QuantoTech founder Alycia van der Gracht in one of their hydroponic units that use LED light to grow vegetables in Port Coquitlam, B.C., on Jan. 16, 2023.Jimmy Jeong/The Globe and Mail

It started with cherry tomatoes.

As a university student, Alycia van der Gracht would plant small pots of them on her apartment balcony. Over time, she added mini peppers and basil. But as the weather grew colder, she had to find a way to keep her little garden alive indoors. So she began experimenting with LED lights.

Fast-forward a decade, and Ms. van der Gracht has turned her hobby into a business. Her Vancouver-based company QuantoTech designs and manufactures vertical farms: LED lights, hydroponic systems and everything else needed to grow food indoors. She’s built a farm of her own as well, growing romaine and green lettuce out of an industrial warehouse in nearby Port Coquitlam.

Vertical farming is a business that’s quickly taken off – for Ms. van der Gracht, but also around the world. Globally, the industry is projected to be worth more than US$20-billion by the end of the decade. Its popularity makes sense in the context of the two urgent challenges facing our global food system: climate change, and feeding a growing population. Vertical farming produces large volumes of food using much less land or water and, crucially in a country such as Canada, it can do it predictably, 365 days a year, regardless of climate or geography.

“There’s no limit in the demand,” says Ms. van der Gracht, whose business recently received investments to expand significantly: up from 50 shelves in 800 square feet to 1,000 shelves in a new, 15,000-square-foot farm.

The indoor grow room at GoodLeaf Farms in Guelph, Ont. The popularity of vertical farming speaks to the prevalence two urgent challenges facing the global food system: climate change, and feeding a growing global population.NATHAN CYPRYS/The Globe and Mail

She’s set on locating the farm as close to Vancouver as possible. But it’s a decision that’s throwing up roadblocks. The few city spaces that are available are expensive, and municipal policies, she said, have created barriers, in part because her operation doesn’t fit the criteria for “farm.” On the flip side, if she goes the rural route, she’d face opposition from traditional farmers concerned about the changing face of agricultural landscape.

Ms. van der Gracht’s difficulties illustrate the challenges faced by players in Canada’s agtech industry – an increasingly popular term that encompasses the growing number of businesses using technology to improve efficiency in agriculture, from AI-powered crop sprayers to robotic dairy-milking systems.

Where do they fit in the larger food system – as food producers, or factories? And do they belong in cities or in the countryside?

“There’s been a bit of a culture war in food,” says Lenore Newman, director of the Food and Agriculture Institute at the University of the Fraser Valley.

Ultimately, the debate reconsiders the idea of farming altogether: What is a farm? And who gets to call themselves a farmer? On this, Ms. van der Gracht is clear: “I am a farmer.”

A head of butterhead lettuce grown in one of the QuantoTech hydroponic units.Jimmy Jeong/The Globe and Mail

‘Doing more with less’

Between October and December, lettuce prices skyrocketed. A head of romaine that earlier in the year might have cost $3 in Vancouver or Toronto was suddenly selling for double, sometimes triple that.

The simple explanation was impatiens necrotic spot virus, carried by tiny winged insects called thrips, which had devastated the Salinas Valley of California. There, 70 per cent of American leafy greens are grown, and an estimated 80 per cent of the year’s crop had been lost. And because Canada imports about 90 per cent of its leafy greens (much of it from California), prices here were affected too.

But a more complicated answer would also examine the fact that the Salinas region has seen major changes to its climate in recent years, which have combined to create the ideal environment for pests such as thrips. It would also take into account the COVID-19 pandemic, and its devastating effect on supply chains.

For years, experts have urged the importance of Canada increasing its local production and decreasing its reliance on imported food. But the country’s climate, which in many places allows for only a short growing season, has always presented a major hurdle.

