The Canada Energy Regulator's Energy Futures report projects a significant increase in power demand because of a shift toward heating Canadian homes and businesses with electricity, the widespread adoption of electric vehicles and the production of hydrogen using clean power.Darryl Dyck/The Globe and Mail

Canadians’ use of fossil fuels will fall by more than 40 per cent by 2050, according to a new report by the Canada Energy Regulator, driven largely by a move away from gasoline and diesel as consumers switch to electric vehicles and long-haul transport looks to hydrogen.

The regulator’s annual flagship Energy Futures report explores how new technologies and climate policy will affect Canadian energy consumption and production trends over the next 30 years. While it emphasizes Canada cannot meet its climate goals on it current path, critics say the CER needs to do more to outline how the country can reach net-zero emissions by 2050.

The report models two scenarios. The evolving policies scenario assumes that action to reduce greenhouse gas emissions will continue to increase at a pace similar to recent history, while the current policies scenario models limited action beyond policies that are in place today.

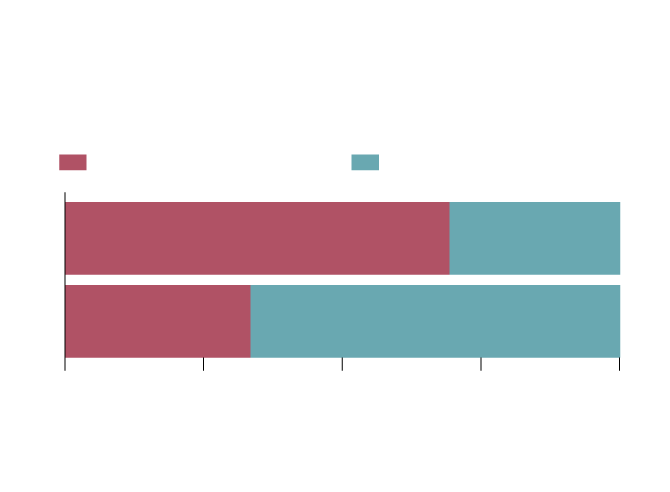

Total Canadian energy use,

evolving policies scenario

Per cent share in 2021 vs. 2050

Unabated fossil fuels

Low and non-emitting

2021

2050

0%

25%

50%

75%

100%

the globe and mail

Source: canada energy regulator

Total Canadian energy use,

evolving policies scenario

Per cent share in 2021 vs. 2050

Unabated fossil fuels

Low and non-emitting

2021

2050

0%

25%

50%

75%

100%

the globe and mail

Source: canada energy regulator

Total Canadian energy use, evolving policies scenario

Per cent share in 2021 vs. 2050

Unabated fossil fuels

Low and non-emitting

2021

2050

0%

25%

50%

75%

100%

the globe and mail, Source: canada energy regulator

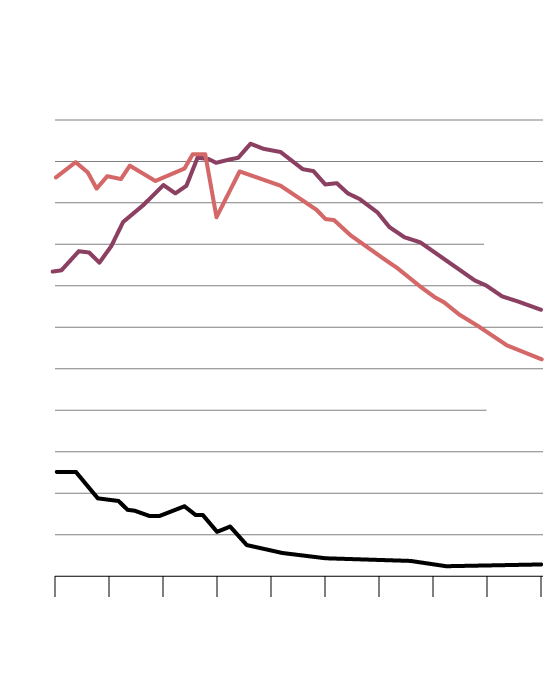

Fossil fuel demand by type,

evolving policies scenario

In petajoules

5,000

Natural

gas

4,000

3,000

RPPs and

NGLs

2,000

1,000

Coal

0

2005

‘10

‘15

‘20

‘25

‘30

‘35

‘40

‘45

‘50

the globe and mail, Source: canada energy regulator

Fossil fuel demand by type,

evolving policies scenario

In petajoules

5,000

4,000

Natural

gas

3,000

RPPs and

NGLs

2,000

1,000

Coal

0

2005

‘10

‘15

‘20

‘25

‘30

‘35

‘40

‘45

‘50

the globe and mail, Source: canada energy regulator

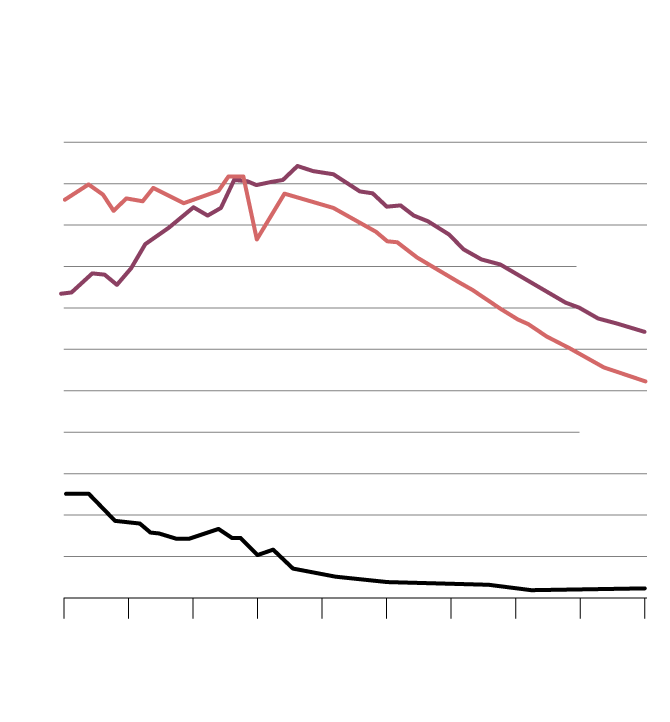

Fossil fuel demand by type, evolving policies scenario

In petajoules

5,000

Natural

gas

4,000

3,000

RPPs and

NGLs

2,000

1,000

Coal

0

2005

‘10

‘15

‘20

‘25

‘30

‘35

‘40

‘45

‘50

the globe and mail, Source: canada energy regulator

Oil production remains relatively stable under the assumptions in the report, but grows more slowly than in the past decade. In the evolving policy scenario, production rises 16 per cent to a peak of 5.8 million barrels a day in 2032. It then declines, but remains resilient despite increasingly ambitious climate policies and relatively low assumed oil prices of US$40 a barrel by 2050.

In the other scenario, production in 2050 is only about four per cent below today’s levels.

But as more crude becomes available for export, Canada’s ability to get it to market will be tested. Pipeline systems – even with their planned expansions – and rail lines will be jammed with oil into the mid-2030s, exceeding capacity altogether under the current policy scenario.

