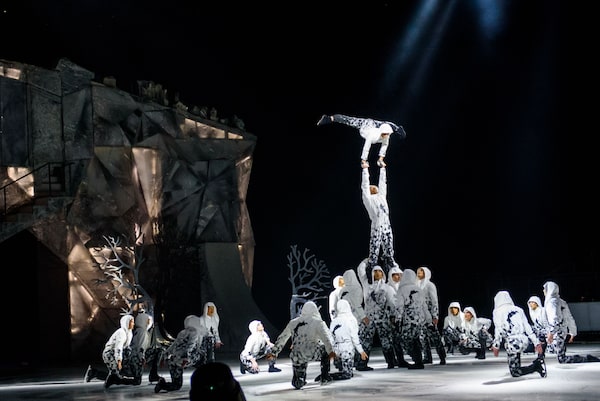

In this file photo taken on Jan. 15, 2020 Canadian circus troop Cirque du Soleil performs in their acrobatic performance on ice titled CRYSTAL at Arena Riga, Latvia.GINTS IVUSKANS/AFP/Getty Images

Lenders holding most of Cirque du Soleil’s $1-billion in secured debt will not accept a bid for the insolvent company launched by shareholders this week, and say they will oppose any proposal that does not offer them full payment.

In a court filing, the group of secured creditors, which is made up mostly of U.S. and Canadian private equity firms, said it had been in discussions with Cirque du Soleil about launching its own offer that would protect their investment, and were surprised by the deal announced this week by its current owners and the Quebec government.

TPG Capital LP, China-based Fosun Capital Group and the Caisse de dépôt et placement du Québec have offered to inject US$300-million to restart the entertainment company, while paying lenders a fraction of what they are owed. The shareholders made the offer as Cirque du Soleil, its finances hammered by the novel coronavirus pandemic, filed for bankruptcy protection on Monday.

The lenders would receive US$50-million in cash, US$50-million in new, unsecured bonds and a 45-per-cent equity interest in the operation. Cirque said the restructuring values the entire company at more than US$420-million.

“The commercial reality is that there is no circumstance in which the [lenders] will consent to the proposed shareholder transaction or any other transaction that would see the secured lenders paid less than the full amount of the indebtedness owing to them in cash,” the creditors’ committee said in its filing. “As such, the proposed shareholder transaction is not executable.”

It added that until a better deal emerges, the lenders’ own bid is the only possible option.

On Monday, Cirque said that the TPG-led submission “was notably the sole fully documented and binding bid received, allowing the company to meaningfully advance toward an eventual restart by launching the in-court process immediately.” It is what is known as a stalking horse bid, which sets a floor for other offers in the sales and investment solicitation process being conducted by the court monitor.

The lender group asked the judge to hold off on deeming the TPG Group proposal the stalking horse bid, so the parties can negotiate a solution.

The TPG-led consortium proposes paying US$15-million to 3,480 Cirque performers and employees who were laid off when the company halted its performances, and an additional US$5-million for Cirque contractors who have not been paid for their services. The restructuring plan would see Cirque’s head office remain in Montreal, and the existing executive team remain in place.

The lender group includes Toronto-based Catalyst Capital Group Inc. and a number of U.S. debt funds such as CBAM Partners, BlueMountain Capital Management LLC and Thomas H. Lee Partners. It said it is supportive of a restructuring for Cirque. But it called the selection of the TPG group bid “flawed and unfair.”

Previously, the creditors had offered to swap about US$1-billion in debt for 100-per-cent ownership of the Montreal-based company. In their filing they said they had even agreed in recent weeks to increase their financing commitment from US$300 million to US$375 million before learning about the finalized shareholder bid.

An investment banker who is advising the first-lien debt holders said the lender group’s bid was superior and involved no government support. “We see no reason why they didn’t engage in negotiating a definitive agreement with our group and chose to enter into an agreement with the out-of-the-money equity holder TPG for a transaction that they knew their secured creditors had already rejected,” said Tuck Hardie at Houlihan Lokey in New York.

Officials with the TPG Group and Cirque were not available for comment on Thursday. In a statement this week, the TPG and its partners said they had worked with Cirque’s management to “preserve the long-term value of the business” with the aim of creating “a strong foundation from which the company can start to rebuild and reposition the brand for the future.”

With files from Andrew Willis

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.