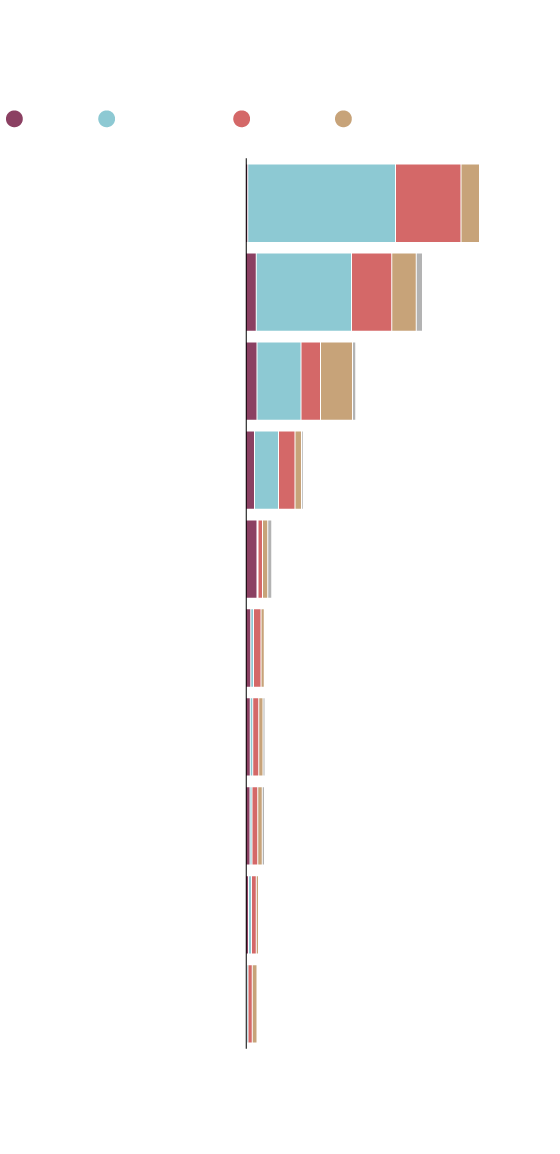

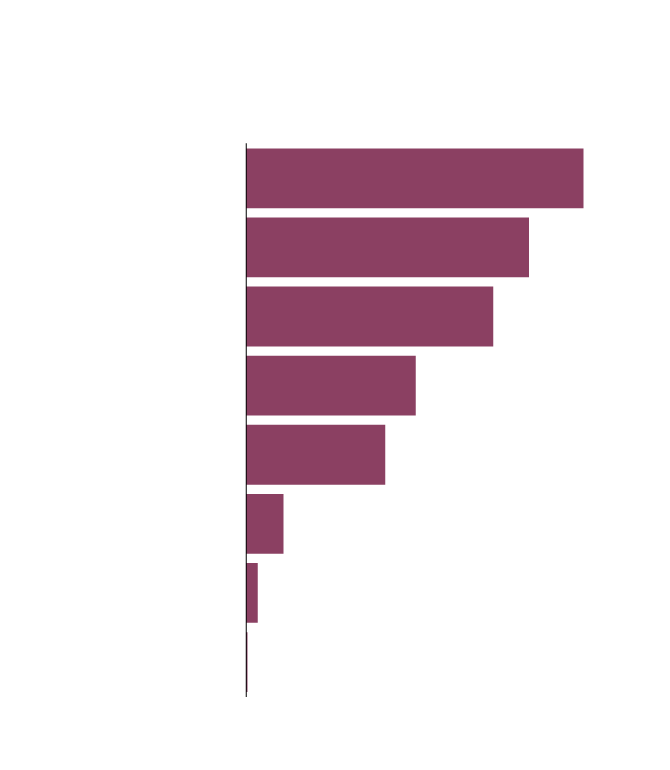

Number of farms in Canada in 2021,

by farm type and region

B.C.

Prairies

Ont.

Que.

Oilseed and grain

farming

65,135

Cattle ranching and

farming

49,036

Other crop farming

30,510

Other animal

production

15,873

Fruit and tree nut

farming

7,101

Poultry and egg

production

5,296

Greenhouse, nursery

and floriculture

production

5,256

Vegetable and

melon farming

5,076

Sheep and goat

farming

3,575

Hog and pig farming

3,016

THE GLOBE AND MAIL, SOURCE:

CENSUS OF AGRICULTURE 2021

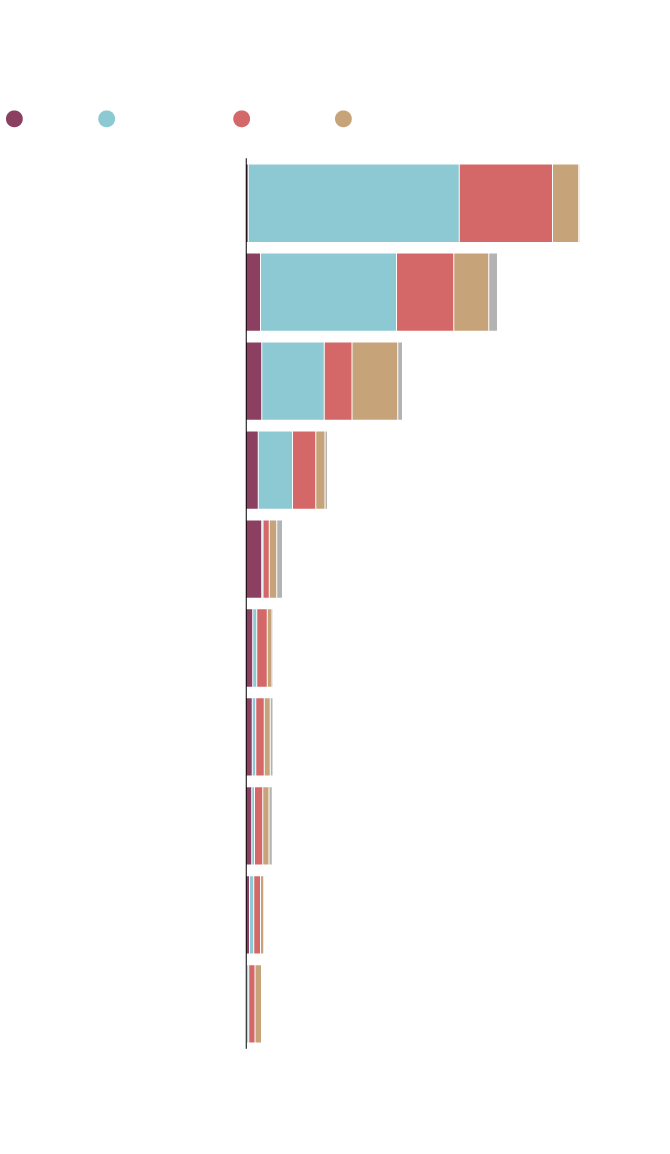

Number of farms in Canada in 2021,

by farm type and region

B.C.

Prairies

Ont.

Que.

Oilseed and grain

farming

65,135

Cattle ranching and

farming

49,036

Other crop farming

30,510

Other animal

production

15,873

Fruit and tree nut

farming

7,101

Poultry and egg

production

5,296

Greenhouse, nursery

and floriculture

production

5,256

Vegetable and

melon farming

5,076

Sheep and goat

farming

3,575

Hog and pig farming

3,016

THE GLOBE AND MAIL, SOURCE:

CENSUS OF AGRICULTURE 2021

Number of farms in Canada in 2021, by farm type and region

B.C.

Prairies

Ontario

Quebec

Atlantic

65,135

Oilseed and grain farming

49,036

Cattle ranching and farming

30,510

Other crop farming

15,873

Other animal production

7,101

Fruit and tree nut farming

5,296

Poultry and egg production

Greenhouse, nursery and

floriculture production

5,256

5,076

Vegetable and melon farming

3,575

Sheep and goat farming

3,016

Hog and pig farming

THE GLOBE AND MAIL, SOURCE: CENSUS OF AGRICULTURE 2021

In much of the country, greenhouses are a big part of the solution. Quebec, for instance, recently announced that it has reached 50-per-cent self-sufficiency in growing its own greenhouse fruits and vegetables, after the provincial government invested $100-million in the industry.

But for British Columbia, where geography and space are major challenges, greenhouses aren’t always viable. Roughly 75 per cent of the province is covered by mountains. And much of it (more than 90 per cent) is Crown land. The remaining land is expensive, especially the closer you get to the Lower Mainland.

That’s where vertical farming companies hope to step in. Their farms require much less space because, as the name suggests, the growing beds are stacked vertically. They are also, in many respects, far more efficient.

Take baby spinach, for example. In an open field or greenhouse, it typically takes at least 40 days to grow. In one of the vertical farms run by GoodLeaf Farms, an Ontario-based company, however, it takes less than half that time. They also require significantly less water – just 5 per cent of what an open field farm uses – and have no need of pesticides, herbicides or fungicides.

