Industrial land has become the top pick for commercial real estate investors as consumers increasingly rely more on e-commerce for everything from groceries to clothing.Jeff McIntosh/The Globe and Mail

Investment in Canadian commercial property hit a record $14-billion in the second quarter, as purchases of warehouses, land and apartment buildings soared.

Industrial property, land and multi-family housing was already coveted before the pandemic changed consumer behaviour, including forcing more people to shop online. That, in turn, has ramped up demand for warehouses, as well as land to build industrial properties such as distribution centres.

“COVID helped the industrial sector,” said Paul Morassutti, vice-chair of commercial real estate firm CBRE.

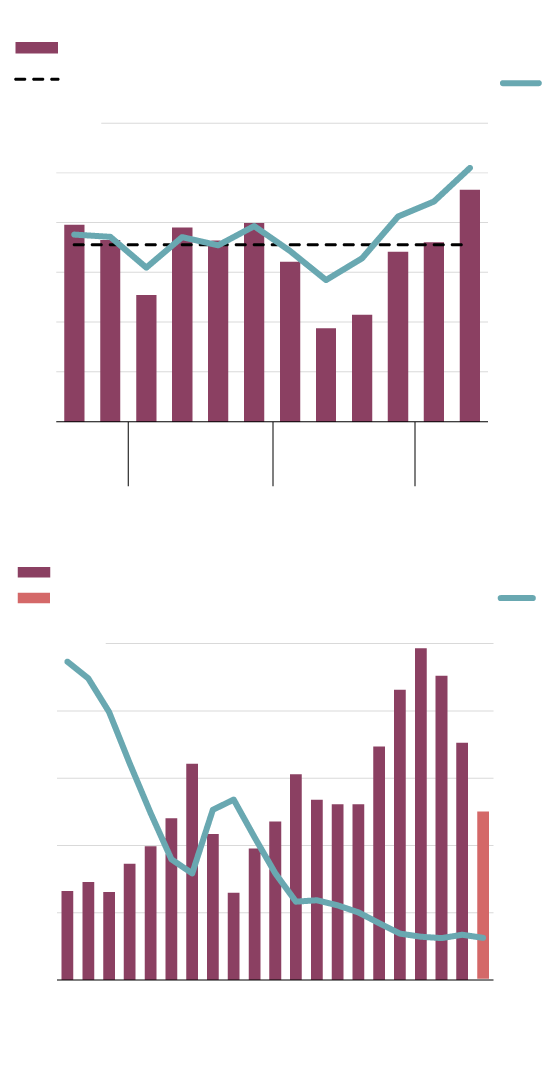

National investment activity by quarter

Investment volumes

Trailing 3-year average

No. of Transactions

$18-billion

3,000

15

2,500

12

2,000

9

1,500

6

1,000

3

500

0

0

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

2018

2019

2020

2021

Historical national investment activity by year

Investment volumes

H1 2021

National avg. cap rate

$50-billion

10%

40

9

30

8

20

7

10

6

5

0

2001

‘03

‘05

‘07

‘09

‘11

‘13

‘15

‘17

‘19

‘21

THE GLOBE AND MAIL, SOURCE: cbre

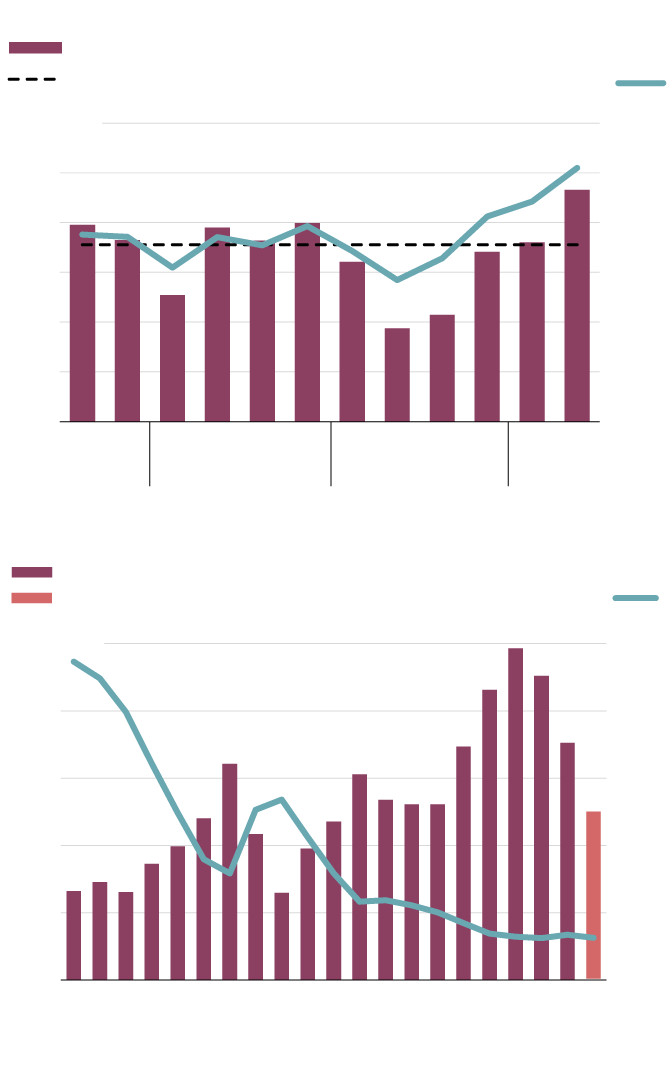

National investment activity by quarter

Investment volumes

Trailing 3-year average

No. of Transactions

$18-billion

3,000

15

2,500

12

2,000

9

1,500

6

1,000

3

500

0

0

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

2018

2019

2020

2021

Historical national investment activity by year

Investment volumes

H1 2021

National avg. cap rate

$50-billion

10%

40

9

30

8

20

7

10

6

5

0

2001

‘03

‘05

‘07

‘09

‘11

‘13

‘15

‘17

‘19

‘21

THE GLOBE AND MAIL, SOURCE: cbre

