed or is eclipsed by new advances. The company is moving at a restrained pace in North America, where it has promised to add charging at 200 locations over two years, across a region where it has 9,000 stores.

Most importantly, Couche-Tard has determined that when it comes to electric cars, familiarity wins. You could even call it boring: In some of its stations, gas pumps have simply been replaced by chargers. Cars move in and out the way they always have. That, at least, is the company’s goal.

“We have to match the fossil fuel experience,” says Pal Heldaas, director of Europe communications for Circle K.

He recalled a conversation with one of the company’s marketing managers about an advertising campaign featuring food for EV drivers. It would be good, Mr. Heldaas thought, to project an image of health and sustainability. Perhaps a salad with some sparkling water?

The marketing manager shot him down, saying: “Do you think people change their eating habits when they change from diesel to electric?”

Similarly, when Circle K looks at the locations of its existing gas stations, “mostly I would say these are the right places to put an EV charger,” says Mr. Hoidahl.

“A fuel station in many ways has the same needs as you have with EV, in regard to how they look, the size of them.”

In other words, Circle K’s vision of the gas station of tomorrow does not look terribly unlike the gas station of today.

There is, of course, a major difference: time. Filling a gas tank takes a few minutes. Drivers usually take nearly half an hour to charge a car. The wait tends to prompt people to wander.

Circle K hopes they will come into its own convenience stores. In some locations, “double the number of consumers go into the store,” relative to those filling up with gas, Mr. Hoidahl said. Where possible, providing more seating for customers can also help.

An EV charges at a Circle K station in Norway. While filling a gas tank only takes a few minutes, EV drivers usually take nearly half an hour to charge a car.Nathan Vanderklippe/The Globe and Mail

At the beginning, EV charging tended to be a money loser, even with subsidized chargers. Today, “the investment in EV chargers can be profitable in itself, without the sale of electricity on top of it,” Mr. Hoidahl said.

It has, of course, come with a fresh set of problems. How can a company ensure that its electronic systems communicate across different chargers made by different manufacturers, and allow customers a convenient way to pay across different charging options? Can charging posts be kept at the fringe of forecourts, or should they be built under cover, like gas pumps? Just how much will customers pay for the convenience of ultrafast charging at highway stations?

Already, Harald Lund, a Norwegian who has driven electric cars since 2014, estimates that the cost to fast-charge his Porsche Taycan sports car is nearly as high as filling an equivalent gas model with fuel. That’s part of the reason he does most of his charging at home, where prices are far more modest.

Podcast: Gas prices are soaring. Are electric vehicles an affordable solution?

But many drivers in Norway say their chief frustration lies in finding chargers when they need them. On holidays, you must go “early in the morning or late evening if you don’t want a big wait to charge,” Mr. Lund said. Any other time, and the lines can be long.

What the country needs is “more action in building new and bigger charging opportunities,” he said. Norway counts roughly 34 electric cars per public charger; the European Union recommends 10.

Electric vehicles charge on a street in Oslo, Norway in 2019. EV owner Chamara Weerasinghe says there are many charging stations in Oslo, but they are often occupied.JONATHAN NACKSTRAND/AFP/Getty Images

Chamara Weerasinghe has owned a battery-powered Nissan Leaf compact, runs several Facebook groups devoted to electric cars and works for a company that uses Circle K for charging, relying on its app to find free spots. But often a spot is taken by the time he gets there, a particularly vexing problem when cold temperatures erode car range and slow down charging times.

“There are so many charging stations inside Oslo, but every time I go to one, it’s full,” he said.

“Everyone says electric is the future but I’m not sure about that,” he adds. He’s begun to think “it’s better to buy a hybrid than an electric car.”

Indeed, of all the problems Circle K has sought to solve with its Scandinavian charging laboratory, figuring out how to manage queues has proven among the most vexing. Fights have broken out, and police have been called. Busy summer weekends can produce a form of EV charging chaos.

“We have discussed queuing since the beginning of the industry,” said Mr. Stiksrud. An app for reservations might make sense, but what about drivers who don’t use cellphones? How can providers satisfy customers who have no desire to reserve?

All of this will become even more important as cargo transport also electrifies, creating an obligation for service stations to assure availability lest drivers waste money waiting.

Circle K has started with a decidedly low-tech response: painting lines on the ground to indicate where to begin queuing. Some sort of reservation system will almost certainly be needed, Mr. Stiksrud said.

“But nobody has come up with the best solution for that yet.”