Barry Murchie, President & CEO of GoodLeaf Farms.NATHAN CYPRYS/The Globe and Mail

“It’s a way of doing more with less,” said Barry Murchie, GoodLeaf’s chief executive officer. “It’s just a better way of growing leafy greens.”

But vertical farms do have major downsides. They’re expensive to build, owing in large part to equipment costs. And, in general, they use an estimated nine times the amount of energy as a typical greenhouse farm, per pound of food produced. While newer technology is helping to address this, it remains a major challenge for the fledgling industry.

This is another reason why British Columbia – with its relatively low hydro rates – is in the sights of many vertical farming businesses.

But for GoodLeaf, getting there might be a challenge.

The 50,000-square-foot GoodLeaf facility in Guelph, Ont., is Canada’s largest vertical farm. It produces about 850,000 pounds of vegetables each year.NATHAN CYPRYS/The Globe and Mail

‘The fear of the unknown’

About a 15-minute drive south of downtown Guelph, Ont., is Canada’s largest vertical farm. It’s a 50,000-square-foot GoodLeaf facility located in an industrial park surrounded by farmland. It produces about 850,000 pounds of vegetables each year.

By this summer, the company – which has received more than $65-million in investments from McCain Foods – expects to complete the building of two new farms, in Montreal and Calgary. Each one will be able to produce two million pounds of vegetables a year.

After that, Mr. Murchie said, B.C. will be a “prime candidate” for GoodLeaf’s next expansion. But the only viable way for the company to continue its growth, he added, is by having access to farmland (which is typically less expensive). He said this is especially true in B.C., with its high land prices.

But also, to him, it just makes sense. “Without a doubt,” he said, “we are a farming company.”

Others aren’t as convinced.

Ms. van der Gracht, for instance, said she is ineligible for grants or credits that traditional farms might receive to help offset costs, because her company is also a manufacturing business. (Caitlin Dorward, a social planner with the City of Vancouver, refuted this in a statement, saying that the city supports urban farming, and pointed to 2016 changes that recognize urban farming as a permitted use in “most” zones. She added that for-profit businesses are ineligible for city grants.)

A 2022 RBC report urging Canada to boost its agtech industry identified a number of key barriers facing the sector. One was adoption: the willingness of some farmers to adopt certain types of technology. Another was government: out-of-date regulations, or a lack of regulations altogether that take into account such new technologies.