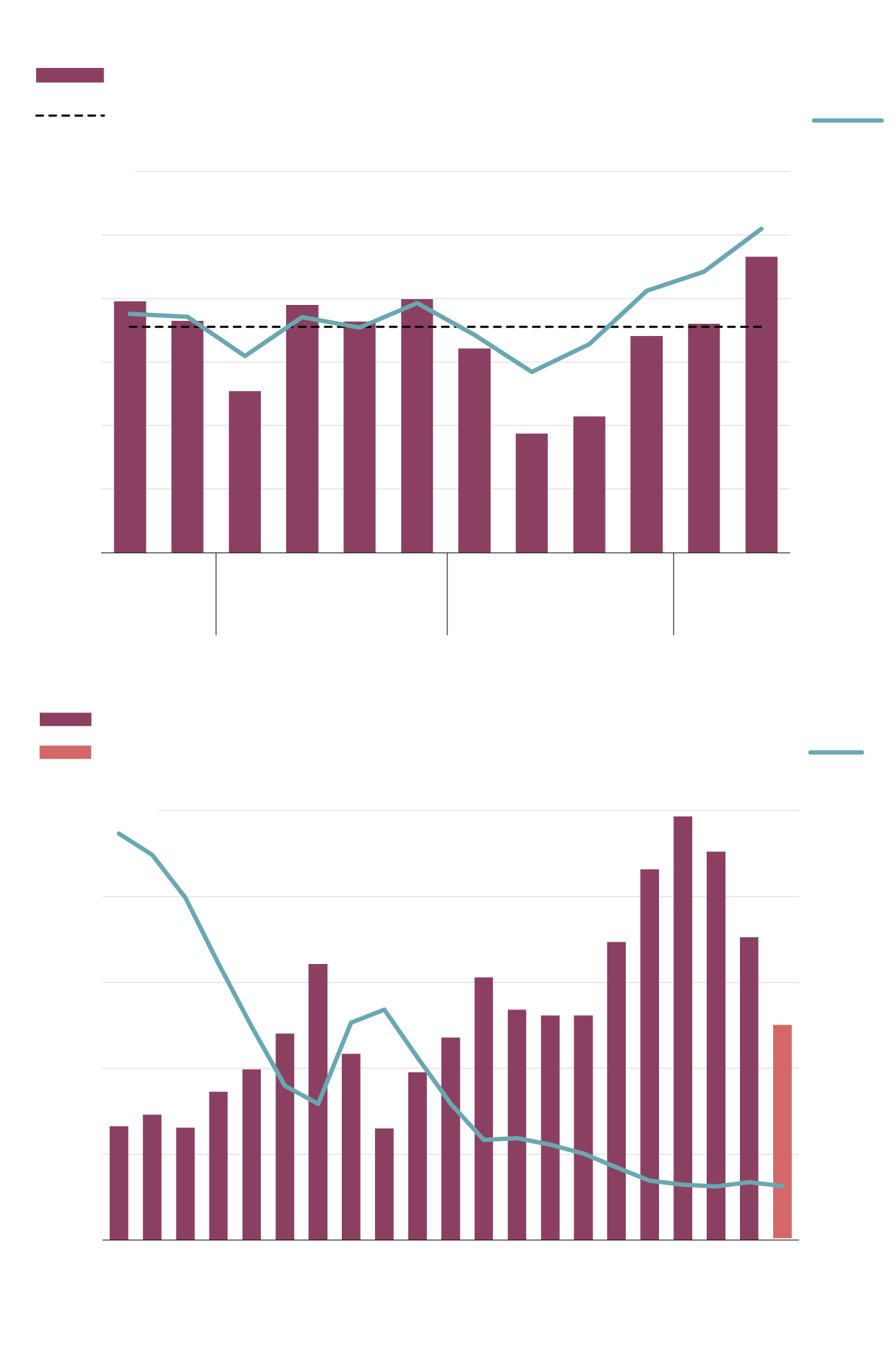

National investment activity by quarter

Investment volumes

Trailing 3-year average

No. of Transactions

$18-billion

3,000

15

2,500

12

2,000

9

1,500

6

1,000

3

500

0

0

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

2018

2019

2020

2021

Historical national investment activity by year

Investment volumes

H1 2021

National avg. cap rate

$50-billion

10%

40

9

30

8

20

7

10

6

5

0

2001

‘03

‘05

‘07

‘09

‘11

‘13

‘15

‘17

‘19

‘21

THE GLOBE AND MAIL, SOURCE: cbre

The second quarter’s investment figure is 29 per cent higher than the first quarter, and more than double the same period last year, when fears of an economic collapse halted most deal activity, according to new data from CBRE.

Combined with $10.8-billion in commercial property acquisitions in the first three months of the year, investment volume is on track to surpass the record $49-billion reached in 2018, when a large office deal helped push the number higher.

This year, wealthy Canadians, high-net-worth residents, as well as smaller development companies and private-equity firms, account for nearly half of the purchases. Real estate investment trusts, larger private-equity firms, pension funds and foreign investors were responsible for the remainder.

The top transaction was a $194.5-million purchase of 59 acres of industrial land in northern Toronto, followed by two other industrial land purchases in the Toronto region, according to CBRE.

Industrial land has become the top pick for commercial real estate investors as consumers increasingly rely more on e-commerce for everything from groceries to clothing. The pandemic accelerated the shift toward e-commerce, as restrictions on malls and other in-person retailers forced Canadians to shop online. Amazon and others are looking for more warehouse space near and en route to major urban centres to help deliver products quickly to homes.