Canadian oil output to peak seven years sooner than previously forecast, energy regulator says

While there’s more wiggle room under the evolving policy scenario, production will still take up more than 94 per cent of transport capacity until mid-2030.

“By historical standards, it’s extremely full. And so that doesn’t provide a lot of flexibility for upsets in the system for things like maintenance, or if production goes a little bit higher, or if there are any surprises in terms of capacity of existing pipeline systems,” said Darren Christie, the regulator’s chief economist.

The report doesn’t delve into world oil demand projections, but notes that Canadian production levels will hinge on global climate policies.

On the natural gas side, the evolving scenario has production gradually declining to 13.1 billion cubic feet per day by 2050, about 17 per cent lower than current levels. British Columbia will increase its share of production, overtaking Alberta as the top natural gas producer in 2028.

It’s not just fossil fuel demand that is set to decrease. Total energy demand in Canada will fall by more than 20 per cent by 2050 under the evolving policy scenario, with more than two-thirds of it met by low- and non-emitting sources (up from one-third today).

Will Alberta squander a $61-billion cleantech opportunity?

Global energy transition could be a $61-billion opportunity for Alberta, new study finds

Much of the heavy lifting on emissions reduction will be done by carbon capture, utilization and storage projects, which force CO2 emissions deep into the ground to keep them out of the atmosphere.

Under the evolving scenario, fossil fuel use where emissions are not captured is projected to fall by 62 per cent in the next 30 years. By 2050, roughly half of all natural gas usage is tied to carbon capture and storage projects.

Mr. Christie said the report signals the need for more changes to Canada’s energy mix to reduce emissions to zero by 2050, but environmental groups say it should have gone further.

The Climate Action Network, a coalition of 130 groups across Canada, argued the CER should have looked to the International Energy Agency’s Net Zero by 2050 road map, released in the spring. That report modelled scenarios that assume global oil demand has already peaked.

Nichole Dusyk, a senior analyst at the Pembina Institute think tank, agreed the CER should have included a third scenario to help guide Canada on its path to net zero.

“It shows us almost a cautionary tale in terms of where we’re headed and that we need to go somewhere different. Where it fails is it doesn’t show us the other path that we actually want to take,” she said in an interview.

She also said that the report doesn’t align with federal government policies, including a pledge to get Canada’s power grid to net-zero emissions by 2035.

The report did, however, include a deep dive into electricity. And, despite the drop in total energy demand under the evolving policy scenario, it projects a significant increase in power demand because of a shift toward heating Canadian homes and businesses with electricity, the widespread adoption of electric vehicles and the production of hydrogen using clean power.

Power generation also gets significantly less carbon-intensive, with 95 per cent of it coming from low- and non-emitting sources by 2050 – up from 82 per cent today.

At the same time, the report highlights the need for more cross-provincial power transmission, particularly in Western Canada.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.

Emma Graney

Emma Graney