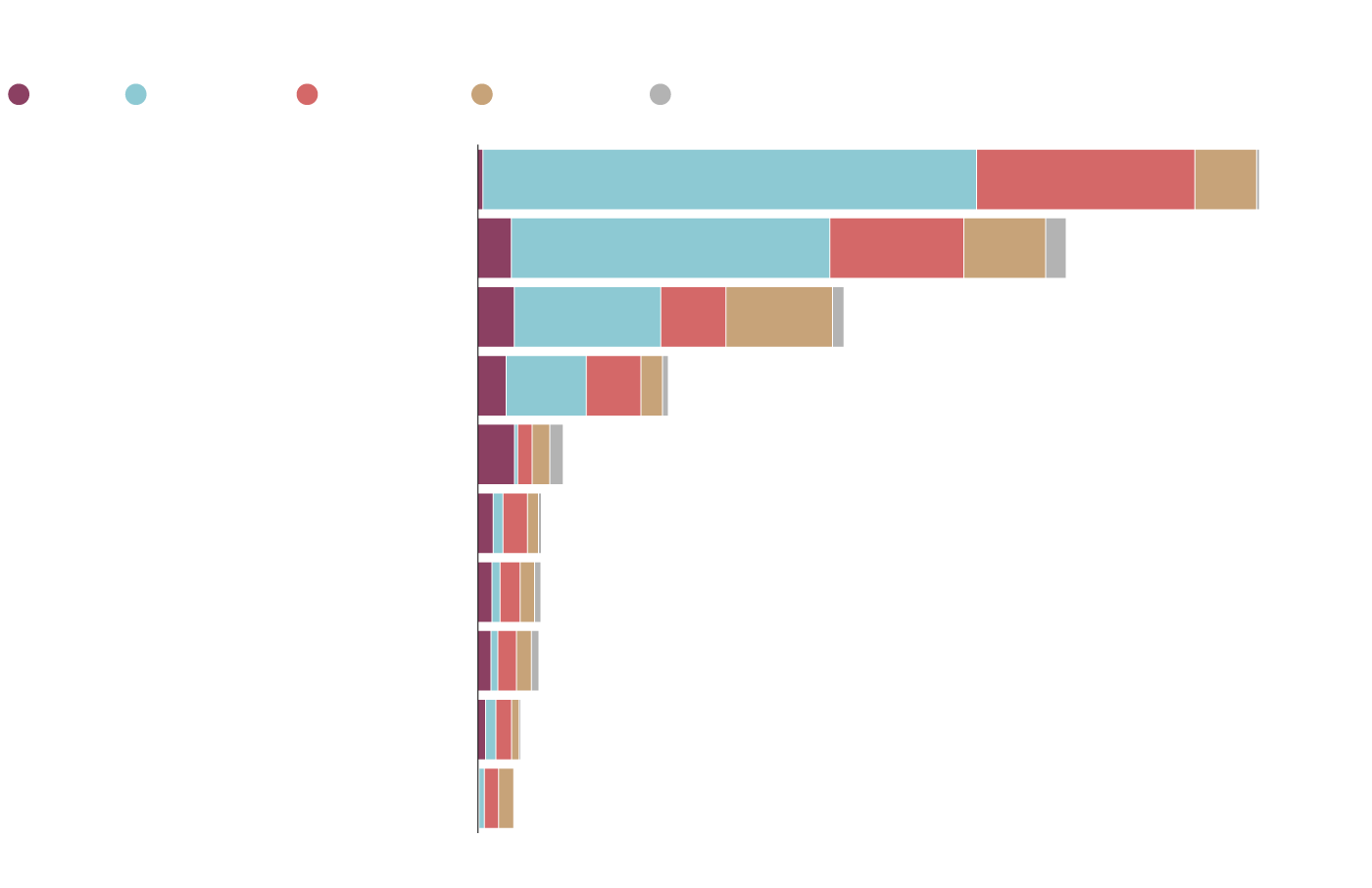

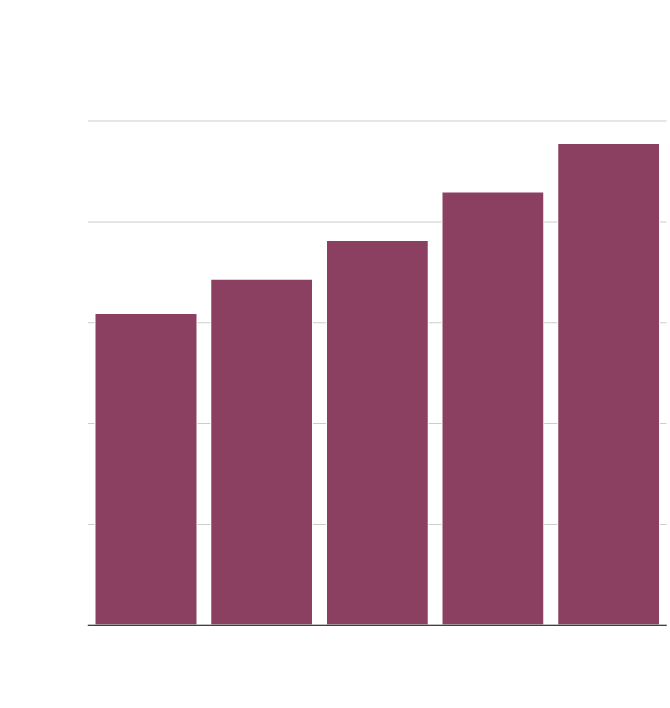

Technologies used on farm

operations in Canada

Number of farms reported in 2021

Soil sample test

60,687

Autonomous vehicles

50,917

Slow-release fertilizer

44,484

Variable-rate seeders

and sprayers

30,567

GIS mapping

25,058

Drones

6,781

Robotic milkers

2,197

Robotic greenhouse

equipment

348

THE GLOBE AND MAIL, SOURCE:

CENSUS OF AGRICULTURE 2021

Technologies used on farm

operations in Canada

Number of farms reported in 2021

Soil sample test

60,687

Autonomous vehicles

50,917

Slow-release fertilizer

44,484

Variable-rate seeders

and sprayers

30,567

GIS mapping

25,058

Drones

6,781

Robotic milkers

2,197

Robotic greenhouse

equipment

348

THE GLOBE AND MAIL, SOURCE:

CENSUS OF AGRICULTURE 2021

Technologies used on farm operations in Canada

Number of farms reported in 2021

Soil sample test

60,687

Autonomous vehicles

50,917

Slow-release fertilizer

44,484

Variable-rate seeders

and sprayers

30,567

GIS mapping

25,058

Drones

6,781

Robotic milkers

2,197

Robotic greenhouse equipment

348

THE GLOBE AND MAIL, SOURCE: CENSUS OF AGRICULTURE 2021

Last year, in light of such challenges, the B.C. government announced a plan to permit agtech businesses such as vertical farms to build on existing protected farmland known as the Agricultural Land Reserve (ALR).

But the policy left room for individual municipalities to regulate such operations, which Prof. Newman at the University of the Fraser Valley calls a mistake.

“Some of the municipalities where they would be most sustainably located – in other words, close to the city – are the ones most likely to take a NIMBY approach,” she said.

B.C. Agriculture Minister Pam Alexis maintains it was the right decision. Local governments, she said in a statement, “deserve to have a say on the types of developments and businesses” that fit the “unique perspectives of their communities.”

About an hour east of Vancouver in Chilliwack, Chris Kloot, a city councillor who chairs the local agricultural committee, said that he’s heard from farmers with concerns about vertical farms and other agtech companies moving in, including the possibility of light pollution, exhaust or water runoff.

Top, pea shoots are trimmed and prepared for packaging at GoodLeaf Farms. Below, CEO Barry Murchie observes one of the facility's indoor grow rooms.NATHAN CYPRYS/The Globe and Mail

Often, he added, the worries relate to commercialization – large buildings or sprawling industrial sites spoiling the pastoral landscape.

“It’s the fear of the unknown,” Mr. Kloot said. “They’re saying, ‘What does this look like? How does this change things?’”

And though Mr. Kloot – who is a dairy farmer himself – does not share all of the same concerns, he said many of the farmers who do are the ones who have had negative experiences with neighbouring cannabis operations or greenhouse growers in the past.

The City of Richmond has taken perhaps the most severe approach. There, a pre-existing bylaw prohibits structures with concrete floors on agricultural land. This means that despite the provincial policy change, vertical farms are still not allowed on farmland.

City spokesman Clay Adams pointed out that Richmond does have bylaws that encourage agtech – but in urban areas. “Richmond is certainly not opposed to vertical farming and other forms of agriculture,” he said, “but wants to ensure the quality of ALR land is maintained and protected.”

Part of the reason for Richmond’s approach stems from its history. The “megamansions” of the 2010s, where developers built 20,000-square-foot monster homes on farmland, have left the city especially protective of its agricultural landscapes.

The main voice of opposition has been Harold Steves, a retired politician and long-time farmland-preservation advocate.

As a member of the provincial legislature, Mr. Steves wrote the first draft of the ALR policy in the early 1970s. He was incensed to learn of the government’s changes last year.

He worries that the new plan will open the door to exploitation – to landowners selling off land in large swaths to industrial or manufacturing companies masquerading as agricultural ones.

“It’s going to do what the megamansions did, and increase the value of property. It’s going to make it more difficult for farmers once again.”

Above all else, he’s concerned about the soil.

His great-grandfather Manoah Steves, who settled the family farm in 1877, cautioned that, “‘you must never destroy the land,’” he said. “What you take from it you must return.”

‘A culture war’

To Kent Mullinix, the term “agtech” feels a bit like a rebrand.

He was a young agriculture student in Missouri in the 1970s in the era of industrial agriculture, when large companies built huge factory farms and farmers embraced new technology that promised bigger yields, better crops. “Get big or get out,” then U.S. secretary of agriculture Earl Butz famously said at the time.

“We were taught that we were going to feed the world,” said Prof. Mullinix, director of sustainable agriculture and food security at Kwantlen Polytechnic University in the Lower Mainland. “That was what this technology was about.”