“The e-commerce impact on warehousing and logistics had been playing out for many years. COVID accelerated it times 10,” Mr. Morassutti said.

Other large deals last quarter included Killam Apartment REIT’s $190.5-million acquisition of apartment buildings in Ontario’s Waterloo region, home to two universities and a tech hub. As well, purchases of industrial real estate, land and apartment buildings were top transactions in Vancouver, Edmonton, Calgary, London, Ont., Montreal and Halifax.

One commercial deal bucked the trend. Private-equity firm KingSett Capital purchased a $193-million shopping centre in Ottawa, even though malls had fallen out of favour with investors before pandemic restrictions required operators to temporarily close them to stem the spread of the virus.

Global real estate owners such as Ivanhoé Cambridge and Brookfield Asset Management have either divested or announced plans to shrink their portfolio of malls.

Office buildings have also lost their shine with the pandemic’s work-from-home mandates and slow return to offices. Even though tenants are paying their rent and some businesses such as Shopify Inc. and Amazon.com Inc. are expanding their office footprint in Canada, there is uncertainty over the future of office work. Large users of office space, such as banks and insurers, have said they will move to a more flexible work environment. It is unclear whether that means those office tenants will eventually need less space.

Mr. Morassutti said he believes investors will eventually come back to the office sector but said those buyers “would like to see physical occupancy in those buildings increase.”

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.