Yet, half a century later, our global food security challenges remain. Meanwhile, the devastation to our environment has been incalculable.

So when Prof. Mullinix hears that “agtech” is the solution – or at least a large part of it – he’s skeptical. Especially when the investments are often coming from major food companies.

“It’s not a technological challenge,” he said. “It’s not an agriculture challenge. It’s some other kind of challenge.”

The real solution, he believes, requires a fundamental rethinking of our food system. Smaller-scale, more “traditional” farms. Smaller businesses and less consolidation. Local production whenever possible.

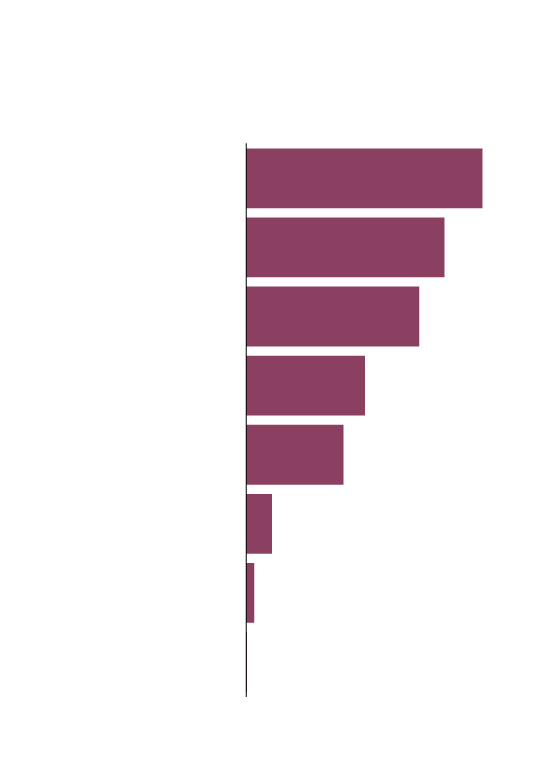

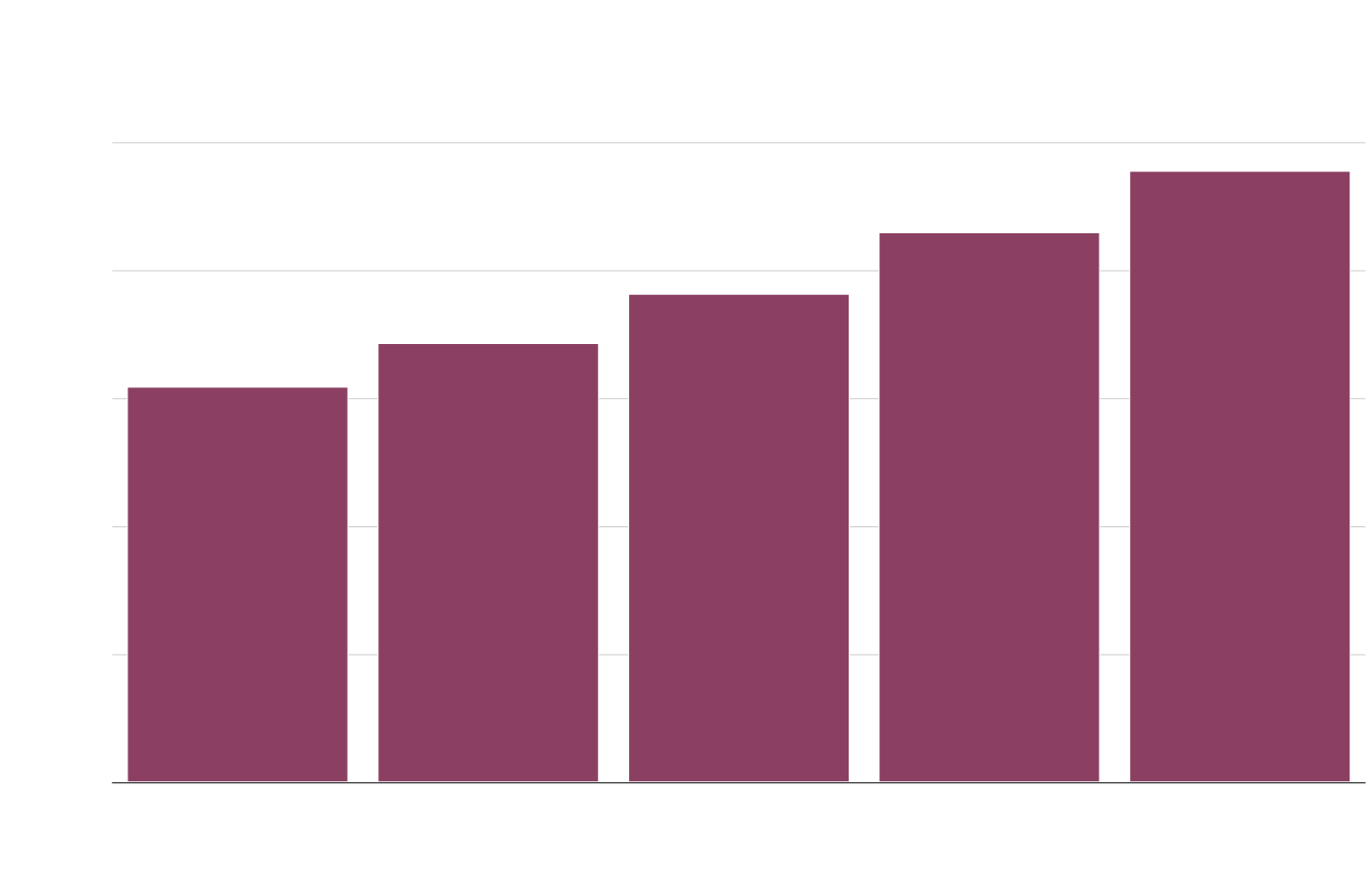

Market value of ag-tech in Canada

Millions of U.S. dollars

$1,000

800

600

400

200

0

2017

2018

2019

2020

2021

THE GLOBE AND MAIL, SOURCE: GLOBALDATA

Market value of ag-tech in Canada

Millions of U.S. dollars

$1,000

800

600

400

200

0

2017

2018

2019

2020

2021

THE GLOBE AND MAIL, SOURCE: GLOBALDATA

Market value of ag-tech in Canada

Millions of U.S. dollars

$1,000

800

600

400

200

0

2017

2018

2019

2020

2021

THE GLOBE AND MAIL, SOURCE: GLOBALDATA

Prof. Newman shares many similar values. She, too, is deeply concerned with climate change and global food security. She is a fierce advocate for local production. She also believes that the food system needs major transformation.

Where the two disagree, vehemently, is on size and scale – and the role of technology. And this is where the “culture war” becomes apparent.

B.C. is just one of many fronts – but one where the tension is especially obvious.

In the Lower Mainland, Prof. Newman said, “there’s still a solid, urban, sort of small-scale obsession here” when it comes to farming, she said, calling it “a bit of a lifestyle.”

Prof. Newman herself often shops at farmer’s markets, but there are limitations on how many people they can feed, she said. And she calls the idea that small-scale, nonindustrial agriculture can provide for the world’s projected 9.8 billion people by 2050 simply unrealistic. In Canada, for instance, only about 7 per cent of existing farms are considered “small.”

QuantoTech founder Alycia van der Gracht, left, has also been developing a separate line of the business, selling ready-to-go “micro-farms” to remote communities that face acute food security challenges.Jimmy Jeong/The Globe and Mail

“We have a very outdated image of farming,” she said – red barns, farmers in overalls, chickens out to pasture. “And that image is highly damaging in the long term, because what it means is you can’t do it right.”

And “right,” in her eyes, means big.

“Agriculture is industrial,” she said. “That’s how we feed the world.”

In Vancouver, Ms. van der Gracht and her search for a farm site continues. It’s already been a year, and she’s scaled down the requirements from 30,000 square feet to half that.

In the meantime, she’s been developing a separate line of the business, selling ready-to-go “micro-farms” to remote communities that face acute food security challenges – places such as Nova Scotia and the northern parts of B.C. and Ontario.

She understands the concerns of policy makers who are looking to protect what scarce land there is. And she is sympathetic to the concerns of conventional farmers. But she doesn’t see her work as being in conflict with theirs.

“We’re not trying to replace,” she said. “We’re trying to work hand in hand.”